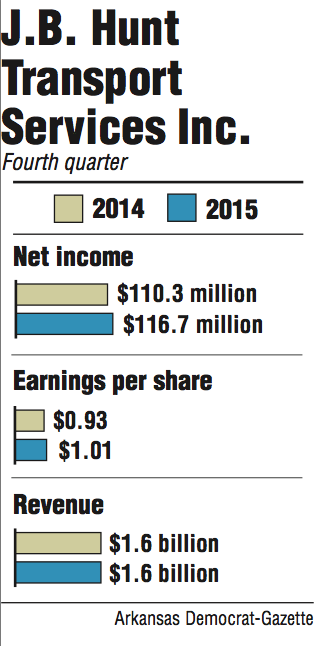

J.B. Hunt Transport Services Inc. reported net income of $116.7 million for the fourth quarter of 2015, a 5.8 percent increase from the same three-month period a year ago.

The Lowell-based company's earnings per share for the quarter were $1.01 and revenue was $1.6 billion. Earnings per share rose from 93 cents a year ago and topped analyst expectations of 99 cents, while revenue projections matched estimates and increased 1 percent from the fourth quarter of 2014.

J.B. Hunt also reported its full-year earnings Thursday. Profits rose 14 percent from $374.8 million in 2014 to $427.2 million in 2015. Revenue was flat at $6.2 billion, while earnings per share were $3.66, up from $3.16 a year ago.

"With the market volatility that we've seen here of late, it's nice to see a company beat expectations, which they did," Stephens Inc. analyst Brad Delco said. "So overall I think it was a good quarter."

J.B. Hunt attributed the rise in fourth-quarter profits to a number of factors, including increased revenue among three of its four business segments. The company also said fuel economy, lower maintenance costs, less reliance on third-party carriers in its intermodal and dedicated contract services divisions, expanding gross margins in its brokerage business, and lower safety and insurance costs played a role in the increased revenue.

The Fortune 500 company produced $967 million in intermodal revenue during the three-month period, a 1 percent increase from a year ago, as rail volumes grew by 6 percent. Operating income in the company's largest segment fell 1 percent to $127.7 million because of increases in rail-purchased transportation, equipment ownership, driver recruiting and retention costs.

But Delco said margins still beat his expectations in the segment.

"The other thing that stands out to me is they saw intermodal volumes accelerate from third to fourth quarter, which was a good sign to see with some of the greater uncertainty in the macroeconomic backdrop that we're in right now," Delco said.

Revenue increased 3 percent to $99 million in the trucking division behind "customer rate increases and an increase in fleet size." J.B. Hunt operated 2,149 trucks during the quarter, up from 1,886 a year ago. Operating income in the segment also grew to $10.4 million, up 29 percent.

Increased rates and new customer accounts contributed to a 2 percent revenue increase to $369 million in the dedicated segment, up from $363 million in the fourth quarter of 2014. There was a 13 percent increase to $42 million in operating income as well, boosted by revenue from new customers, higher truck productivity, less reliance on third-party carriers and lower maintenance costs.

Operating income grew by 40 percent to $12.8 million in the brokerage business, but revenue fell 4 percent to $189.5 million. The company said the drop was mostly because of a "31 percent decrease in revenue per load due to lower fuel prices and freight mix changes driven by customer demand." J.B. Hunt reported a 44 percent decrease in fuel surcharge revenue across all divisions when compared with the fourth quarter of 2014.

"You can see the majority or major portion of that revenue decline was a function of cheaper fuel prices," Delco said of the brokerage business. "And to some extent, cheaper spot rates in the market."

J.B. Hunt reported the repurchase of 672,500 shares of company stock for about $50 million during the quarter. Shares of J.B. Hunt stock closed Thursday at $66.99, up $1.27. The company still has about $451 million under a share reauthorization program and 114 million outstanding shares of stock remaining as of Dec. 31, 2015.

Delco said it's another indication of a diverse company that had a "very strong year," and there's room for growth in 2016. J.B. Hunt previously announced 2016 expectations that included a 9 percent to 12 percent anticipated increase in revenue and 8 percent to 11 percent increase in operating income.

"When we look forward to 2016, particularly on the intermodal side, they have some lanes that are reopening or have recently reopened," Delco said. "You have better rail service. You have an improvement with West Coast port activity after the disruptions from the labor disputes. And you have Norfolk Southern, which discontinued their triple crown service, which was an intermodal service they provided that J.B. Hunt, we believe, won a fair share of that business.

"So if you look across those four different drivers of growth, those four issues, they're all opportunities for them to sort of outpace growth of general macroeconomic trends."

Business on 01/22/2016