Arkansas' general-revenue collections in August dipped by $4.5 million from the same month a year ago to $473.6 million and fell $10.8 million short of the state's forecast.

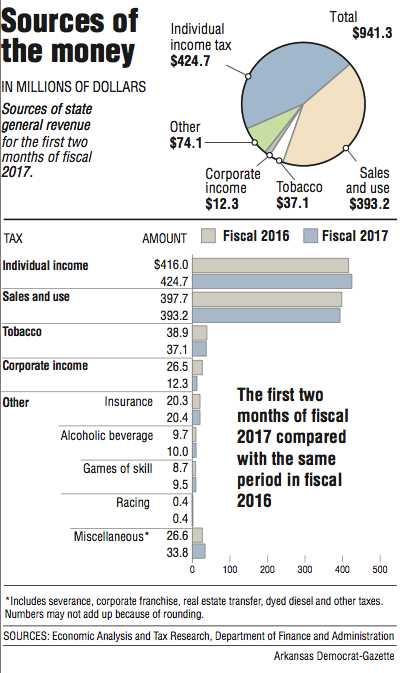

It was the second month in a row that revenue has been short of the forecast. August is the second month in fiscal 2017, which started July 1. During the first two months of fiscal 2017, total general-revenue collections lagged behind the state's forecast by $19.1 million, or 2 percent. Compared with the same period in fiscal 2016, they dropped by $3.5 million, or 0.4 percent, to $941.3 million.

"The Arkansas economy is running at a fast pace with record low unemployment numbers, and our rate of growth is outpacing the nation," Gov. Asa Hutchinson, a Republican, said Friday. "With that backdrop, it is somewhat puzzling that the first two months reflected revenue numbers slightly below forecast."

"There are some one-time factors that have played a role in lowering the first few months' revenue picture, but we remain confident in our forecast for the year. Individual income-tax revenues remain strong, but we will closely monitor the coming months as we get closer to the 2017 legislative session and as we continue to work on the budget for next year," Hutchinson said.

The state's record for August general revenue was $478.1 million in 2015, said Department of Finance and Administration tax analyst Whitney McLaughlin.

Sales- and use-tax collections slipped last month compared with the same month a year ago, and the state's individual income-tax collections decreased slightly last month, the finance department said Friday in its monthly revenue report.

The state's two largest sources of general revenue are individual income taxes and sales and use taxes.

"The consumer portion [of the sales- and use-tax collections] seems to be holding steady, but we think that internal business sales tax seems to be more volatile," finance department Director Larry Walther said Friday.

The General Assembly's 2017 regular session is scheduled to begin Jan. 9. Hutchinson has said he wants to work with the Legislature to enact an individual income-tax cut of a yet-to-be-determined size, which may be phased in.

Earlier this year, the Republican-controlled Legislature and Hutchinson enacted a $5.33 billion general-revenue budget for fiscal 2017 -- up from $5.19 billion the previous year -- that factors in nearly $101 million in individual income-tax-rate cuts approved in 2015.

Most of the $142.7 million increase in general revenue would go to the state Department of Human Services and public schools under the Revenue Stabilization Act enacted in the spring's fiscal session.

Tax refunds and some special government expenditures, such as court-mandated desegregation payments, come off the top of total revenue, leaving a net amount that state agencies are allowed to spend.

So far in fiscal 2017, the net has decreased by $3.8 million, or 0.5 percent, over the same period in fiscal 2016 to $816.8 million. That's $15.3 million, or 1.8 percent, below the state's forecast.

That's no reason to panic, said Walther.

According to the finance department, August's revenue included:

• A $4.4 million, or 2.2 percent, decrease in sales- and use-tax collections from a year ago to $200.2 million that fell $8 million, $3.9 million, short of the state's forecast.

The state's rising sales-tax collections in August 2015 were aided by about $6 million in one-time payments from sales-tax audits, state officials said a year ago.

If one factors out the increased one-time sales-tax collections from audits in August 2015, sales-tax collections would have grown last month compared with the same month a year ago, Walther noted.

• A $1 million, or 0.5 percent, decrease in individual income-tax collections from a year ago to $214.1 million, which lagged behind the state's forecast by $5 million, or 2.3 percent.

Withholdings make up the largest part of individual income-tax collections.

August's withholdings dropped by $3 million, or 1.5 percent, from a year ago to $199.8 million, and fell $6.6 million short of the state's forecast. There was one fewer Thursday payday last month compared with a year ago, John Shelnutt, chief economic forecaster, said.

• A $700,000, or 11.5 percent, decrease in corporate income-tax collections from a year ago to $5.5 million, which fell short of the state forecast by $900,000, or 14.8 percent.

Corporate income taxes are a volatile source of revenue that fluctuates widely, Walther said.

• A $2 million, or 10.9 percent, increase in tobacco-tax collections compared with a year ago, to $19.9 million, which exceeded the state's forecast by $3.2 million, or 19.5 percent.

Monthly changes in tobacco-tax collections can be attributed to uneven patterns of tobacco stamp sales to wholesale purchasers.

In a May special legislative session, the Legislature enacted Hutchinson's highway-funding plan, which relies largely on using 25 percent of future surpluses and $20 million in future increased earnings from the state's $3 billion in treasury investments to raise about $50 million a year. Those funds would be used to match $200 million a year in federal highway funds available under the five-year federal highway law.

In fiscal 2017, the plan relies on $40 million from the state's rainy-day fund and $7.3 million from other state sources to provide the needed $47.3 million.

The state ended fiscal 2016 with a $177.4 million general-revenue surplus. The surplus resulted mostly from higher-than-expected individual and corporate income-tax collections and lower-than-expected individual and corporate income-tax refunds, according to the finance department.

The Legislature and Hutchinson will decide how to allocate that surplus during the 2017 regular session. Legislative leaders and Hutchinson have said they would like to allocate a substantial portion to the state's long-term reserve fund in case it's needed in a future economic downturn.

A Section on 09/03/2016