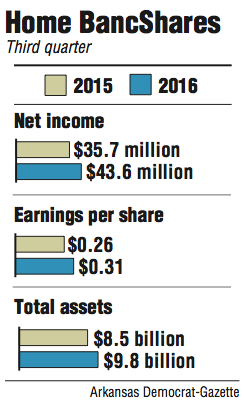

Home BancShares Inc., which owns Centennial Bank offices in four states, made record net income of $43.6 million in the third quarter, the Conway firm said Thursday.

That is an increase of 22 percent from earnings of $35.7 million in the third quarter last year. Home BancShares earned 31 cents a share for the period ending Sept. 30, matching the average projections of nine analysts surveyed by Thomson Reuters.

Home BancShares closed at $20.41 Thursday, down 11 cents, in trading on the Nasdaq exchange.

It was the 22nd consecutive quarter in which the bank reported the most profitable quarter in its history, said Randy Sims, Home BancShares' chief executive officer.

Home BancShares purposely has not been as aggressive in acquisitions as it has been previously, said John Allison, the firm's chairman. The reason is because the bank is nearing the $10 billion threshold in assets where federal regulators increase oversight.

Home BancShares ended the third quarter with $9.8 billion in assets. If it were to exceed $10 billion at the end of the year, the additional expenses and scrutiny on the bank would begin next July. If the bank exceeds $10 billion in the first quarter next year, it would not face the extra costs and regulations until July 2018.

"I've watched some of our friends leap over the [$10 billion] mark and originally I thought that was what would be in the best interest of Home BancShares," Allison said. "However, we have changed our minds and decided to crawl over it."

The bank will have to carefully watch its possible loans until the end of the year, Allison said.

"We don't want to go over $10 billion," he said.

So Home BancShares will be more aggressive in pursuing acquisitions in 2017 and 2018, Allison said.

"There are plenty of opportunities [for purchase] in the marketplace," Allison said.

Home BancShares has met with banks with $2 billion, $5 billion and $8 billion in assets, Allison said.

"And lots of $300 million, $400 million and $500 million banks [are possibilities]," he said.

Home BancShares reported an annualized efficiency ratio of 39.41 percent in the third quarter, which means it costs the bank $39.41 to earn $100.

On Sept. 30, nonperforming loans -- those more than 90 days past due -- totaled $60.1 million, with $25.1 million in Arkansas, $33.9 million in Florida, $1.1 million in Alabama and zero in New York City.

Centennial has 77 branches in Arkansas, 59 in Florida, six in Alabama and one in New York City.

Matt Olney, a Little Rock banking analyst with Stephens Inc., reiterated his buy rating on Home BancShares.

The bank's fee income was steady and beat expectations, Olney said in a research brief. Olney owns no stock in the bank.

Loan growth not related to loans through acquisitions grew at only a 5 percent annualized level as compared to analysts' expectations of 11 percent, Olney said.

"The slowdown appears to be driven by Home BancShares' [existing] markets of Arkansas and Florida," Olney said.

Allison, 70, addressed his recent decision to sell almost 2.7 million shares of his Home BancShares stock. He, his wife and their children own about 11 million shares of the bank's stock.

Even with the sale, Allison's family will own more than 8 million shares of the bank's stock, Allison said.

As was reported last month, Allison chose to sell the stock for estate planning and liquidity reasons.

"I don't intend to become a spectator," Allison said. "I'm not sick, I'm not tired, I'm not leaving. And my enthusiasm for this company has never been stronger."

Business on 10/21/2016