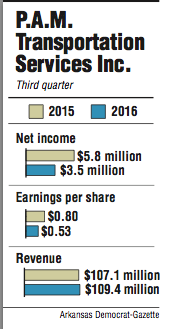

P.A.M. Transportation Services Inc. reported $3.5 million in net income in the third quarter of 2016, down 40.4 percent from the previous year.

Earnings per share also fell 33.8 percent to 53 cents compared with the same quarter in 2015, when the Tontitown-based trucking company recorded its second-best quarter on record with $5.8 million in net income, or 80 cents per share.

P.A.M. reported a revenue increase of 2.1 percent to $109.4 million in the quarter, compared with $107.1 million during the same three-month period a year ago.

Chief Executive Officer Dan Cushman said in a news release he was pleased with the revenue growth, but he said profits continue to lag because of hurdles that are evident throughout the trucking industry.

"Our situation can be summarized as the inability to increase freight rates to cover increasingly higher operating costs," Cushman said. "As the economy remained somewhat sluggish and overcapacity existed throughout the quarter, our freight rates continued to be pressured lower."

Cushman said the company continued to be affected by higher operating costs for equipment, plus increases in insurance and employee wages and benefits during the third quarter.

Employee health care costs have been "significantly" above the company's historical levels throughout the first nine months of 2016, the company said, and have represented a $2.1 million -- or 53 percent increase -- over similar costs from a year ago.

Equipment sales also reflected the weakness of the used-truck market, according to Cushman. The company's gains from equipment sales decreased by $400,000 during the quarter compared with 2015.

In addition, P.A.M. has incurred $3.6 million in additional costs for its driver recruitment, training and retention programs over the nine-month period.

"Our efforts to improve these programs have been successful and higher costs were anticipated as a part of the improvement process," Cushman said. "However, the current environment does not allow us to recover these additional costs through rate increases."

Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock, was impressed to see P.A.M's base revenue increase in the current environment. Williams said it was contrary to current trucking industry trends.

"The industry is in a classic squeeze," Williams said. "Their margins are getting squeezed. They've got too much capacity due to a soft economy. And their expenses are going up. The competition won't allow them to raise prices or pass them along."

P.A.M hauled 81,006 loads during the quarter, an increase from 79,864 a year ago.

Revenue per truck per workday also increased from $684 to $708.

Overall, trucking revenue increased 6.3 percent even though year-over-year revenue was flat in July because of what Cushman described as downtime in the automotive industry. About 50 percent of P.A.M.'s revenue comes from automotive industry customers.

Cushman said P.A.M.'s expedited division has been "extremely challenging" as well, but the company's Mexico operation remains one of its most successful divisions. The division represents about 40-45 percent of P.A.M.'s business, and Cushman said it is "something our driving professionals desire."

Despite the difficult environment, Cushman said P.A.M. expanded its customer base during the quarter.

"We continue to develop new customer relations and have managed to secure five new dedicated fleets with customers that we have not done business with prior to his year," Cushman said.

Shares of P.A.M stock ended Wednesday trading at $19.63, down 20 cents.

Business on 10/27/2016