Tyson Foods reported better-than-expected sales for its latest quarter, with demand increasing for its chicken products and the year-ago purchase of Hillshire Brands paying dividends.

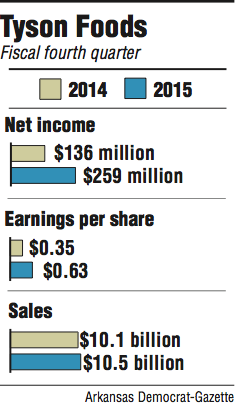

Adjusted profit, excluding one-time expenses, is up 21 percent from the same time last year, hitting $568 million for the fourth quarter ending Oct. 3. The company's earnings per share came in at 63 cents, up from 35 cents last year.

For the year, Tyson attained a record-high operating income of $2.25 billion, an increase of 37 percent over last year.

Tyson has been angling for a bigger slice of the prepared foods business, which is more stable than the volatile commodity market, since it purchased Hillshire last year for $8.5 billion. This year, Tyson introduced two new products -- Ball Park Jerky and Hillshire Snacking.

Net income was $259 million compared with $136 million a year ago. Most of the difference comes from Tyson selling foreign operations to help pay for the Hillshire acquisition.

In fiscal 2015, the first full fiscal year since the Hillshire acquisition, Tyson's prepared foods division had an operating income of $150 million, up from a loss of $47 million last year.

Driven by strong demand, Tyson's chicken segment performed the best of any of the company's divisions with an income of $370 million. Cheaper feed costs also helped boost the segment's bottom line.

Tyson's chicken segment struggled earlier this year after a bird flu outbreak that caused other countries to ban imports of U.S. poultry led to high domestic supplies that pushed down prices. Donnie Smith, Tyson's chief executive, said in a conference call with analysts that the bird flu outbreak hurt the company's bottom line by about $139 million.

Tyson and other meatpackers have had to cut out entire export markets as countries -- including Mexico, the industry's largest trading partner -- banned poultry from the U.S. In the first half of 2015. U.S. poultry and egg exports fell by 14 percent, according to the Foreign Agricultural Service.

As the weather cools, the poultry industry is keeping a wary outlook as waterfowl migrate south through some of the country's largest poultry-producing states. Wild waterfowl are thought to spread the virus to domestic flocks.

"I would not say that we are necessarily out of the woods," said Smith in the conference call with reporters. "We are taking every precaution."

The strength of the prepared foods and chicken divisions offset weakness in beef. Tyson reported a loss of $33 million in its beef segment for the quarter and a loss of $66 million for the year.

"Our chicken business is strong, pork continues to do well and we think the worst is behind us in beef," he said.

Smith said that a collapse in live cattle futures in September crippled the company's beef segment this quarter.

"It's going to stretch out more over the year," he said. "It's fair to say that had the quarter ended a couple of weeks earlier, our earnings would have been higher. It's absolutely a timing issue."

Tyson has been narrowing its beef operations over the past year. The closure of a beef production plant in Denison, Iowa, in August added $12 million to the company's balance sheet this year.

Tyson announced last week that it will close two plants -- one in Chicago and one in Jefferson, Wis. -- ending 880 jobs.

"The toughest thing we ever have to do is close a facility," Smith said. "We try to prevent that with everything we have in us."

Tyson estimated that revenue for next year will reach $41 billion. That's higher than analyst estimates, which came in at $40.4 billion, according to a survey of analysts by Thompson Reuters.

Shares jumped more than 10 percent, closing at $48.09 per share, on Monday after the quarter's earnings were released.

Ken Shea, a Bloomberg Intelligence analyst, said Tyson stock rose because the company came out with a robust outlook for next year's earnings.

"They may have exceeded some expectations out there," Shea said. "To get there may be a challenge given some of the market conditions."

Business on 11/24/2015