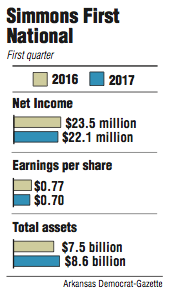

Simmons First National Corp. posted a profit of $22.1 million for the first quarter, down from $23.5 million in the same period last year, the bank reported Wednesday.

Simmons earned 70 cents per share, down 7 cents from 77 cents in the first quarter last year. It missed the average estimate of 82 cents a share projected by five analysts surveyed by Thomson Reuters.

Shares of the Pine Bluff-based bank closed at $53.80 Wednesday, up $1.15 in trading on the Nasdaq exchange. The earnings report was released after the markets closed.

"We are satisfied with our operating results during the first quarter," George Makris, Simmons' chairman and chief executive officer, said in a prepared statement.

Simmons' core expense control remains "relatively stable," Makris said.

"Our noninterest income experienced some usual seasonal declines along with a softer mortgage market during the first quarter," he said.

"Simmons incurred additional expenses from merger-related transactions and other professional fees," said Garland Binns, a Little Rock banking attorney.

Noninterest expense was $4.5 million greater in the first quarter of 2017 as compared with the first quarter of 2016, Binns said.

Simmons announced the purchase of three banks last year -- Hardeman County Investment Co. and its subsidiary, First South Bank of Jackson, Tenn.; Southwest Bancorp of Stillwater, Okla.; and Southwest Bank in Fort Worth.

"We are excited about our previously announced mergers," Makris said. "We look forward to closing these mergers and integrating these new markets."

When the acquisitions close, Simmons will have more than $10 billion in assets, which will cost the bank more in regulatory costs.

"As we prepare for the $10 billion asset threshold, we have managed to offset most of our increases in audit and regulatory affairs expenses with economies gained because of our size and scale," Makris said.

Simmons had assets of $8.6 billion on March 31, up from $7.5 billion in the first quarter last year.

The bank also had loans of $5.8 billion, up $847 million from the first quarter last year.

Deposits rose $709 million to $6.8 billion in the first quarter.

Simmons had an efficiency ratio of 60.92 percent in the first quarter, up from 58.73 percent in the same period last year. That means that it cost Simmons $60.92 to earn $100.

The bank has branches in Arkansas, Kansas, Missouri and Tennessee.

Simmons will hold a conference call today at 11 a.m. to discuss its first-quarter earnings. To access the call, dial (866) 298-7926 and use identification code 297-4437.

Business on 04/20/2017