Wal-Mart Stores Inc. continues efforts to streamline and reorganize its operations, announcing Friday that it plans to close 269 stores worldwide.

The closings, which include 154 stores in the U.S., are expected to affect as many as 16,000 employees worldwide. Wal-Mart pledged to assist laid-off workers with finding jobs at other stores. The company will give them 60 days of pay, and some will be eligible for additional severance. All but one of the U.S. stores will close by the end of the month.

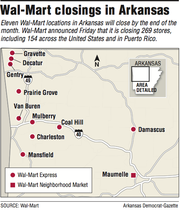

The 11 stores shutting down in Arkansas, most in the western half of the state, are a Neighborhood Market in Maumelle and Wal-Mart Express locations in Charleston, Coal Hill, Damascus, Decatur, Gentry, Gravette, Mansfield, Mulberry, Prairie Grove and Van Buren.

Wal-Mart operates 11,600 stores worldwide and announced along with the closures that it still has plans to add up to 405 locations this year, including 165 in the U.S.

Chief Executive Officer Doug McMillon, at an October meeting with analysts, hinted at the shutdown of underperforming stores, noting then that the retailer needed to shift its focus from being the biggest retailer to being the best. He further addressed the closures and the retailer's future in an article posted Friday on a Wal-Mart blog.

McMillon, who will mark his second anniversary as CEO on Feb. 1, said the changes will help improve the relationship that Wal-Mart has with its customers. He reiterated the retailer's goal of further blending the online and in-store shopping experiences.

"Managing our portfolio is essential to maintaining a healthy business," McMillon said. "This allows us to create an even stronger Wal-Mart by winning with our proven store formats and deepening our relationships with customers. Ultimately, this is in the best interest of our company and reflects the priorities of our growth plan."

Wal-Mart has stores in 28 countries and employs 2.2 million worldwide. It has more than 4,000 stores in the U.S. with 1.3 million employees. McMillon noted that the revenue generated by the stores that will close accounts for 1 percent of Wal-Mart's $485.7 billion in revenue and total square footage worldwide. The 154 domestic closures represent about 3 percent of the stores in the Wal-Mart U.S. division.

About 10,000 U.S. employees are affected by the closures. Wal-Mart said that more than 95 percent of the U.S. employees losing their jobs are working at locations within 10 miles of other Wal-Mart stores and will be encouraged to apply for jobs at those stores. Wal-Mart also will offer resume and interview training.

Analysts said they were not surprised by news of the closures. McMillon had been preparing investors for the possibility over several months, but Edward Jones analyst Brian Yarbrough said some were likely hoping to see Wal-Mart pull out of underperforming international markets entirely.

"It's positive that management is actually closing some stores. For years they were so stuck on store growth," Yarbrough said. "Still, they're opening more stores next year than they're closing. When you look at it, and so much is moving to online, at the end of the day, do they need 3,500 or so Supercenters in the United States? You wonder is there a need for as many locations as they have, even after the closures."

Wal-Mart has undergone notable changes this year including the layoff of 450 home office employees in October. The total number of corporate employees laid off increased Friday with 120 let go at Sam's Club, separate from the store closures.

Primarily the shutdowns in the U.S. focused on smaller-format stores, including 102 Wal-Mart Express locations. Those stores average 12,000 square feet and were part of a pilot program begun in 2011.

None of the college campus locations, at one time considered part of Wal-Mart's smaller-format operation, was included on the list of closures. Wal-Mart operates campus locations, ranging from 3,000 to 5,000 square feet, at the University of Arkansas at Fayetteville, University of Missouri, Georgia Tech, Arizona State and Virginia Commonwealth.

At one point, Wal-Mart had been building smaller Neighborhood Markets, but now prefers them to be of about 40,000 square feet. Some of the stores affected by the closures were opened as Neighborhood Markets but reclassified on the basis of square footage.

"While we have learned a lot from this pilot, including a deeper understanding of the everyday needs of our customers, we have decided not to proceed with this offering," McMillon said. "We feel we can better serve our customers by focusing on Supercenters and Neighborhood Markets and by investing in e-commerce and services like Pickup."

Wal-Mart trimmed its earnings estimates for the year in August and has been looking for ways to improve its bottom line with modest sales growth and raising employee wages. The retailer also earmarked up to $1.5 billion for e-commerce expenditures this year.

Investors were told in October to expect in fiscal 2017 a decline in earnings of 6 percent to 12 percent per share, despite net sales growth of 3 percent to 4 percent. That led to a one-day drop in share price of more than 10 percent.

At least one organization critical of the retailer pointed to the raise in wages as the motivation for the store closures. Making Change at Wal-Mart, the organization behind an effort to unionize the retailer's employees, has called for years for Wal-Mart to raise pay, but criticized the decision Friday.

"Sadly, these latest store closings could very well be just the beginning," Making Change at Wal-Mart spokesman Jessica Levin said. "This sends a chilling message to the company's hardworking employees that they could be next and with no one standing up for them, that is no doubt the reality."

McMillon defended the company's decision to increase pay. Wage increases, another round of which is set for February, are part of a plan to improve the in-store experience and entice more shoppers.

"This is about managing our portfolio smartly," McMillon said. "Our investment in associate wages and training is a long-term investment that is already paying off."

Included in the store closures are 23 Neighborhood Markets, 12 Supercenters, six discount centers, four Sam's Clubs in the U.S. and seven stores in Puerto Rico. Internationally the company is closing 60 stores in Brazil and 55 of what it describes as "primarily small, loss-making stores in other Latin American markets."

During fiscal 2017, which begins Feb. 1, the company will open 50 to 60 Supercenters, 85 to 95 Neighborhood Markets and seven to 10 Sam's Club stores in the United States. Wal-Mart is planning to open 200 to 240 stores internationally in the new fiscal year.

This month, the final in its fiscal 2016, the company is opening 69 stores and will hire 6,000 employees in the U.S., according to a spokesman.

Despite the changes, some analysts still view Wal-Mart as an undervalued stock. Shares ended Friday trading at $61.93, down $1.13.

"From a strategic standpoint they are focusing on winning where it matters," Morningstar analyst Ken Perkins said, adding, "We still think, long term, this is a company that has some pretty strong competitive advantages with size, reputation and location."

A Section on 01/16/2016