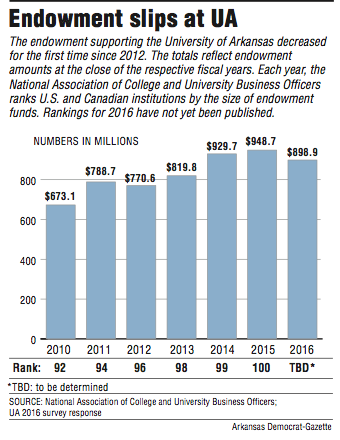

FAYETTEVILLE -- The endowment supporting the University of Arkansas at Fayetteville decreased by $49.8 million in the 12-month period ending June 30, a drop in value driven by investment losses that were larger than new gifts.

The university listed endowment assets of $898.9 million at the close of fiscal 2016 in a survey report, down from a record high of $948.7 million a year earlier.

Investment losses totaled $12.6 million compared with $9.9 million in individual gifts and bequests. The endowed gifts dropped from $21.1 million reported in a 2015 survey.

The endowment includes funds devoted to various purposes, such as establishing faculty positions or student scholarships.

Donors step up to provide gifts that are then invested by the University of Arkansas Foundation, which, according to its website, supports campuses and units of the UA System. The Fayetteville campus in September kicked off the public phase of its Campaign Arkansas drive to raise $1 billion.

Approximately 5 percent of the endowment is paid out each year in support of these efforts and to cover expenses, according to the foundation.

Endowment assets fell for the first time since 2012, with the drop the largest since a 2009 decrease of $235.2 million.

But in fiscal 2009, an economic recession led to double-digit percentage decreases in market indicators such as the S&P 500.

Last fiscal year, the same index increased by 1.73 percent, while University of Arkansas Foundation endowment investments resulted in a negative 2.1 percent net annualized return, according a survey report released under the state's public disclosure law.

Mark Rushing, UA-Fayetteville spokesman, gathered information from campus officials and the foundation, which is led by president and chief executive officer Clay Davis.

A 10-person executive committee of the foundation's board oversees investing policies, according to the foundation's website. Global investment firm Cambridge Associates serves as an investment adviser.

An email from Rushing stated that "beating the S&P 500 is not the Foundation's investment objective or even one of its benchmarks," calling it an "apples to oranges" comparison to look at the index and the net annualized return reported on the survey.

Rushing's email stated that the S&P 500 is composed solely of U.S. equities while the foundation "manages a diversified, multi-asset investment pool."

For the foundation's full $1.4 billion endowment -- which includes the endowment benefiting the Fayetteville campus -- the one-year investment return "will be -1.5% which we believe will compare very favorably with the investment returns of our peers in the Southeastern Conference," Rushing said in an email.

UA-Fayetteville staff members completed the survey as part of the annual National Association of College and University Business Officers-Commonfund Study of Endowments.

Comprehensive information about other universities will not be published until next year.

However, the University of Missouri System also reported a negative net annualized return -- though a smaller loss than UA -- on endowment investments in fiscal 2016, according to a survey report released under Missouri's public disclosure law. The University of Missouri System reported a net annualized return of negative 0.2 percent.

The net annualized return is defined by the survey as being the net of external fees for the year.

At UA, "roughly $3.27 million was paid by the Foundation for investment advisory services related to the management of the UA System endowment of $1.4 billion," Rushing said in an email.

"That comes to a management fee of slightly less than 0.4%. The Foundation continuously evaluates investment managers and makes changes as needed," Rushing wrote.

An Internal Revenue Service return for the foundation's 2015 fiscal year lists $2.8 million in compensation to Cambridge Associates for the 2014 calendar year, plus payments of several hundred thousand dollars each to other firms for investment management services.

Charlie Eaton, a postdoctoral scholar at Stanford University, has studied the reliance of universities on endowments. Eaton said many schools similar to UA-Fayetteville with endowments below $1 billion turn to high-risk hedge funds "to get results that are comparable to the very wealthy schools."

But "there's been very mixed performance," Eaton said.

Hedge funds are an alternative investment vehicle, usually in the form of a limited partnership.

For the University of Arkansas Foundation, Rushing said "alternative strategies include hedge funds as well as private equity." The university's survey report lists 38.6 percent of assets invested in "alternative strategies."

The report also lists 32.5 percent of assets in "non-U.S. equities." Both categories of investments were listed on the survey as resulting in negative returns: negative 0.68 percent for "alternative strategies" and negative 8.23 percent for "non-U.S. equities."

Rushing said "donor intent" drives whether a gift directly contributes to the total endowment.

UA announced in August an increase in total fundraising for the 12-month period that ended June 30, with a total of $131.6 million in cash, gifts-in-kind, planned gifts and new pledges.

The total included $50.3 million in gifts for athletics and to the Razorback Foundation, which supports the university's intercollegiate athletics. In June, during a presentation on expanding Donald W. Reynolds Razorback Stadium, UA's athletic director Jeff Long said, "signed commitments" existed for "over $20 million of capital investments in this project for new suites in the stadium."

Despite the decrease in the UA's endowment, the university's operations will not be affected, Rushing said in an email.

"Spending from the endowment is made on a rolling or moving average over the past 12 quarters, so it would take multiple negative quarters of performance to actually impact spending," Rushing said.

The foundation's investment adviser has calculated, as of June 30, a three-year annualized return on total foundation endowment investments of 6 percent and a five-year annualized return of 6.4 percent, Rushing said.

Eaton said endowments are a public asset.

"They only exist because the state and taxpayers invested billions of dollars over the decades, so people have every right to demand the best rates of return and that excessive fees not be paid to hedge fund managers or other investment managers," Eaton said.

Metro on 12/04/2016