WASHINGTON -- The Obama administration's confirmation last week that the budget shortfall for the federal fiscal year that ended Sept. 30 totaled $587.4 billion marked the first time in seven years that the size of the deficit grew as a share of the nation's economy.

The uptick, which had been projected last winter by government analysts, largely reflected the revenue loss from tax breaks for businesses and individuals that Congress extended in December. President Barack Obama had proposed to pair the tax cuts with some tax increases on wealthy Americans to avoid adding to the deficit, but Congress refused.

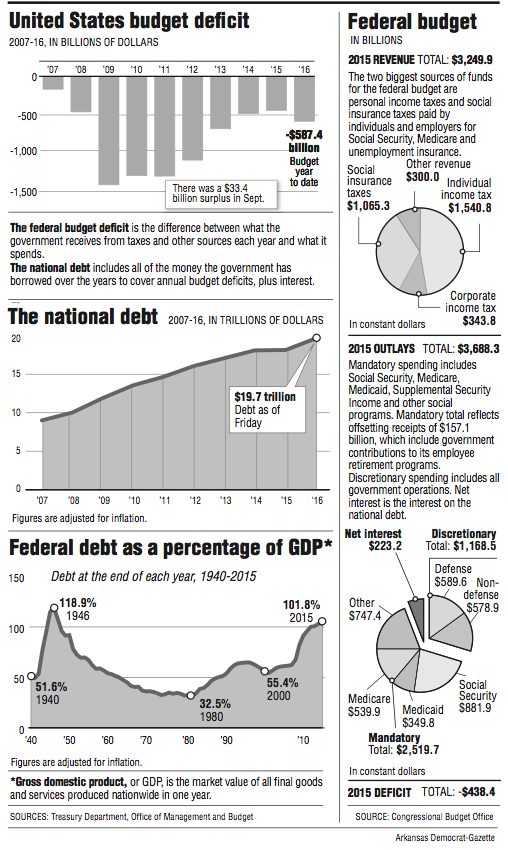

On Friday, the U.S. Treasury Department compared the fiscal 2016 deficit figure of $587.4 billion to the $438.4 billion budget gap for fiscal 2015.

As a share of gross domestic product, the shortfall rose to 3.2 percent from 2.5 percent a year earlier, the first such increase since 2009, government figures show.

"The slowdown in tax collections suggests some cooling in labor market activity," said Gennadiy Goldberg, a strategist at TD Securities LLC in New York.

While the tax cuts were the immediate cause of the return to rising annual deficits, budget shortfalls long had been forecast to climb unsustainably after 2018 because of the costs of an aging population.

The number of people 65 years or older is expected to increase nearly 40 percent in a decade, driving up spending for Medicare and Social Security.

The rising deficit also comes amid warnings from the International Monetary Fund of the risks of increasing debt loads, which it says complicates the task for policymakers worldwide who want to use fiscal policy to stimulate the global economy.

Debt levels are expected to rise under the plans of both U.S. presidential candidates.

Democratic nominee Hillary Clinton's spending proposals include $275 billion for infrastructure and $350 billion for making college more affordable.

Over a 10-year period, her proposals would add $200 billion to $1.8 trillion to the deficit, according to independent economists' projections.

She has proposed tax increases for the wealthy to help fill the gap.

Donald Trump, the Republican candidate, has pledged to cut taxes and spend as much as $500 billion on infrastructure programs.

Projections of the effect of his proposals say he'd increase the national debt by roughly $5 trillion over 10 years.

Trump says his proposals would boost economic growth, which in turn would help reduce the federal debt.

The Treasury Department said receipts in fiscal 2016 totaled $3.27 trillion, or 17.8 percent of GDP, while spending totaled $3.85 trillion, or 20.9 percent of GDP. Receipts rose $18 billion from fiscal 2015, while outlays jumped $166 billion, the figures showed.

The department cited higher spending on Social Security, Medicare, Medicaid and interest on government debt.

For September, the final month in the fiscal calendar, the government reported a $33.4 billion surplus. That was lower than the $90.9 billion surplus a year earlier, in part because of calendar adjustments, according to the Treasury.

Accumulating budget deficits add to the overall federal debt, which now totals more than $19.7 trillion. That figure includes $5.4 trillion the government owes itself, mostly from borrowing from Social Security Trust Funds.

The Obama administration's final reckoning on spending and taxes for 2016, which was released by Treasury Secretary Jacob Lew and the budget director, Shaun Donovan, showed increases in spending for veterans benefit payments, health programs Medicare and Medicaid, and interest payments on the nation's debt.

Military spending increased little overall, and it dropped for military operations and maintenance. Spending on supplemental food assistance for the poor, formerly known as food stamps, was down 4 percent.

Information for this article was contributed by Jackie Calmes of The New York Times and Saleha Mohsin of Bloomberg News.

A Section on 10/18/2016