Wal-Mart Stores Inc. lifted its earnings outlook for the year and reported better-than-expected profit and sales for the second quarter of fiscal 2017, showing signs its strategy to spend big to improve store and online shopping is paying off.

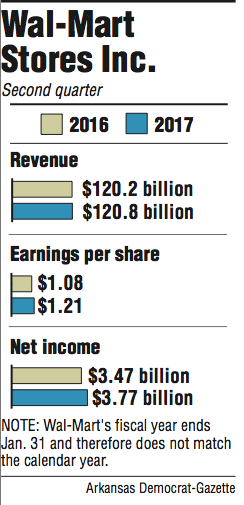

The Bentonville-based retailer reported a net income increase of 8.6 percent to $3.77 billion, or earnings per share of $1.21. Revenue for the quarter was $120.85 billion, up slightly from a year ago.

Both that quarterly revenue and adjusted earnings per share of $1.07 -- which doesn't account for a noncash gain of 14 cents per share from Wal-Mart's sale of its Chinese e-commerce business to JD.com during the quarter -- beat analyst expectations of $120.3 billion and $1.02.

The results came as other bricks-and-mortar retailers like Target and Macy's struggled through difficult quarters as consumers continued to shift their shopping to online marketplaces like Amazon.com. But Wal-Mart turned in what analysts agreed was a strong quarter. Shares of company stock rose 3 percent in pre-market trading Thursday and closed at $74.30 a share, up $1.37.

"This is not just a function of easy comparisons," Stephens Inc. retail analyst Ben Bienvenu said of Wal-Mart's quarterly results. "It's a function of real progress being made."

Wal-Mart has invested billions in efforts to improve shopping for customers, believing it would lead to improved sales. The retailer boosted wages for employees, worked to clean up its stores and keep items in stock and strengthened its e-commerce operation.

Chief Executive Officer Doug McMillon said Thursday that the retailer's strategy is working in U.S. stores, which reported $76.2 billion in net sales for the quarter, a 3.1 percent increase from a year ago.

Domestic same-store sales -- or sales from stores that have been opened for at least one year -- grew 1.6 percent, which was the division's eighth consecutive positive quarter. Wal-Mart's U.S. stores also saw positive traffic increases for the seventh straight quarter at 1.2 percent.

Wal-Mart U.S accounts for more than 60 percent of the retailer's overall business.

"I think if you step back a year and a half ago, I don't think a lot of people believed it," Edward Jones retail analyst Brian Yarbrough said. "But it's coming together. I think they're doing a solid job in a very tough retail climate and backdrop. They're generating positive traffic. That's difficult."

Wal-Mart reported strong traffic in food and consumables during the quarter, but the falling price of food affected overall improvement in the grocery business. Stronger pharmacy sales were the result of the increased price of brand-name drugs and the growth in the number of filled prescriptions. Wal-Mart said strength in sporting goods was driven by new products, while entertainment sales were soft.

Overall, U.S. division CEO Greg Foran said, customers are responding favorably to Wal-Mart's changes.

"The contributing factor to our results is simply a consistent improvement in the customer experience," Foran said. "The word that comes to mind there is execution. ... Customers are reacting to better shopping experiences, better execution when they're in our stores."

Wal-Mart also got a lift from its global e-commerce operations, which had seen growth decelerate for the past several quarters. The company reported e-commerce sales increased 11.8 percent quarter over quarter, boosting a segment that McMillon said had been growing too slowly in the first quarter.

McMillon said e-commerce sales were stronger in the U.S than the company's key international markets. Wal-Mart rolled out Wal-Mart Pay, its mobile-payment system, nationwide and added grocery pickup service to 30 more markets during the quarter. Earlier this month Wal-Mart purchased online retailer Jet.com for $3.3 billion, though the sale is still subject to regulatory approval.

Wal-Mart also benefited from the continued expansion of its online assortment. McMillon said about 7 million items have been added to Walmart.com since the beginning of the year and the retailer currently offers about 15 million items on its website.

"I think for me, it's one where it's definitely nice to see a bounce sequentially," Bienvenu of Stephens Inc. said of the e-commerce acceleration. "But it's still early to call it a trend. So I think if they can continue to stamp out accelerated results, maybe that will change the market's tune on that segment of the business."

Sam's Club reported net sales of $14.5 billion, which is a 1.3 percent loss. Same-store sales were down 1.2 percent, and market deflation -- primarily in food -- accelerated from the first quarter. But the warehouse division reported a membership income increase of 2.9 percent as the company continues to implement new strategies and invests in technology.

Wal-Mart International's net sales decreased by 6.6 percent to $28.6 billion. But same-store sales were positive in nine of Wal-Mart's 11 international markets.

The company's Mexico and Central America division -- Walmex -- was the strongest performer internationally, with same-store sales increasing 7.3 percent. Same-store sales at Asda, the company's United Kingdom grocery chain, fell 7.5 percent and traffic at stores dropped 6 percent because of the intense price competition that has led to continued drop in food prices across the market, according to Wal-Mart.

"Our strategy to turn things around is focused on improving the retail basics," McMillon said about Asda's struggles. "While our turnaround will take time, I'm confident in the new leadership team there and want to assure you we're addressing this with urgency."

Wal-Mart raised its outlook for the 2017 fiscal year to between $4.15 and $4.35 per share. Previously, it issued guidance of between $4.00 and $4.30 per share. The retailer also said third-quarter same-store sales would rise between 1 percent and 1.5 percent.

Yarbrough, the Edward Jones analyst, said the adjusted guidance and performance in the second quarter shows Wal-Mart is moving in the right direction with consumers. But he said the company still has a long way to go as it continues to face competition from other retailers in a competitive environment.

"It's not going to get any easier for them," Yarbrough said. "But positive traffic, positive comps, raising of guidance is pretty darn strong in this retail market."

Business on 08/19/2016