NEW YORK -- U.S. stocks climbed Friday as banks made a rapid recovery after Thursday's steep fall. Investors hoped Deutsche Bank and the financial system in general were in better shape than they had feared.

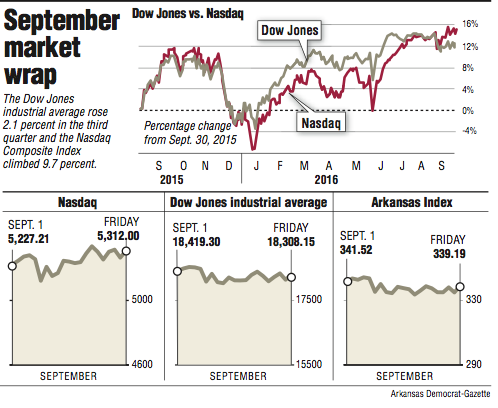

The Dow Jones industrial average jumped 164.70 points, or 0.9 percent, to 18,308.15. The Standard & Poor's 500 index rebounded 17.14 points, or 0.8 percent, to 2,168.27. The Nasdaq composite rose 42.85 points, or 0.8 percent, to 5,312.

Banks made the biggest gains Friday as Germany's largest bank tried to reassure investors about its financial health. Investors hope Deutsche Bank will be able to negotiate down the cost of settling a U.S. investigation into mortgage securities. Energy companies rose as the price of oil continued to move higher, and strong earnings from Costco sent consumer stocks higher.

Deutsche Bank is the largest lender in Germany, and investors are concerned about not only its plunging stock price, but also the potential effect on the financial system if Deutsche Bank gets into serious trouble and the German government does not help it. Those fears faded on Friday.

"People came to the realization that this isn't likely to be a big systemic risk that ripples through the financial sector," said Nate Thooft, head of global asset allocation for Manulife Asset Management.

Financial stocks tumbled Thursday afternoon following reports that some hedge funds were moving their business out of Deutsche Bank. On Friday, bank stocks and the broader market regained almost all of those losses.

Among U.S. banks, shares of JPMorgan Chase rose 94 cents, or 1.4 percent, to $66.59, and Citigroup gained $1.43, or 3.1 percent, to $47.23.

Benchmark U.S. crude oil rose 41 cents to $48.24 a barrel in New York, and it rose 8 percent over the past three days. Brent crude, the international standard, slipped 18 cents to $49.06 a barrel in London.

Oil prices surged this week after OPEC surprised investors with an agreement on a small cut in production. Investors hope energy companies will book larger profits as a result. Chevron jumped $1.65, or 1.6 percent, to $102.92, and EOG Resources rose $1.66, or 1.7 percent, to $96.71.

Shares of warehouse club operator Costco Wholesale jumped $5.02, or 3.4 percent, to $152.51 after it reported a profit that was larger than analysts expected. Companies that make and sell household necessities also climbed. Procter & Gamble gained $1.52, or 1.7 percent, to $89.75, and Wal-Mart rose $1.39, or 2 percent, to $72.12.

Major stock indexes set records in the third quarter thanks mostly to tech stocks. The S&P 500 technology index climbed 12 percent over the past three months. Apple, the most valuable company in the S&P 500, surged 18 percent, partly on indications of strong sales for the newest iPhones.

Bond prices sank. The yield on the 10-year Treasury note rose to 1.60 percent from 1.56 percent. Stocks that pay high dividends, like utilities and real estate and phone companies, traded lower.

Business on 10/01/2016