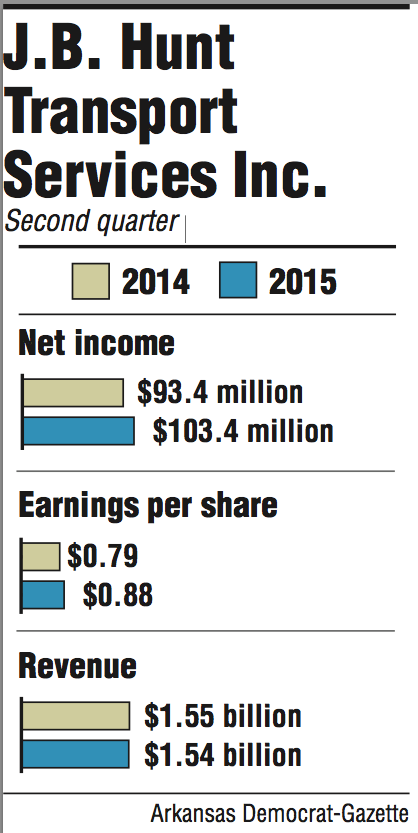

J.B. Hunt Transport Services Inc. reported net income of $103.4 million, or 88 cents per share, in the second quarter of 2015, but the company missed analysts' forecast for the three-month period.

The Lowell-based company's earnings were a 10.7 percent increase from $93.4 million, or 79 cents per share, for the second quarter of 2014. Revenue for the quarter was $1.54 billion, a slight decrease from a year ago when J.B. Hunt reported $1.55 billion.

Analysts forecast $1.61 billion in revenue and 90 cents per share in earnings for the quarter.

The modest drop in revenue was J.B. Hunt's first for a quarter since the fourth quarter of 2009. The company said the quarter was affected by a $100 million decrease in fuel-surcharge revenue, sluggish customer freight demand and lower equipment utilization in its trucking segment.

Brad Delco, a transportation analyst for Stephens Inc. in Little Rock, still characterized the quarter as a strong one after looking at factors that were in the Fortune 500 company's control.

"They can't control what's happened with the West Coast ports," Delco said. "They can't necessarily control the reliability and the service metrics with their rail partners. Both impacted volumes in their intermodal business. ... Margin performance based on managing a fairly balanced network, that performance was strong. That led to a lot better margin performance than what many had expected."

Intermodal revenue was $904.9 million, a 3 percent decline from $930.7 million in the second quarter of 2014. The company said in its earnings report that load growth grew by 2 percent in the same quarter of 2014, but a 4.5 percent decrease in revenue per load led to the drop in revenue.

"The lingering effects of disruptive shipping patterns due to the West Coast port issues, slow rail service recovery and a softer consumer driven freight demand all contributed to the slower load volume growth," the company said in its earnings report.

Operating income in the intermodal segment was up 5 percent to $118.6 million largely because of rate increases, lower insurance and cargo claim costs, and lower fleet maintenance costs. The intermodal segment accounts for about 70 percent of J.B. Hunt's operating income.

Revenue in J.B. Hunt's trucking division also dropped in the quarter. The company reported $98 million in revenue, down 3.5 percent from $101 million a year ago. But the division did see a 3 percent increase in operating income behind "favorable changes in core rates, increased truck count, lower equipment maintenance costs and improved fuel economy."

J.B. Hunt's dedicated contract services segment experienced the best growth with revenue increasing 5 percent to $367 million and operating income improving 34 percent to $40.6 million.

An additional 413 revenue-producing trucks were in the dedicated fleet by the end of the quarter compared with last year, which aided the revenue growth. New accounts, higher productivity, lower maintenance costs and less reliance on third-party carriers also led to the increase in operating income.

"It seems to me that there's still general concern about getting capacity, which is why shippers would elect to move freight more into a dedicated-service offering," Delco said. "So that obviously resonates very well. There's certain retail businesses that have their own fleet of trucks. Finding drivers is challenging. The regulatory environment is more challenging. A lot more of those private carriers are electing to convert to an outsource dedicated model. And again, that resonates well."

Revenue in the company's brokerage division was $174 million, flat compared with the second quarter of 2014. Operating income was down 21 percent to $4.9 million, which J.B. Hunt attributed to a number of factors, including higher personnel costs.

The company also said $4.4 million in costs were incurred by the brokerage division as part of corporatewide streamlining and technology redevelopment.

The total cost across all divisions was about $14.1 million, but J.B. Hunt said benefits are "expected to be realized over the next two fiscal years."

Business on 07/18/2015