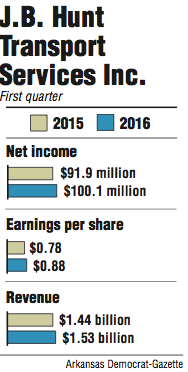

J.B. Hunt Transport Services Inc. reported net income of $100.1 million for the first quarter of 2016, a 9 percent increase from the same three-month period a year ago.

The Lowell-based company's earnings per share for the quarter were 88 cents and revenue was $1.53 billion. Earnings per share increased from 78 cents a year ago and topped analyst expectations of 85 cents, while the 6 percent rise in revenue from $1.44 billion matched estimates for the quarter.

J.B. Hunt said a number of factors contributed to the increases, including better pricing, volume growth and lower maintenance costs on equipment. The benefits outweighed other factors such as reduced fuel surcharge revenue, increased costs for driver wages and recruiting and technology upgrades.

"They certainly beat street expectations and better growth in certain areas was the predominant driver of that," said Brad Delco, a transportation analyst for Stephens Inc. in Little Rock. "Then, I think, good, solid execution on behalf of management was another reason for some of their performance."

Revenue increased across every business segment, including a 6 percent rise to $895 million in J.B. Hunt's intermodal division. The segment, which accounts for 59 percent of the company's revenue, experienced a 12 percent increase in load growth during the quarter, which the company said was the result of volumes along the West Coast ports returning to normal and rail service significantly improving from a year ago.

"There was some challenges last year with West Coast ports and quite a big disruption," Delco said. "But I think what you have here, really, is J.B. Hunt winning new business. I think there's a strong value proposition that the rails and the railroads provide shippers. More importantly, it's the consistent capacity."

Intermodal operating income was down 1 percent to $103.1 million in the quarter because of driver recruiting and retention costs, rail transportation purchases and other equipment expenses, according to the company. The division was the only J.B. Hunt segment to report a decrease in operating income during the quarter.

Operating income jumped 25 percent to $44.8 million in the company's dedicated contract services segment, while revenue rose 4 percent to $358 million. Rate increases, additional customers and 345 more revenue-producing trucks compared to the first quarter of 2015 contributed to the increase in revenue.

J.B. Hunt's brokerage division, Integrated Capacity Solutions, reported a 12 percent increase in revenue to $183 million and 63 percent increase in operating income to $10.8 million during the quarter. The division benefited from a 45 percent increase in load growth from the first quarter of 2015.

A 12 percent jump in fleet size also helped J.B. Hunt's trucking segment increase revenue by 5 percent to $96 million and operating income by 8 percent to $9.2 million. Increasing the fleet size to 2,270 tractors contributed to a 9.5 percent increase in loads moved, improving to 94,410 during the quarter.

J.B. Hunt's fuel expenses dropped 27 percent to $59.4 million because of lower diesel prices. But Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock, said the lower prices may have hurt J.B. Hunt more as fuel surcharge revenue fell 42 percent to $102.1 million.

"The surcharges look to me like they've been profitable," Williams said. "I think the other side of that diesel equation, too, is the lower fuel prices are going to impact the economics of short-term intermodal. Diesel has gotten so cheap right now that you might've previously taken something and thrown it in a container and trucked it to a freight yard and had it moved by train. The economics may not be there right now with fuel where it is."

J.B. Hunt said in its earnings release the company will maintain its previously published 2016 expectations as the "annual customer bid season is in progress and customer freight demand is expected to be closely aligned with the current choppy and unpredictable nature of the overall United States economy." J.B. Hunt anticipates a 9 percent to 12 percent increase in revenue in 2016, while operating income rises between 8 percent and 11 percent.

Delco said there's diversity in the business model to navigate any "soft patches" that arise.

"This is a multifaceted transportation service company that can better ebb and flow with demand than almost any other company that's out there," Delco said.

Shares of J.B. Hunt stock closed trading Monday at $87.25, up $1.82.

The company will hold its annual shareholders meeting at 10 a.m. Thursday in Lowell. The agenda will include a shareholder's proposal requesting the company amend its equal employment opportunity policy to specifically prohibit discrimination based on sexual orientation, gender identity or gender expression.

J.B. Hunt's board of directors recommends shareholders vote against the proposal, believing an amendment is unnecessary because the company's current policy and practice achieves its objective.

Business on 04/19/2016