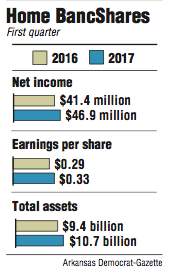

Home BancShares, which owns Centennial Bank branches in four states, had record net income of $46.9 million in the first quarter, the Conway bank said Thursday.

It was the 24th consecutive quarter -- or six full years -- of record earnings for the bank. Net income was up from $41.4 million in the first quarter last year.

Home BancShares earned 33 cents per share compared with 29 cents per share in the first quarter last year. That matched expectations of nine analysts surveyed by Thomson Reuters.

Home BancShares closed at $25.96 Thursday, up 68 cents in trading on the Nasdaq exchange.

The bank had $10.7 billion in assets, up from $9.4 billion in assets in the first quarter last year. It was the first time Home BancShares exceeded the $10 billion threshold in assets that requires stricter regulatory oversight.

Home BancShares had solid financial results in the first quarter in spite of additional expenses associated with the acquisitions of Giant Holdings Inc. and Bank of Commerce, two Florida purchases announced last year that closed in February, John Allison, Home BancShares' chairman, said in a prepared statement.

There were $6.7 million of merger-related expenses associated with the two bank closings.

Home BancShares expects this year to close on the purchase of Stonegate Bank of Pompano Beach, Fla., which was announced in March.

"With common culture and operating philosophy, this partnership could be -- for the employees as well as the shareholders -- the best trade we've ever done," Allison said in a conference call Thursday.

Publicly traded Stonegate had a pretty flat quarter in loans and Home BancShares had a pretty flat quarter, Allison said.

Home BancShares produced about $450 million in new loans in the first quarter but also about $475 million in loan payoffs, Allison said.

A major unexpected loan payoff was $70 million that had been lent for a New York hotel project, Allison said.

"That was a little earlier than we anticipated," Allison said. "That was the difference in the quarter."

The bank's New York office has been doing what it said it would do, Allison said.

"They said they'd produced 24- to 36-month loans and it's doing what it set out to do," Allison said.

Home BancShares had $7.8 billion in total loans compared with $6.9 billion in loans in the first quarter last year. Total deposits were $7.6 billion in the first quarter, up from $6.6 billion in deposits in the same period last year.

Excluding loans gained through acquisitions, Home BancShares' loan growth was up $16 million, which was below the expectations of Stephens Inc., Matt Olney, a banking analyst with Stephens, said in a research brief.

Olney, who owns no stock in Home BancShares, has a buy rating on the bank.

Centennial Bank has 151 branches -- 76 in Arkansas, 68 in Florida, six in Alabama and one in New York City. Centennial closed one branch in Davie, Fla., in the first quarter. Before the end of June, Centennial plans to close one branch in Sarasota, Fla., and two in Fort Lauderdale, Fla. It expects to open a branch in Clearwater, Fla., and a loan production office in Los Angeles by the end of June.

Home BancShares still has to find space to lease in Los Angeles for the lending office, which will be about $250,000 a year. The bank expects the Los Angeles office to produce about $200 million a year in loans.

Business on 04/21/2017