NEW YORK -- Stocks moved mostly lower Wednesday as gains in blue-chip energy companies and banks were not enough to make up for losses in the broader market.

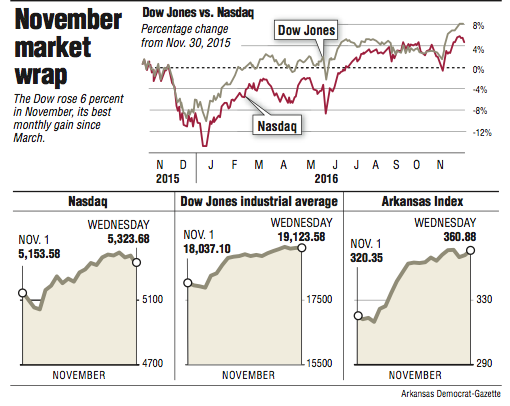

The Standard & Poor's 500 index fell 5.85 points, or 0.3 percent, to 2,198.81, and the Nasdaq composite dropped 56.24 points, or 1.1 percent, to 5,323.68.

The 30-member Dow Jones industrial average closed with a gain of 1.98 points, or 0.01 percent, to 19,123.58. The gain was attributable to big increases in a handful of Dow components, mainly Goldman Sachs, Chevron and DuPont.

Oil stocks climbed after OPEC nations, which collectively produce more than one-third of the world's oil, agreed to trim production for the first time in eight years.

The bond and energy markets saw the most drama Wednesday. Bond prices fell sharply yet again, and the 10-year note's yield rose to 2.38 percent from 2.29 percent on Tuesday, a major move for that market. That yield is now trading at its highest level since July 2015.

The election of Donald Trump as the country's next president has sent investors fleeing out of safe-play assets such as bonds, gold and dividend-paying stocks and into riskier investments like small companies, which would benefit the most from a growing domestic economy.

The Russell 2000 index, which is made up of mostly small- to midsize companies, soared 11 percent in November. That's the biggest one-month gain for that index in five years.

Investors believe that Trump's promises to cut taxes, invest heavily in infrastructure, and cut back regulation will help grow the economy and might even cause inflation, which has been almost nonexistent since the financial crisis. U.S. government bonds quickly become less appealing to investors in a healthy, growing economy and in an inflationary environment.

"We have elected a pro-growth president who is going to move very quickly to make some drastic changes, and investors are trying to figure out what to do with that," said Tom di Galoma, head of Treasury trading at Seaport Global Holdings.

The price of U.S. crude surged $4.21, or 9.3 percent, to close at $49.44 a barrel in New York. That's the biggest one-day gain since February. Brent crude, the international benchmark, gained $4.09, or 8.8 percent, to $50.47 a barrel in London.

Crude dropped almost 4 percent Tuesday as investors felt a deal was becoming less likely.

Other energy commodities also jumped sharply. Heating oil rose 11 cents to $1.57 a gallon, wholesale gasoline rose 11 cents to $1.49 a gallon, and natural gas rose 3 cents to $3.35 per 1,000 cubic feet.

Higher oil prices mean more revenue for companies that extract or sell oil, and energy companies made big gains Wednesday. Exxon Mobil picked up $1.40, or 1.6 percent, to $87.30, and Chevron rose $2.22, or 2 percent, to $111.56.

More specialized oil companies, particularly drillers, oil exploration companies and companies that support drillers, soared. Marathon Oil leaped $3.11, or 20.1 percent, to $18.06. Ocean rig operator Transocean jumped $1.88, or 17 percent, to $12.90.

Business on 12/01/2016