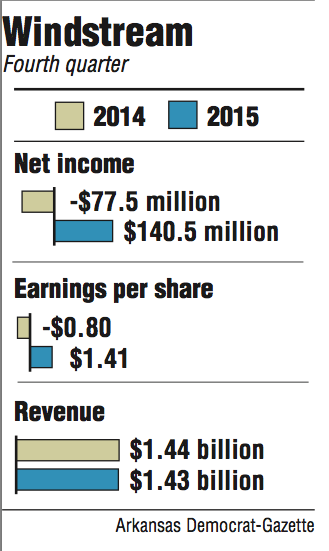

Windstream Holdings Inc. on Thursday posted a fourth-quarter profit of $140.5 million, reversing a loss during the same period a year ago.

The Little Rock-based company had earnings per share of $1.41 for the period that ended Dec. 31, compared with a loss of 80 cents during the same quarter in 2014.

Windstream had a net loss of $77.5 million during its fourth quarter in 2014.

The telecom company had revenue of $1.43 billion for the fourth quarter, down from $1.44 billion during the same period a year ago

The company's earnings "were OK," said Barry McCarver, an analyst with Stephens Inc. "Revenue came in basically in line with my estimates, but a little bit below consensus."

Revenue estimates for the quarter ranged between $1.4 billion and $1.44 billion. Analysts had expected Windstream to post a loss of 44 cents per share for its fourth quarter.

Shares of Windstream rose 1.97 percent to close at $6.74 Thursday on the Nasdaq.

"During the year, we made significant progress on our strategic objectives," said Tony Thomas, president and chief executive officer, in a prepared statement.

"We remain focused on stabilizing and improving Windstream's financial performance and advancing our network capabilities -- all of which position the company for long-term success and shareholder value creation," he said.

Windstream completed its $75 million share repurchasing plan in February, the company said. The buyback program was started in August 2015.

Windstream said Thursday that the company reduced its debt by $3.5 billion in 2015 as a result of the sale of its data center business in December and the spinoff of its network into Communications Sales & Leasing in April.

Windstream retains about a 20 percent equity stake in Communications Sales & Leasing that they plan to use in the future to further reduce debt.

The company said it also plans to spend between $800 million and $850 million on capital projects in 2016.

That is in addition to spending another $200 million to complete a program to upgrade Windstream's broadband capabilities by the end of 2016. Part of the $200 million is funded by the sale of the data center business.

"We are executing a focused strategy to stabilize and grow operating cash flow," Thomas said in the statement.

"We also will continue to prudently manage our balance sheet and take a balanced approach to capital allocation that includes reducing debt, making capital investments that create incremental cash flows and returning capital to shareholders," he said.

Business on 02/26/2016