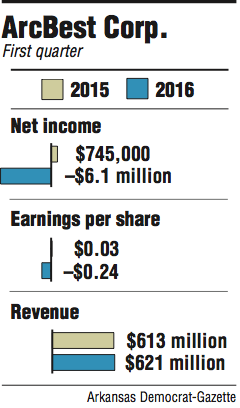

Trucking company ArcBest Corp., based in Fort Smith, lost $6.1 million in the first quarter, the company reported Friday.

Weak manufacturing and low fuel prices weighed on ArcBest. The quarterly loss totaled 24 cents per share. In the same period last year, ArcBest reported earnings of $745,000, or 3 cents per share.

"Ongoing economic weakness continued to impact our business, consistent with trends that began in the fall of 2015," said ArcBest Chief Executive Officer Judy McReynolds. "We are encouraged ... by the positive reception our customers have to the expanding array of services we offer in helping them better manage their complex supply-chain issues."

ArcBest's revenue grew, compared with the same period last year, rising from $613 million to $621 million. But revenue still missed analyst expectations, and the company suffered higher operating costs.

The lower-than-expected revenue resulted from softer demand for trucks to carry manufactured goods. The company's truck division, ABF Freight, performed worse than it did in the same quarter last year, reporting a revenue of $439.5 million, down from $441.2 million.

Ups and downs in the manufacturing sector stalled the demand, said Brad Delco, transportation analyst at Stephens Inc. As manufacturers produce more goods, they need to pay more trucks to transport them.

"The results sort of highlight the fact that we are in a choppy economic environment," he said.

But this quarter, the manufacturing sector didn't produce the expected demand to meet the supply of trucks ArcBest provided. ArcBest saw tonnage, or the amount of goods that need to be transported, declines of between 5 percent and 6 percent in the first quarter.

"You see that trend and you realize that we are seeing some weakness in freight demand," he said. "General economic activity is good for moving freight."

Low fuel prices also cut into the transportation company's bottom line. Customers pay trucking companies fuel surcharges for miles traveled. When fuel prices drop, companies' revenue tends to fall as well.

"The way the algebra works, it puts pressure on the margin," Delco said. "You're losing revenue."

Two of the company's logistics branches -- ABF Logistics and Panther Premium Logistics -- also reported lower revenue because of lower fuel prices and low demand for transportation.

ArcBest acquired Bear Transportation Services for $26 million in December. The company said the acquisition didn't help this quarter's bottom line, but that the purchase will help position ArcBest for growth.

McReynolds said ArcBest is trying to return to its previous profit levels.

"Although we've experienced a challenging quarter, we are continually making investments in new innovations where even small portions of efficiency improvements have the potential to yield revenue growth, significant cost savings and better experiences for our customers," McReynolds said.

Business on 04/30/2016