Fueled by better than expected sales and use tax collections, state general revenue in March increased by $11 million over a year ago to $547.8 million and exceeded the state's forecast by $20.8 million.

The state's individual income tax collections in March also were slightly better than forecast, the state Department of Finance and Administration said Monday in its monthly revenue report.

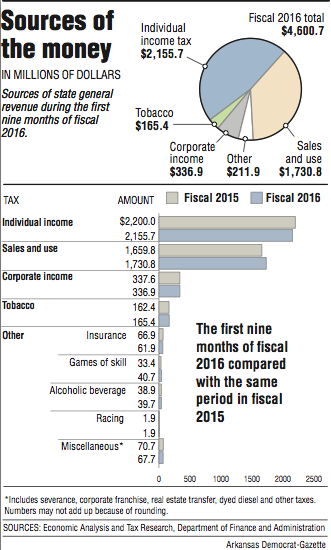

Individual income and sales and use taxes are the state's two largest sources of state general revenue.

March's general revenue collections of $547.8 million represented a record for the month, beating the previous record of $546.4 million from March 2014, department tax analyst Whitney McLaughlin said.

"The revenue report for March is good news for Arkansas and more evidence of a growing state economy," Gov. Asa Hutchinson said in a written statement.

"Revenue collections were above forecast in all major categories, continuing a strong trend of outperforming our expectations. However, while the state has enjoyed positive revenue growth, the national and global economy remains volatile, and we should be cautious on our expectations for future revenue growth," the Republican governor said.

Arkansas' unemployment rate continued to decline in February, falling to 4.2 percent from 4.4 percent in January, matching the lowest level in 40 years, the U.S. Bureau of Labor Statistics reported late last month.

The rate was 4.2 percent from April to September in 2000 but has never been lower since 1976, the earliest records readily available on the bureau's website. The national unemployment rate was 4.9 percent in February.

Arkansas' tax refunds and some special government expenditures, such as court-mandated desegregation payments, come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

In March, the net increased by $48.6 million, or 13.3 percent, over the same month a year ago to $413.7 million and exceeded the state's forecast by $41.1 million, or 11 percent.

The combination of general revenue exceeding expectations and individual income tax refunds falling $16.8 million lower than forecast are responsible for net revenue exceeding the forecast, finance department Director Larry Walther said.

Last month, the state distributed 178,178 individual income tax refunds with an average refund of $427.80, compared with 207,743 refunds and an average refund of $540.21 in March 2015, said department spokesman Jake Bleed.

During the first nine months of fiscal 2016, total general revenue collections have increased by $29 million, or 0.6 percent, over the same period last fiscal year to $4.6 billion. That's $14.1 million, or 0.3 percent, above the forecast.

So far in fiscal 2016, the net general revenue has increased by $123 million, or 3.3 percent, over the same period in fiscal 2015 to $3.82 billion. That's $72.9 million above the state's latest forecast Feb. 1.

The state's Feb. 1 general revenue forecast projected a fully funded $5.19 billion general revenue budget in fiscal 2016 and a $35.9 million surplus.

Last year, the Arkansas Legislature enacted a $5.19 billion general revenue budget for fiscal 2016 -- a $131.5 million increase from fiscal 2015 -- as it approved tax cuts projected to reduce state general revenue by $26.5 million in fiscal 2016 and nearly $101 million in fiscal 2017.

Asked whether the state now expects a surplus of roughly $100 million in fiscal 2016, "we are tracking ahead of the forecast that predicts a roughly $36 million surplus, so the tracking ahead isn't guaranteed, but it's indicating a higher surplus," said John Shelnutt, the state's chief economic forecaster.

Walther added: "We have three more months. We got another quarter to go [in fiscal 2016]."

Richard Wilson, an assistant director of research for the Bureau of Legislative Research, said that "we are well on our way" to a $100 million surplus "and just might get there."

In the fiscal session starting April 13, the Legislature will consider Hutchinson's proposed $142.7 million increase in the state's general revenue budget to $5.33 billion for fiscal 2017, which starts July 1.

According to the finance department, March's general revenue included:

• A $14.4 million, or 7.8 percent, increase in sales and use tax collections over a year ago to $193.9 million, exceeding the state's forecast by $8.5 million, or 4.6 percent.

Shelnutt said the state's sales and use tax collections in February "were fairly weak" with only 1 percent growth over a year ago, "so I think what we have to do is to combine February and March together and do a a two-month average."

"That's about 4.5 percent growth, which is in line with the economy," he said.

• A $7 million, or 3 percent, increase in individual income tax collections over the same month last year to $236.4 million. That's $3.6 million, or 1.5 percent, above the state's forecast.

Gains from the withholding tax and payments with income tax returns accounted for most of the increase over a year ago, the department said.

• A $9.5 million, or 12.5 percent, decrease in corporate income tax collections from a year ago to $65.9 million, which still exceeded the state's forecast by $5 million, or 8.3 percent.

Corporate income taxes are a volatile source of taxes and often driven by federal tax strategies, department officials have said.

Metro on 04/05/2016