The $11.04 million loss that Acxiom Corp. recorded for the 2015 fiscal year is partly due to the revenue decline in the information-technology segment it plans to sell off in a potential $190 million deal, the company reported Thursday.

Acxiom reported a 14-cent-per-share loss for its 2015 fiscal year, which ended March 31, compared with a profit of $8.8 million, or 12 cents per share, in 2014.

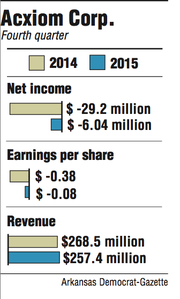

The Little Rock-based company also had a loss of $6.04 million, or 8 cents per share, for the fourth quarter, compared with a loss of $29.2 million, or 38 cents per share, during the same period a year ago.

Acxiom said its fiscal year earnings were affected by declines in its information-technology infrastructure management business, along with expenses associated with "business separation and transformation activities," and noncash compensation.

The company said its fourth-quarter financial results declined as a result of one-time expenses of restructuring in Europe.

On Wednesday Acxiom said it would sell its information-technology infrastructure management business to two private-equity firms, Charlesbank Capital Partners and M/C Partners. Spokesmen for both firms declined to comment.

When the deal is completed, Acxiom will retain a 5 percent interest in the value of the business. The company also will receive $140 million in cash when the sale closes and up to $50 million in payments contingent on performance requirements that Acxiom did not detail.

Acxiom said the sale of its information-technology operations would allow the company to focus more on its marketing and data services business.

The company's main business is as a data broker. In that role, the company uses information it collects from public records, shopping habits and clients to help its customers with targeted marketing campaigns.

"Connectivity's strong performance in the fourth quarter capped off a year of explosive adoption and growth," said Scott Howe, chief executive officer, in a prepared statement. "Our focus in fiscal 2016 is on aggressively extending our early lead in onboarding and connectivity, and returning our marketing and data services business to a position of growth."

During the fourth quarter, Acxiom added 20 new connectivity -- or data and marketing -- customers. Onboarding is the process of converting information to a digital format so it can be used for marketing campaigns.

The company also expanded its partnership with Facebook and Twitter during the fourth quarter.

Acxiom's stock dropped 5.2 percent to $16.58 on the Nasdaq on Thursday. The company announced its deal with Charlesbank Capital and M/C Partners after the markets closed on Wednesday, and released its earnings after the markets closed on Thursday.

Acxiom shares opened at $16.13 on Thursday after closing at $17.49 the previous day. The company's stock hit a new 52-week low of $16.02 during intraday trading, with Acxiom shares moving in more than triple the average trading volume.

"The valuation and terms of the deal were largely as expected and a little under four years after [chief executive officer] Howe joined and first detailed the vision to become a pure-play marketing and data services business, Acxiom has gotten there," said a report by Daniel Salmon, an analyst with BMO Capital Markets Corp.

In the report, Salmon noted that the data center landscape has changed since the possibility of a divestiture of Acxiom's information technology assets came to be.

"Acxiom investors must now instead gauge the balance of a clear positive to the long-term strategic vision," said the note.

The sale of the information-technology business is expected to close in 45 to 60 days, pending regulatory approval. Once the transaction is completed, the business will become a privately owned company.

Acxiom saw revenue fall 4 percent during the fourth quarter to $257.4 million as income from the information-technology segment dwindled 12 percent.

The bulk of Acxiom's revenue comes from its marketing and data services. That sector saw revenue slide 2 percent during the fourth quarter to $206 million.

For the full year, Acxiom's total revenue also fell 4 percent and income from the information-technology segment dropped 16 percent year-over-year.

Acxiom said unusual items, including expenses associated with restructuring activities, influenced to the company's reported earnings for fiscal 2015.

The company did not provide details on the restructuring activities, but when asked a month ago about possible layoffs at Acxiom, Jena Compton, senior vice president of Human Resources, said in a statement provided by the spokesman:

"We constantly evaluate ways to increase efficiencies, sharpen the focus on our core business and deliver outstanding service to our clients. The recent changes in our workforce are a result of that process along with the normal course of doing business in a fast-paced, ever-evolving environment."

Business on 05/22/2015