With about a week to go before the start of a special session on highways, state senators had their first look Wednesday at draft legislation to temporarily raise gasoline and diesel taxes, and a state representative put on hold his proposal to generate revenue.

Reader poll

Are you in favor of increasing the state's gas and diesel taxes to pay for improving roads?

- No, the taxes are high enough as is.

- Yes, it's worth it to have better roads.

436 total votes.

RELATED ARTICLE

http://www.arkansas…">State opens bids on road projects worth $27.4M

Meanwhile, Gov. Asa Hutchinson held firm to his proposal to re-purpose existing monies and not raise taxes.

A plan to raise fuel taxes immediately -- but cut other taxes in future years -- will not be considered during the special session on highways, said Rep. Joe Jett, D-Success, the plan's architect.

"I spoke with leadership. They just really want to put the governor's plan out there. I think that's a good, responsible approach," he said. "Let's take the long-term plans, put them off to the side and take care of the governor's plan. We can use it for one year for a one-time fix, then come back in a special session or a regular session."

Meanwhile, several Republican senators seeking an "intermediate" funding solution for state highways are moving forward with a proposed motor-fuel tax increase that would generate as much as $160 million a year by fiscal 2019.

One of the proponents, Sen. Jimmy Hickey, R-Texarkana, said that though there may be opposition to a tax increase, the draft legislation he has shared with fellow senators is at least a starting point for addressing road funding in the next few years.

"We've said you don't need a consultant to go out and know we have a problem with these highways. That's been hashed out," Hickey said. "What we're saying is we do have a solution for the midterm, the problem that exists there, we've got [a solution] in writing."

However, raising taxes is a nonstarter for Hutchinson, said J.R. Davis, a spokesman for the Republican governor. Hutchinson has said he wants to call a special legislative session on highway funding to start next week, on May 19.

The governor remains "very firm in his opposition in raising taxes," Davis said. "At the end of the day he feels very comfortable and confident in his plan, that it addresses the immediate needs of the highways, again without raising taxes."

Nearly four months ago, Hutchinson proposed a highway funding plan that wouldn't raise taxes. Instead, he proposed using some state surplus funds and reallocating other funds to increase the state's match for federal highway dollars that will become available this fall. The special session would be held to pass the authorizing legislation and is expected to last just a few days.

Jett and Hickey both believe the governor's plan will fix a funding shortfall for at least one year. However, they question using surplus funds to fill the gap in future years.

"You factor in the tax cuts, you factor in the amount of money we're paying for Arkansas Works, we're not going to have that extra money -- not unless we have significant revenue growth," Jett said. "The way I see the budget, we're not going to have a lot of excess money."

Jett was referring to income tax cuts enacted in the 2015 regular legislative session. Arkansas Works is a state program that buys private insurance for low-income Arkansans; in the next fiscal year, it will use state funds for the first time.

House Speaker Jeremy Gillam, R-Judsonia, also said Wednesday that the governor is offering a plan that will only work for so long.

"This is step one, and then step two will take place in the summer and the fall on building a consensus behind a long-term plan. I think we've got the capability of getting that prepared and ready for 2017 or sooner if that's what the governor wants to do," he said.

"The governor and Legislature definitely want to address the long-term funding issue that is present. We will definitely be looking at that and working toward that after we move past this short-term solution that's being presented."

Jett's plan would have partially repealed the sales-tax exemption on motor fuels and indexed the tax to inflation. Doing that would have required a majority vote for approval.

A 5-cent-per-gallon tax would raise about $100 million a year, he said. The proposal could include tax cuts in other areas of the state budget in future years.

He said that option could still be considered during a future special session or next year's regular legislative session.

The tax increase pushed by Hickey -- as well as Republican Sens. Bill Sample of Hot Springs, Greg Standridge of Russellville and Ronald Caldwell of Wynne -- is aimed at complementing Hutchinson's revenue-neutral proposal for immediate funding needs.

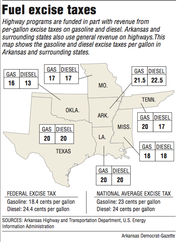

Currently, consumers pay a 21.5-cent-per-gallon gasoline tax and a 22.5-cent-per-gallon diesel tax, which together pulled in about $442 million in fiscal year 2015.

The senators' proposed legislation would raise the gas tax to 26.5 cents and the diesel tax to 27.5 cents, which would raise about $100 million in fiscal 2018.

For the next three years, the fuel taxes would grow another 3 cents, taking in an additional $60 million a year. The proposal would end in 2021, when, Hickey said, lawmakers would be spurred to find long-term funding sources for highway maintenance.

As a part of the plan, lawmakers would consider putting before voters an initiated act calling for a highway-dedicated tax increase that would replace the gas and diesel tax increases before they expire.

That's a key difference, Jett said.

"The problem I have is that if we're going to fix this problem and really fix this problem, let's just take one vote of this thing," he said.

Hickey said a tax increase is seldom wanted, but he suspects that there would be "an appetite" for his proposal if lawmakers can find a way to make the tax revenue neutral, either through rebates to consumers or to other cuts in the budget.

"We've never said we had a long-term solution, that's why there is a sunset [provision] on this," Hickey said. "Long-term solutions require looking at all types of stuff, from fuel-efficient vehicles, alternative fuel sources, indexes with inflation. There's all types of stuff to consider to get a permanent solution."

Gillam said he ultimately didn't see the governor adding legislation to increase taxes to the call for a special session.

"I don't think they're going to get enough consensus behind it to get it on the call," he said. "The governor has made it clear, for any of these extra items, members need to be able to demonstrate that they've got support for their idea. It's a tall order when everyone's scattered."

And on Wednesday, Senate President Pro Tempore Jonathan Dismang, R-Searcy, said he thinks the climate is not ripe for a proposal like Hickey's.

"There's some hesitancy about using general revenues in the regular budget to fund highway needs," Dismang said. "I think the governor is close to finalizing his proposal. I think it appears fairly close to what he's outlined over the last couple months. But beyond that, I think it is the most realistic proposal at this point to consider."

When asked about discussion on a long-term revenue source for highway funding, Dismang said the approaching special session doesn't give lawmakers enough time to figure out a long-term solution.

"I think there is value in starting discussions," he said. "But I don't think there's enough time to have that conversation before [May 19]."

Asked if it was likely that the Legislature would consider a one-year solution during the coming session, Gillam said, "I think that's where we're headed."

A Section on 05/12/2016