The oil slump deepened Thursday as crude prices were sent to lows not seen in more than a decade on fears that turmoil in China’s stock market means weaker demand from the world’s second-biggest oil consumer.

Concerns about slowing demand from China have weighed on an oversupplied oil market for two years, and Thursday crude came close to $30 a barrel as the world remains awash in crude, analysts said.

“I think supply is the major issue,” said Rob Lutts, president and chief investment officer for Cabot Wealth Management. “There’s just a lot of supply. Demand, I think, hasn’t really waned tremendously even though there’s fear of it.”

Oil prices reached the lowest level in 12 years Thursday as investors grew more concerned about China’s economic slowdown. The U.S. stock market also plunged on worries about China, with the Dow Jones industrial average tumbling almost 400 points.

The plunge in oil prices eased after China’s regulators suspended a circuit-breaker rule that halted trading automatically, said Phil Flynn, an energy analyst with Price Futures Group.

The plunge “was based on fear to a large extent because global markets were falling apart,” he said.

West Texas Intermediate crude declined 2.1 percent and closed at $33.27 a barrel on the New York Mercantile Exchange. During trading, prices dropped to $32.10, the lowest level since 2003.

Brent crude, a benchmark for international oils, fell 1.4 percent to $33.75 a barrel, the lowest close since 2004.

The sell-off of crude occurred because of an oversupply of oil on the market, with inventories in some regions at record highs.

“If you are concerned about the global economy falling apart, it’s going to make those [oil] inventories look that much higher,” Flynn said.

Some time ago, supply began to outstrip demand as U.S. shale production rose and OPEC decided to forgo limits on output.

This cut crude prices, which were more than $100 a barrel in 2014, by about 50 percent. And as the glut persisted in 2015, oil prices were reduced another 30 percent.

Analysts don’t expect crude to significantly rebound in 2016, meaning there could be further slowdown of the energy industry in the United States.

Oil producers already have laid off tens of thousands of employees, pulled drilling rigs and reduced spending in response to the slump in prices.

Murphy Oil of El Dorado reduced its 2015 budget by 30 percent and its workforce by at least 23 percent. The company has not yet released its 2016 capital budget.

U.S. production is down only 3 percent since the middle of 2015 — that’s despite a 50 percent reduction in the number of active drilling rigs.

This is because oil producers have become more efficient at pulling oil from the ground and cutting costs.

“It’s been remarkable how resilient production has been,” Lutts said. “There’s just a lot of supply out there and no indication of someone saying ‘uncle’ yet.”

Analysts said Thursday that the closer prices get to $30 a barrel and lower, the harder it is going to be for U.S. producers to keep producing at the levels they are now.

“If we close below $32 to $33 — it’s a can of worms,” said Tom Kloza, chief oil analyst for gasbuddy.com, which operates a price-tracking website. “And I think they are ugly worms for people in the oil patch.”

Energy company shares also took a hit Thursday. Murphy Oil shares fell 3.4 percent; Marathon Oil Corp. dropped 5.4 percent; and Exxon Mobil Corp. 1.6 percent.

Kloza expects oil prices to range between $32 and $50 a barrel this year.

He said that with supply dwarfing demand, the oil market won’t rebalance until at least the second half of this year.

Until then, the oil market is being tested, he said. Demand for crude will decrease further by March because refineries will use less as they go down for seasonal maintenance, and then supply also will get a boost if Iran places more of its oil on the market as it plans to do when sanctions are lifted.

“If all of the calculus for rebalancing crude is based on oil demand going up about 1.4 million barrels of crude a day, it’s tough to generate growth permanently,” Kloza said.

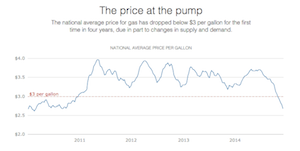

A bright spot in the plunge in oil prices is that U.S. consumers are paying for some of the cheapest gasoline prices since 2009.

The national average of gasoline was $1.99 a gallon Thursday, down from $2.19 a year ago. And in Arkansas, prices at the pump averaged $1.75 a gallon, down from $2.06 in January 2015, according to AAA’s daily fuel gauge report.

Gasoline prices will increase about 50 cents to 75 cents in the spring when refineries go down for maintenance, but overall they will be lower this year than they were in 2015, Kloza said.

“It will be lower,” he said. “And it will be a cheap year.”

Business on 01/08/2016