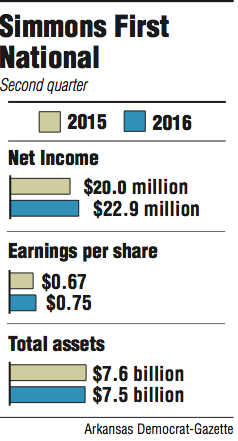

Simmons First National Corp. earned $22.9 million in the second quarter but missed analysts' expectations for the period, the Pine Bluff bank reported late Wednesday.

The bank earned 75 cents a share, less than the average estimate of 81 cents a share based on a survey of five analysts by Thomson Reuters.

Simmons shares fell 88 cents to close Thursday at $47.30 in trading on the Nasdaq exchange.

Simmons incurred a charge-off for a fraudulent farming loan in the second quarter, said George Makris, the bank's chairman and chief executive officer.

In the last week of the second quarter, Simmons learned about the agriculture loan with a longtime customer of the bank, Makris said.

"Some grain that we held receipts on, the grain wasn't actually there," Makris said.

The bank charged off the full amount of the loss, about $2 million, Makris said.

Because the loan was considered a quality loan, Simmons had no loss provisions for it, Makris said. So the bank felt it also was appropriate to replenish the $2 million during the second quarter, Makris said.

"We're still a little unclear about our opportunities for recovery, because it's turned into a fairly complicated situation," Makris said. "We'll be dealing with that for some time."

Simmons announced in May that it had agreed to buy Citizens National Bancorp of Athens, Tenn., which had about $550 million in assets. It was the ninth purchase for Simmons since 2010.

Simmons got approval on Thursday from the Federal Reserve for the Citizens purchase, Makris said.

It is likely that Simmons will continue growing through acquisitions, Garland Binns, a Little Rock banking attorney, said in a telephone interview.

"I think that Simmons and the other public banks in the state are going to keep looking for acquisitions that would fit into their [existing markets]," Binns said. "They'll continue to expand, assuming they find the right acquisitions at the right price."

Simmons has branches in Arkansas, Kansas, Missouri and Tennessee.

Matt Olney, a banking analyst in Little Rock for Stephens Inc., said it would not be out of character for Simmons to announce another deal this year.

"They are not afraid of doing multiple deals at a time," Olney said in a telephone interview.

In May 2014, Simmons announced it would buy Community First Bancshares of Union City, Tenn., and Liberty Bancshares of Springfield, Mo., Olney said.

Simmons may announce a purchase this year, but it wouldn't push the bank beyond $10 billion in assets, Makris said. Banks that have more than $10 billion in assets face extra regulatory scrutiny and costs. Simmons reported $7.5 billion in assets on June 30.

"We have determined that we are not going to cross $10 billion [in assets] until 2017 at the earliest," Makris said. "I think we have all underestimated a little bit the preparation necessary to be a $10 billion bank. We have spent a considerable amount of time and effort internally, with our regulators and with outside consultants on the process to be prepared to cross $10 billion."

Simmons currently is considering some smaller transactions but it still is actively negotiating with larger banks in new markets.

"Those, collectively, will get us past that $10 billion mark," Makris said. "We hope that we're successful with some of those in the next 12 to 18 months."

Business on 07/22/2016