WASHINGTON — Shortly after Jeb Bush left the Florida governor’s office in 2007, he established his own firm, Jeb Bush & Associates, designed to maximize his earning potential as one of the country’s more prominent politicians.

Tax returns disclosed last week by the Republican’s presidential campaign revealed that the business not only made him rich but also provided a steady income for his wife and one of his sons.

The family salaries were among the new information to emerge from last week’s disclosures, which provided the most detailed picture yet of the structure and finances of the firm that formed the core of Bush’s private-sector work during the past eight years.

The returns show that the company set up a generous and well-funded pension plan now rare in corporate America, allowing Bush to take large tax deductions while he and his wife built up their retirement portfolio.

They also illustrate how Bush — who has touted his business experience on the campaign trail — relied on his public persona and political connections to rapidly increase his net worth.

More than a third of the firm’s $33 million in proceeds from 2007-13 came from banking giants Lehman Brothers and Barclays, which paid Bush a combined total of about $12 million for his work as a senior adviser, according to the tax filings and campaign officials. An additional $8.1 million during that period came from speaking fees.

Although Bush presented the release of 33 years of tax returns as evidence of his transparency, a review of the filings shows that more than a third of his company’s income was from sources that his campaign has largely declined to disclose.

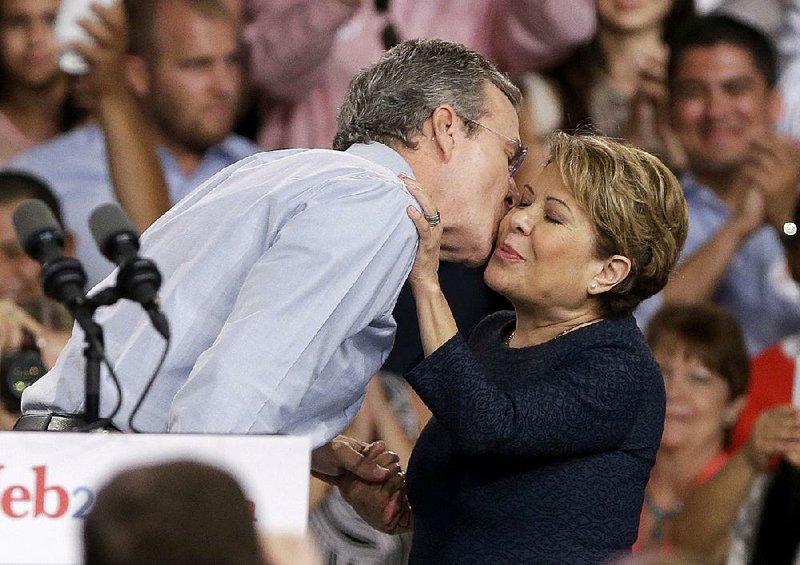

Bush’s small firm paid more than $2 million in wages over seven years. A large share of that money appears to have gone to his youngest son, Jeb Bush Jr., 31, who worked as a management consultant. The tax records indicate that Bush’s wife, Columba Bush, was collecting an annual salary of about $31,500 — totaling more than $220,000 over seven years.

The position she held at the firm is unclear. Bush did not mention his wife’s role during his tax-document release. His campaign declined to provide any information about her duties. A campaign official, who spoke on the condition of anonymity to discuss Columba Bush’s position, called her a “true partner in work and life” who “contributed significantly to the firm’s success.”

Bush opened the firm in February 2007, less than two months after leaving the governor’s office. He first set up shop in Glass tower in Miami before moving to a suite at the Biltmore Hotel in Coral Gables. In late 2008, he was joined by his youngest son, then in his mid-20s, who had previously worked for two years at a south Florida real estate firm.

“If you ever have the opportunity to work side-by-side with one of your children, I recommend it,” Bush wrote in a statement about his business history released Tuesday along with his tax returns. “It was a phenomenal experience.”

In its first year, Jeb Bush & Associates pulled in $2.7 million in gross income, tax documents show. One of Bush’s first consulting clients was InnoVida, a Miami-based company that marketed prefabricated housing materials for use in disaster zones, whose chief executive was ultimately convicted of fraud.

Half of Jeb Bush & Associates’ income in 2007 came from Lehman Brothers, which paid Bush about $1.3 million annually to serve as a consultant, in part because of the global network of contacts he developed as a big-state governor and as the scion of a powerful political family.

That summer, as the bank slid toward insolvency, Bush was dispatched to Mexico to persuade Carlos Slim, a telecommunications tycoon and one of the world’s wealthiest men, to take an ownership stake in Lehman Brothers. Nothing came of that mission, which was dubbed “Project Verde” by a Lehman colleague and was first reported by the New York Times.

The bank ultimately failed in a crash that jolted global markets. Bush was not implicated in any way, according to a person familiar with examinations of the conduct of Lehman officials.

After Lehman’s demise, the British bank Barclays bought Lehman’s North American assets and retained Bush as a senior adviser. He also got a substantial pay increase, earning an average of $2 million annually from 2009-14, campaign officials said.

In his statement last week, Bush said his work for Barclays taught him that “the United States can be much more competitive and create new and better-paying jobs if only we learned the lessons of why companies choose to invest other places.”

A senior Barclays official said Bush did not advise bank officials or offer investment advice to clients.

“He was not a deal-maker,” said the official, who spoke on the condition of anonymity because he was not authorized to discuss the matter publicly.

Instead, Bush’s role was akin to that of a global emissary, whose star power appealed to the bank’s clients. Occasionally, the former governor was a keynote speaker at dinners with chief executives and senior managers of companies doing business with Barclays. He often shared his views on economic trends, the significance of events in Washington and other general matters, the bank official said.

“It would be intellectually stimulating for our clients,” the official added.

By 2011, Jeb Bush & Associates had vastly expanded its client base, tax records indicate. Its gross annual income that year rose to $7.2 million, up from $3.9 million in 2010.

The full scope of Bush’s clientele remains shielded from public view.

Nearly $13 million of the $33 million the firm was paid from 2007-13 came from sources other than Bush’s speaking fees and bank consulting. Among the company’s clients were the online education firm Academic Partnerships, the asteroid-mining company Planetary Resources and the health-care companies Clinical Medical Services and All-Med, campaign officials said. They declined to release a full list, citing confidentiality agreements.

In March, as he geared up for his presidential run, Bush sold the firm to Jeb Bush Jr., a campaign official said.

From its inception, Jeb Bush & Associates made large contributions to retirement plans for its employees. From 2007-13, the company put nearly $2.4 million into a pension plan and a 401(k) plan, money that it was then able to deduct from its taxes. That’s more than the $2 million it spent on wages during the same time period.

A large share of the retirement contributions went to a defined-benefit plan for just two employees, according to records the firm filed with the Labor Department.

The campaign declined to say which family members participate in the plan. But, spokesman Kristy Campbell said, “by virtue of being predominantly a family business, the Bushes were able to plan for their retirement through Jeb Bush & Associates.”

Bush has noted that he declined the state pension he was due as governor.

Defined-benefit programs are considered more generous and stable than defined-contribution programs, such as 401(k) plans, in which employers contribute a set amount to the plan annually but benefits can vary depending on the stock market. The pension payouts by Jeb Bush & Associates were first reported Wednesday by the Wall Street Journal.

Pension experts who reviewed documents describing the plan said it was designed to pay retirees a maximum pension equal to 80 percent of their salaries.

“It’s quite a nice deal,” said Donald Williamson, a professor of taxation at American University and an accountant who prepares taxes for small businesses. “It’s the kind of pension that my father might have had working for DuPont or some other big company back in the 1950s.”

Such plans are increasingly rare in corporate America but are often still available to government employees, drawing criticism from Republican budget cutters.

For family businesses such as Jeb Bush & Associates, a defined-benefit program offers key tax advantages, allowing the company to sock away large contributions for its employees while taking a tax write-off.

“The pension plans are about the best deal in the tax code, because the employer gets a deduction for making contributions to the plan,” said Rebecca Wilkins, a tax expert who serves as executive director of the Financial Accountability and Corporate Transparency Coalition, which seeks to eliminate corporate tax loopholes. “The employee doesn’t have any taxable income until they take money out.”

If Bush or his family members are among the participants in the pension plan, they get a tax write-off as they finance their own retirement nest eggs.

Daniel Halperin, a professor at Harvard Law School who specializes in pensions, said federal law allows companies to take a tax write-off for large pension payments to encourage them to offer solid retirement plans to their employees.

He said those rules make less sense in the case of Jeb Bush & Associates, which offers the plan to only two people.

“It is generous,” Halperin said. But, he added, “the law allows them to be generous.”

Information for this article was contributed by Allen Sloan and Ed O’Keefe of The Washington Post.