With weeks to go before the start of the next legislative session, Gov. Asa Hutchinson on Tuesday announced a new element to his tax-cut plan, seeking to eliminate the state income tax on military retiree benefits.

During a news conference at the state Capitol, Hutchinson called the elimination of the tax an economic driver for Arkansas.

“I believe it will help us bring more military retirees here, welcome them back to Arkansas,” he said. “It’s not for every veteran, because not every military veteran has retiree benefits.”

Hutchinson said the proposed exemption, resulting in a $13 million reduction in general revenue, would be offset by closing other exemptions.

Those changes include removing the exclusion from income on unemployed compensation as well as applying sales taxes on the full cost of manufactured housing and sale of candy and soft drinks.

Only 62 percent of the cost of manufactured housing is currently taxed, and candy and soft drinks are taxed at the lower grocery rate, Hutchinson said.

Hutchinson’s proposal also seeks to reduce the syrup tax, initially passed as a temporary tax, by 40 percent, or $6.3 million.

By closing exemptions, Hutchinson said, the state would receive $19.3 million in additional revenue — $13.8 million of which would come from raising the tax on candy and soft drinks.

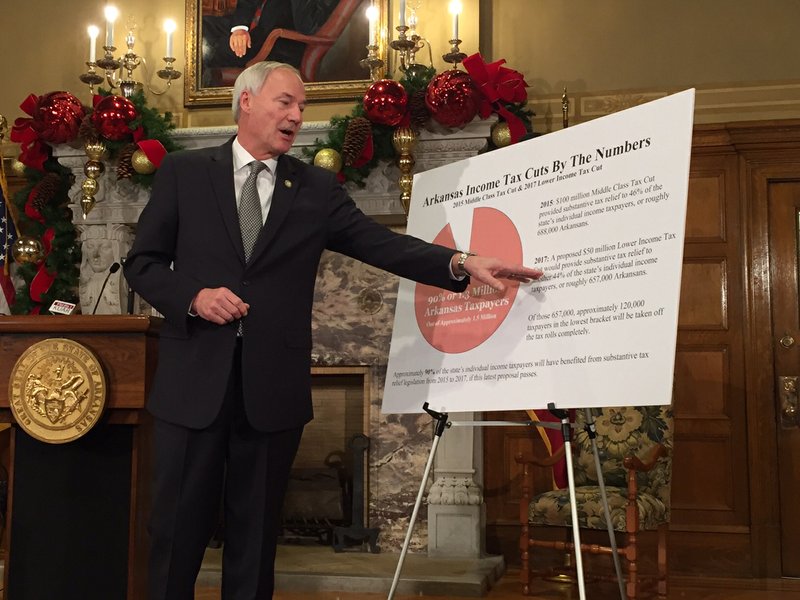

The governor’s tax cut plan would additionally alter tax rates for Arkansans across four income brackets making less than $21,000, resulting in a total income tax cut of about $50 million for around 657,000 residents.

The income tax for those making $4,299 annually or less — about 120,000 taxpayers in the state — would be eliminated.

“That is progress that encourages growth and encourages spending,” Hutchinson said, noting that the elimination “makes the difference in providing for children, buying the groceries, buying the cars and having a good Christmas.”

Other low-income brackets would see reduced rates: from 2.4 percent to 2 percent for those earning $4,3000 to $8,399; 3.4 percent to 3 percent for those making $8,400 to $12,599; and 4.4 percent to 3.4 percent for taxpayers with annual pay of $12,600 to $20,999.

In 2015, Hutchinson enacted a $100 million tax cut for middle-income Arkansans earning between $21,000 and $75,000 annually.

Check back with Arkansas Online for updates and read Wednesday’s Arkansas Democrat-Gazette for full details.