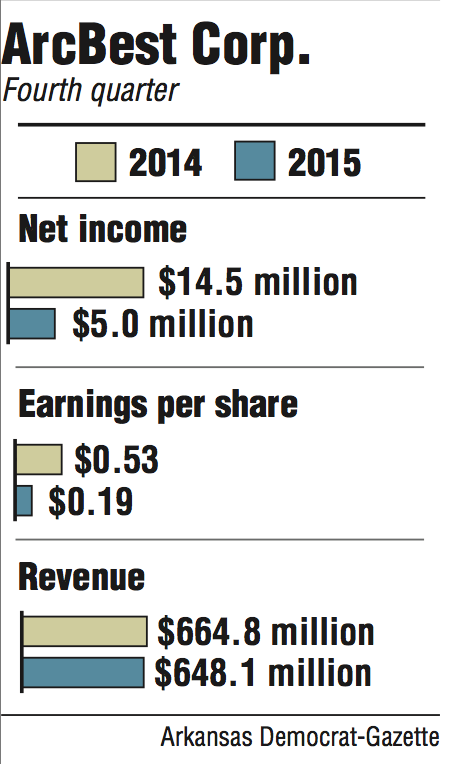

ArcBest Corp. reported a 66 percent decline in net income and a 2.5 percent drop in revenue during the fourth quarter of 2015, results that led the Fort Smith-based company's stock to tumble Wednesday.

ArcBest's $5 million in profit for the quarter was well below $14.5 million during the same period a year ago, while earnings per share dipped from 53 cents to 19 cents. Revenue also fell to $648.1 million, down from $664.8 million in the fourth quarter of 2014.

It was the second straight quarter the company reported top and bottom line decreases, and ArcBest cited a soft freight environment, weakness in the manufacturing and industrial sectors, and lower fuel surcharge revenue stemming from the decline in diesel fuel prices.

Fourth-quarter results missed analyst expectations of $652.5 million in revenue and earnings per share of 41 cents.

Shares of ArcBest stock closed Wednesday trading at $17.63, down $3.38, or 16 percent.

"The results were below expectations, which we think illustrates weakness in the industrial economy," said Brad Delco, a transportation analyst with Little Rock-based Stephens Inc.

The challenges also took a toll on the company's workforce. Chief Executive Officer Judy McReynolds said ABF Freight, the company's largest subsidiary, laid off 200 dockworkers and city drivers last month in an effort to "better align" the labor force with fewer shipments moving through the network.

The layoffs represented a 4 percent reduction in labor compared with the fourth quarter of 2015 and a 3.3 percent decline from January 2015. The company also had attrition elsewhere as an unspecified number of retiring workers were not replaced.

McReynolds said workforce costs account for about 65 percent of the company's expenses and ArcBest would continue to monitor labor levels closely.

"We're watching the business to see how things are going to go here," McReynolds said. "It's certainly the case it's not just the field operation that has to work through this, but the rest of the company. So if we see that this is going to be a continued lower level of business, a sustained lower level, we're going to have to evaluate those things and make the necessary adjustments."

ABF Freight reported $461.5 million in revenue during the fourth quarter, down 5 percent from $485.9 million a year ago. David Cobb, the company's chief financial officer, said the revenue total was impacted by "reduced business levels" and lower fuel surcharges.

ArcBest said manufacturing fell to levels that haven't been seen since 2009.

"In the fourth quarter we were challenged by the weaker environment and did not accomplish our objectives in the freight business," McReynolds said. "However, we made progress in growing the asset-light portion of our business."

Those businesses -- Panther Premium Logistics, ABF Logistics, FleetNet and ABF Moving -- accounted for $198.3 million in revenue during the quarter, up 6 percent from $187.1 million a year ago. The revenue also accounted for 30 percent of ArcBest's total revenue in the fourth quarter, which was an increase from 28 percent during the fourth quarter of 2014.

ABF Logistics, FleetNet and ABF Moving all experienced double-digit revenue gains compared with the fourth quarter of 2014. FleetNet's 18 percent gain to $45.3 million in revenue was the largest jump, while ABF Logistics grew by 17 percent to $56.5 million.

McReynolds told investors the company continues to invest in its logistics business, pointing to December's $26 million acquisition of Texas-based Bear Transportation Services. She said the segment has a "massive opportunity" to grow and will continue to pursue it, believing the business is "not affected by what's going on with the economy."

"They continue to make investments to grow those businesses," Delco said. "As a result, we don't believe that we've seen the full potential yet of that segment in terms of earnings. So I still think there's more to come in terms of the earnings that that segment will generate in the future."

For the full year, ArcBest's revenue of $2.7 billion was a 2 percent increase from $2.6 billion in 2014. Profits were down about 3 percent to $44.8 million from $46.1 million, while earnings per share decreased to $1.67 from $1.69.

ABF Freight's full-year revenue of $1.9 billion was on par with 2014, while tonnage per day decreased 1.5 percent. The logistics businesses reported revenue of $798.1 million in 2015, a 10 percent increase from $722.5 million a year ago.

McReynolds said ArcBest still made significant progress throughout the year in improving ABF Freight's operations and growing its other business offerings. She described 2015 as a year of "transformation" for ArcBest, but that the company is moving through a "period of economic uncertainty."

"This year's progress would've been even more if not for the soft environment that resulted from high customer inventory levels and weakness in the industrial and manufacturing sectors of the economy," McReynolds said. "This weakness accelerated at the end of the year and has yet to abate."

Business on 02/04/2016