Dillard's Inc. on Thursday reported a profit drop of about 1.9 percent in the first quarter of fiscal 2015, missing analysts estimates.

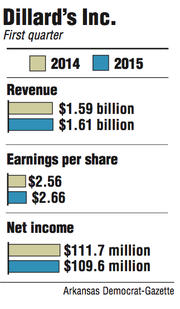

Dillard's reported a net income of $109.6 million for the period ending May 2, compared with profit of $111.7 million during the same quarter in 2014.

"We are disappointed with our first quarter performance," William Dillard, chief executive officer of the Little Rock-based retailer, said in a statement.

"Our 1 percent sales decline hampered our ability to leverage operating expenses and to drive net income growth," he said. "Although inventory is higher than we would like, we believe the levels are manageable."

Dillard's total merchandise sales, which exclude operations for CDI Contractors, dropped 1.2 percent from $1.54 billion in 2014 to $1.52 billion during the quarter. Sales in comparable stores declined 1 percent.

Industrywide, retailers have seen in-store sales soften, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"You are starting to see across the board same-store sales drop," he said. "I think it is part of the consumers' shift to the Internet."

Dillard's said it also saw sales perform below average in Texas as a result of that state's economy, which has been hurt by the drop in energy prices. Oil prices fell about 50 percent starting in August.

The company's sales were strongest in juniors' and children's apparel, and "notably weak in the home and furniture category," the company said.

During the first quarter, Dillard's recorded $1.61 billion in revenue, up from $1.59 billion a year ago.

The company reported earnings per share of $2.66 for the quarter, compared with $2.56 per share during the same period a year ago. Analysts had estimated per share earnings of $2.78.

Dillard's shares fell $2.34, or 1.9 percent, to close Thursday at $124.20 on the New York Stock Exchange. The company released its financial results after the markets closed.

Dillard's also said Thursday it has arranged a new $1 billion senior unsecured revolving credit facility, replacing the company's previous secured credit facility.

The new credit, which will mature on May 13, 2020, can be used for general purposes, including working capital financing, capital expenditures and share repurchases, the company said.

Dillard's said it plans to open three new stores this year in Utah, Louisiana and Ohio. The company has 274 store locations and 23 clearance centers in 29 states.

Business on 05/15/2015