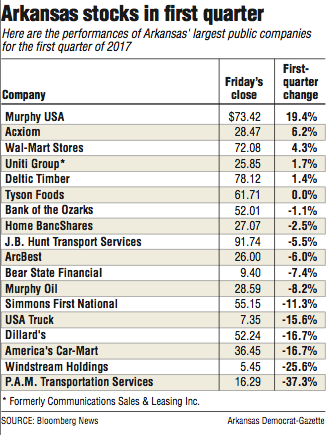

Only five stocks in the Arkansas Index rose in the first quarter, led by Murphy USA.

The Arkansas Index includes the largest public companies based in the state.

Murphy USA of El Dorado rose by 19.4 percent for the quarter, easily the best-performing stock in the state. Acxiom rose 6.2 percent and Wal-Mart Stores climbed 4.3 percent for the quarter.

The two other stocks with percentage increases in the first quarter were Uniti Group, formerly Communications Sales & Leasing, and Deltic Timber.

In all, 12 stocks lost ground for the quarter, five rose and one was unchanged. The Arkansas Index closed at 346.09, down about 4 percent for the quarter.

Murphy USA continued to benefit from its long-term relationship with Wal-Mart, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"The industry was challenged by reduced fuel sales and below-average retail margins," Williams said. "But Murphy USA more than doubled the industry average on fuel sales per store. Credit for that was attributed to its proximity to Wal-Mart Supercenters and the resultant high traffic."

Shareholders for Acxiom, based in Little Rock, continue to benefit from the worldwide adoption of new technologies, Williams said.

"Acxiom's subscriber base has grown with Snapchat among its more notable new clients," Williams said. "The company continues its metamorphosis to a pure digital marketing business model" and has begun implementing a new subscription and billing model for new subscribers.

Wal-Mart of Bentonville has constantly acted and reacted to maintain its leadership in an incredibly competitive retail environment, Williams said.

"As a result, Wal-Mart has focused on driving profitable comparable store, digital and e-commerce sales," Williams said. "Near term, this has resulted in slower unit growth and more investment in its core business but has paid off for shareholders."

P.A.M. Transportation fell 37.3 percent for the first three months of the year, the biggest drop for the period.

Profits for the Tontitown trucking company were off almost 80 percent last year compared with 2015, Williams said.

"The industry faced excess capacity, which hit some firms much harder than others," Williams said. "P.A.M. was squeezed on both sides of the balance sheet. Profit margins shriveled as health care and driver turnover expenses rose resulting in an exceptionally difficult operating environment."

Windstream Holdings of Little Rock faced several operational challenges as a result of the nature of the telecommunications business, Williams said. Windstream fell 25.6 percent for the quarter.

"While Windstream is a major competitor in residential hard-wired phone and Internet services, alternatives offering faster network speeds have become more widely available," Williams said.

Moody's Investor Services announced a change in outlook for the company on Monday, saying "The negative outlook reflects the risk that Windstream may not be able to reverse its unfavorable operating trend."

It was a tough quarter for America's Car-Mart, Williams said. The Bentonville company fell 16.7 percent for the quarter.

"Its shares had already dropped prior to the negative earnings surprise of 46 percent in February," Williams said. "While Car-Mart bottomed out a few days later, its subsequent bounce still left it nearly 25 percent off its 52-week high."

The banking sector didn't perform as well in the first quarter as it did in the fourth quarter. Bank of the Ozarks of Little Rock fell 1.1 percent and Conway-based Home BancShares lost 2.5 percent for the first quarter, but both gained more than 30 percent in the fourth quarter.

Simmons First National of Pine Bluff and Little Rock-based Bear State Financial fell more than 7 percent each in the first quarter. But Simmons was up 24 percent and Bear State was up more than 10 percent in the fourth quarter.

Arkansas bank stocks had a "spectacular year" in 2016, said Garland Binns, a Little Rock banking attorney.

"Arkansas bank stocks may have taken a breather in the first quarter, particularly when one considers the outstanding year that bank stocks had during 2016," Binns said.

Business on 04/01/2017