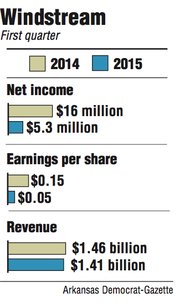

Windstream Holdings Inc. on Thursday reported a first-quarter net income of $5.3 million, or 5 cents per share, compared with a profit of $16 million, or 15 cents per share, during the same period last year.

The Little Rock company's revenue fell slightly to $1.41 billion from $1.46 billion in 2014's first quarter.

The report pushed Windstream's shares down to a new 52-week low.

"It was an OK quarter," said Barry McCarver, an analyst with Stephens Inc., which has advised Windstream. "But it wasn't a good quarter."

Windstream missed analysts revenue estimates of $1.43 billion, but the company beat earnings expectations of a loss of 6 cents per share.

The shares slid to a new 52 week low of $9.77 during trading Thursday. Windstream released its earnings before the market opened.

Windstream shares fell 45 cents, or 4.4 percent, to close Thursday at $9.83 on the Nasdaq stock exchange. The shares have traded between $9.77 and $20.84 in the past 52-weeks.

McCarver said Windstream's earnings are "likely to be volatile" for the next few quarters because the company's new chief executive officer, Tony Thomas, has only been in the position for a few months. Thomas took over Windstream from Jeff Gardner in December.

"It may be 2016 before we really see meaningful and sustainable improvements in revenue and margins," McCarver said.

Shares of the real estate investment trust created by Windstream also fell on Thursday. Last month, Windstream completed the spinoff of its copper and fiber networks into a new company, Communications Sales & Leasing Inc., also known as CS&L.

CS&L shares dropped 3.3 percent to close Thursday at $27.62 on the Nasdaq. Closing prices of CS&L shares have ranged between $27 and $34.63 since they started trading last month.

Windstream and CS&L earnings are reported as a combined entity for the first quarter because the quarter ended March 31 and the spinoff was not completed until April 24.

The telecommunications company saw its consumer broadband service revenue increase 2 percent from the previous year, but overall consumer revenue was flat at $312 million.

Windstream also saw revenue from carrier services fall 7 percent while data and integrated services increased 3 percent.

The company said its free cash flow was $232 million in the first quarter and that it paid $151 million to shareholders in dividends.

Windstream previously paid an annual dividend of $1 per share, but investors were worried about the company's ability to dispense that much cash as its profit margins shrank. The company plans to now pay an annual dividend of 60 cents per share following the spinoff and a 1-for-6 reverse stock split with CS&L, which said it will pay a $2.40 per share annual dividend.

"It is now time for a new chapter, and through the innovative spin-off of CS&L, we have provided shareholders with two companies, each with their own investment thesis," Thomas told analysts during the company's conference call Thursday morning.

"At the same time, we have re-positioned Windstream to invest in our network to achieve improving financial results, and I'm confident that our new focus will continue to create value for shareholders," he said.

Windstream said it paid down $2.4 billion in debt on April 24 as it spun-off CS&L and will repay another $850 million with cash received in the spinoff. Windstream said it retained about 20 percent of CS&L in order to further reduce debt.

Business on 05/08/2015