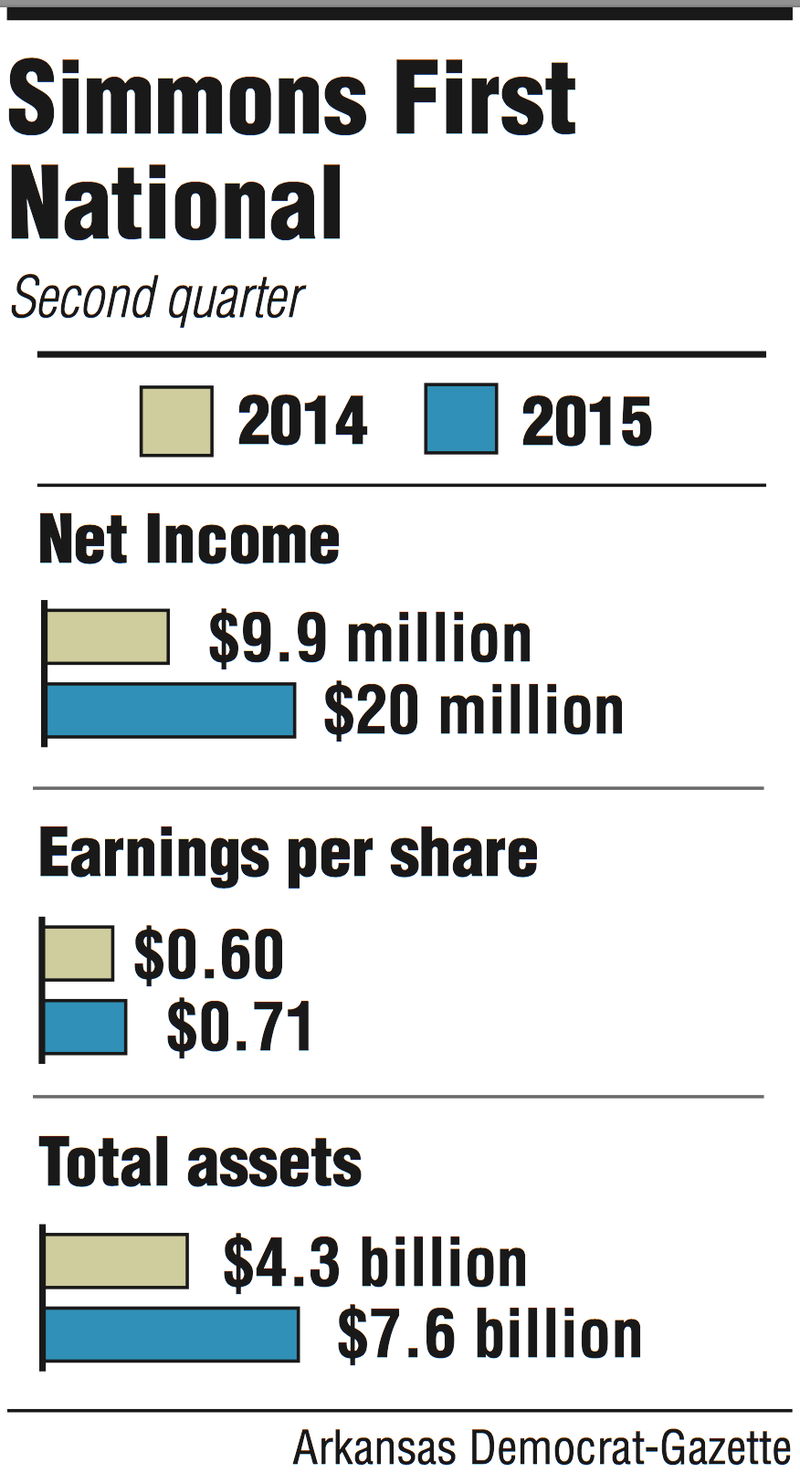

Simmons First National Corp. earned $20 million in the second quarter, more than double its income of $9.9 million in the second quarter of last year, the Pine Bluff bank said Thursday.

The bank earned 71 cents a share in the second quarter, up from 60 cents a share for the same period last year.

Excluding certain charges, Simmons had core earnings of 76 cents a share for the quarter, missing the average expectations of 78 cents by four analysts surveyed by Thomson Reuters.

Simmons is recording good loan growth throughout its service areas of Arkansas, Kansas, Missouri and Tennessee, George Makris, the bank's chairman and chief executive officer, said in a conference call Thursday.

That includes an increase of $30 million in loans from Community First Bancshares in Union City, Tenn., since that acquisition deal closed in the first quarter, Makris said.

"Quite honestly, we always anticipate a little [decline in loans after a purchase], but they've done a great job maintaining their loan portfolio and actually growing it," Makris said. "That is what we really like to see."

In the first quarter, Simmons closed on the purchases of Community First and Liberty Bancshares of Springfield, Mo. Together, the two banks added $3 billion in assets to Simmons.

Simmons also has announced it will acquire Ozark Trust and Investment Corp. of Springfield, Mo. The firm has more than 1,300 clients and will add about $1.1 billion in assets to Simmons when the deal closes later this year.

Simmons closed 12 branches and has agreed to sell three more in Salina, Kan., Makris said. The closings are expected to save Simmons $2 million annually.

Simmons' revenue and loan growth were strong in the second quarter, said Matt Olney, an analyst in Little Rock with Stephens Inc.

"Their core trends were strong," Olney said. "They had a pretty good quarter, all things considered. They are getting more efficient and more profitable."

Simmons had total assets of $7.6 billion at the end of the second quarter, up from $4.3 billion in the second quarter last year.

Olney expects Simmons to continue its acquisition of banks. Since 2010, Simmons has acquired eight banks and a trust company.

Simmons has a continued interest in bank acquisitions, Makris said.

"We've had a lot of discussions, but nothing that we consider imminent," Makris said.

Part of the reason is that Simmons will face stricter regulatory oversight should it pass a $10 billion threshold in assets. When the Ozark Trust purchase closes, Simmons will be less than $1.5 billion from $10 billion in assets.

Banks with $10 billion in assets face stiffer "stress" tests and require sufficient compliance staff trained for the change, Makris said.

"If we wait until we get to $10 billion to address these issues, it will be too late," Makris said.

Business on 07/24/2015