Windstream Holdings Inc. shares fell 3.7 percent Thursday after the telecommunications company posted its second quarterly loss of the year.

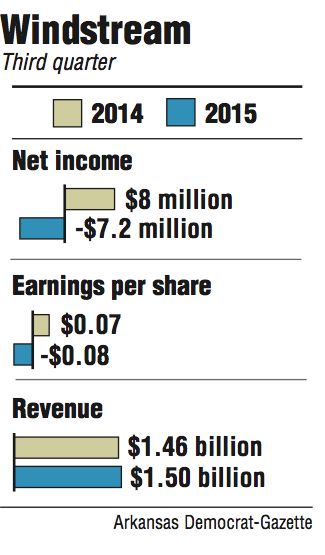

Windstream reported a loss of $7.2 million for the third quarter of 2015, compared with a profit of $8 million during the same period in 2014.

Chief Executive Officer Tony Thomas on Thursday reiterated the company's shifting business strategy and focus on investing capital to improve its telecommunications network.

"These changes take time, but the Windstream team is executing on all facets of our strategy and making progress," he said during a conference call with analysts.

"The new business unity structure has sharpened our focus and it's producing operational excellence. We're making smart investments to strengthen the network and develop growth opportunities while also optimizing the balance sheet," Thomas said.

Windstream shares fell 24 cents, or 3.8 percent, to close Thursday at $6.14 on the Nasdaq stock exchange. The company released its quarterly financial results before markets opened. The shares have traded between $4.42 and $16.04 in the past 52 weeks.

The Little Rock company had an earnings per share loss of 8 cents in the third quarter, beating analysts estimates of a loss of 34 cents. That compares with earnings per share of 7 cents during 2014's third quarter.

Windstream reported revenue of $1.5 billion for the period ending Sept. 30, up from $1.46 billion a year ago.

The company spent $20 million in the third quarter to repurchase 3.1 million of its own shares. The shares purchased represent 25 percent of the $75 million share buyback plan the company announced in August.

Windstream announced last month its plans to sell its data center business for $575 million to TierPoint, a St. Louis-based data services company.

The company said Thursday that the money will allow Windstream to reduce its debt by by $300 million and fund "Project Excel," a $250 million program to "upgrade and modernize" the company's broadband network by the end of 2016.

"It appears they are taking the right steps, particularly to clean up the balance sheet," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"They're doing what a company is suppose to do. They are allocating their capital to where they can get the best returns for shareholders," he said.

Windstream has said that the deal with TeirPoint will allow both companies to sell their respective services to each other's customers through referrals.

"This structure allows Windstream to focus capital on core telecom offerings, while continuing to offer traditional data center services to enterprise customers across a broader TierPoint footprint," Thomas said during the conference call.

Business on 11/06/2015