Bolstered by increased sales and corporate income tax collections, Arkansas' general revenue in January totaled a record $628 million, a $12.2 million increase over what was collected in the same month a year ago.

RELATED ARTICLE

http://www.arkansas…">State's '17 outlook adds $106.8M to agency tills

January's general-revenue collections exceeded the state's forecast by $18.3 million, the state Department of Finance and Administration said Tuesday in its monthly revenue report.

Last month's collections are a record for the month of January, said finance department tax analyst Whitney McLaughlin. The previous record was the $615.8 million collected in January 2015, she said.

"The state's economy is doing well," said John Shelnutt, the state's chief economic forecaster.

"It is difficult to see in a single month's report. When we combine [monthly] reports, it appears to be on track with acceleration in growth, as we expected," he said.

State officials determined that the retail component of the state's sales and use tax collections in December and January increased by 4.25 percent over the same two-month period from a year ago, Shelnutt noted. Those taxes paid to the state in December are from sales in November; likewise, the taxes paid to the state in January are from sales in December.

"The first part of that Christmas-shopping season was weak, and it picked up later," Shelnutt said.

Richard Wilson, assistant director of research for the Bureau of Legislative Research, added: "The sales tax revenue from the holiday season reflects moderate growth."

Individual income taxes dipped slightly in January, from the same month last year, after the individual income tax rate cuts, enacted by the 2015 Legislature, became effective on Jan. 1.

Arkansas' unemployment rate dipped to 4.8 percent in December, the lowest since April 2001, the U.S. Bureau of Labor Statistics reported last week.

The rate fell two-tenths of a percentage point from 5 percent in November. It has fallen nine-tenths of a percentage point since December 2014 and has steadily declined for seven straight months. The national unemployment rate was 5 percent in December.

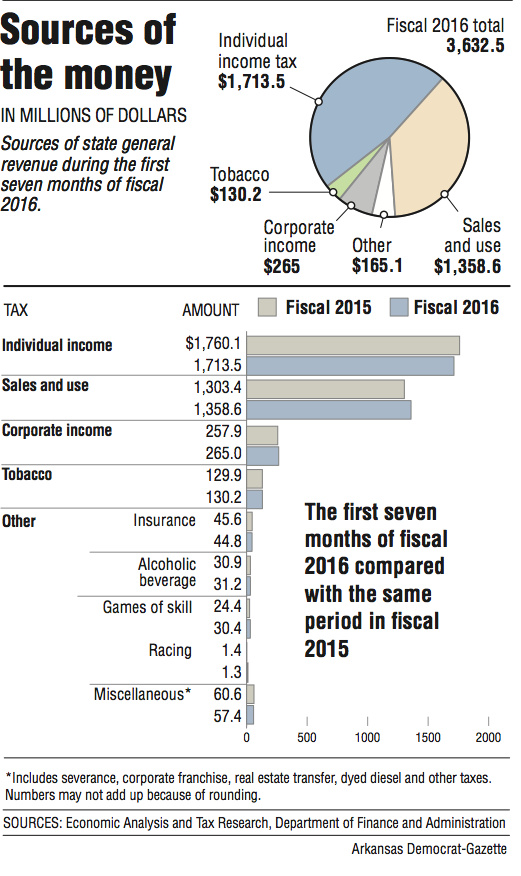

During the first seven months of this fiscal year, Arkansas' total general revenue increased by $18.3 million (0.5 percent) over the same period in fiscal 2015, to $3.63 billion. That's above the state's forecast by $103.6 million, or 2.9 percent.

State tax refunds and several other government expenditures come off the top of total general revenue, leaving "net" general revenue that agencies are allowed to spend.

The net revenue in January increased by $30.6 million (5.9 percent) over the same month a year ago to $551.9 million, exceeding the state's forecast by $31 million (5.9 percent).

January's net revenue was bolstered by a bigger-than-expected drop in the month's individual income tax refunds, which totaled $17.3 million -- a decline of $17.6 million from a year ago and $10.7 million below the state's forecast.

Wilson said he expects the lower-than-expected individual income tax refunds in January to "catch up" during the next two months.

During the first seven months of fiscal 2016, the net has increased by $12.9 million (0.4 percent) over the same period in fiscal 2015 to $3.13 billion, and that's $97.8 million (3.2 percent) above the forecast.

Finance department Director Larry Walther said the administration is projecting a $35.9 million general-revenue surplus for fiscal 2016.

Last year, the Legislature enacted a $5.19 billion general-revenue budget for fiscal 2016 -- a $131.5 million increase from fiscal 2015 -- as it approved tax cuts projected to reduce state general revenue by $26.5 million in fiscal 2016 and nearly $101 million in fiscal 2017.

According to the finance department, January's general revenue included:

• A $4.4 million (2.3 percent) increase in sales and use tax collections over the same month in 2015 to $197.6 million, exceeding the state's forecast by $600,000 (0.3 percent).

The collections largely are the taxes paid by businesses from their sales in December, the department said.

• A $2 million (0.6 percent) decrease in individual income tax collections from a year ago to $354.2 million. However, the collections exceeded the state's forecast by $4.9 million (1.4 percent).

Reduced collections from individual income tax withholdings and estimated quarterly payments accounted for the decline from a year ago, the department said.

"This is the first month of that $100 million tax reduction," proposed by Gov. Asa Hutchinson and enacted by the 2015 Legislature, Walther said. "We are very pleased that our forecast was pretty much on target."

The tax cut reduces the income-tax rate from 6 percent to 5 percent for Arkansans earning between $21,000 and $35,000 and the rate on incomes between $35,100 and $75,000 from 7 percent to 6 percent.

• A $6.3 million (18.8 percent) increase in corporate income taxes over a year ago to $39.8 million, exceeding the state's forecast by $7.3 million (22.4 percent).

It's difficult to predict monthly corporate income taxes, Walther said.

"You'll get one or two large taxpayers that will drop some money in one month versus another."

• A $600,000 (3.9 percent) increase in tobacco tax collections over 2015, to $17.1 million. Collections beat the state's forecast by $600,000.

Monthly changes in tobacco tax collections can be attributed to uneven patterns of stamp sales to wholesale purchasers, the department said.

A Section on 02/03/2016