Stung by falling oil prices, Murphy Oil Corp. on Wednesday joined other U.S. energy companies in cutting its capital budget for 2015.

The El Dorado-based company expects to spend $2.3 billion this year, down 33 percent from 2014. The company's cut in capital spending includes a 46 percent reduction in spending in the Eagle Ford Shale in Texas -- making it one of several energy producers scaling back operations in U.S. shale formations.

"The recent collapse in commodity prices is a concern for our business and our industry," Roger Jenkins, president and chief executive officer for Murphy Oil, said in a statement. "Our goal is to reduce capital expenditures as much as possible to commitment only levels, protect our balance sheet and evaluate opportunities that emerge over the coming year."

Investment by U.S. shale producers is expected to decline this year as a result of a volatile oil market. ConocoPhillips and Marathon Oil Corp. said in December that their capital spending would be cut by about 20 percent in 2015. And other companies in the industry have idled drilling rigs or are planning for layoffs.

Declining global demand and oversupply has sent the oil market tumbling since the summer, with prices down more than 50 percent. Crude prices hit their lowest level in six years on Wednesday, even as analysts suggested the volatile market is close to stabilizing.

Oil prices slid after a government report showed stockpiles rose last week to their highest level in decades.

Crude supplies gained 8.8 million barrels to 406.7 million in the week ending Friday, according to the report by the U.S. Energy Information Administration.

West Texas Intermediate crude for March delivery dropped 3.9 percent to $44.45 a barrel on the New York Mercantile Exchange. Brent crude fell 2.3 percent to $48.47 a barrel on the ICE Futures Europe exchange in London.

So far this year, the drop in oil prices has also hit both energy stocks and earnings estimates, with analysts expecting the sector as a whole to post a decline in fourth-quarter earnings.

"Obviously we're going to get a lot of earnings from these companies, but we know it's not going to be pretty -- even if they are able to say this is a good quarter," said Phil Flynn, an energy analyst with Price Futures Group.

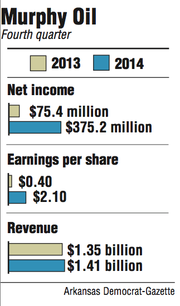

Murphy Oil released its 2014 fourth-quarter financial results Wednesday after the markets closed. The company reported a net income of $375.2 million for the quarter, up from $75.4 million during the same period a year ago. Earnings per share was $2.10 for the period that ended Dec. 31, compared with 40 cents for the 2013 quarter.

Excluding discontinued operations and other items during the period, Murphy had earnings of $69 million, or 39 cents per share, for the fourth quarter -- a $56.8 million, or 28 cent, decline from the previous year.

Revenue for the quarter was $1.41 billion, up from $1.35 billion a year ago.

On Wednesday morning, analysts expected Murphy Oil to post earnings per share of 32 cents, before lowering their estimates to 25 cents later in the afternoon.

Shares of Murphy Oil tumbled 7.2 percent before closing Wednesday at $43.40 on the New York Stock Exchange. Trading volume doubled during the day, and the company's stock hit a 52-week low of $43 during intraday trading.

During the fourth quarter, Murphy Oil closed on the first phase of the $2 billion sale of a 30 percent stake of its Malaysian oil and gas assets to Pertamina Malaysia Eksplorasi Produksi, an Indonesian state energy company.

The first phase of the transaction covers about 20 percent of the assets, and the deal is expected to close this month. The company also completed the sale of its U.K. retail gasoline business during the period.

Murphy Oil will hold a conference call at noon today to discuss its quarterly earnings. The call can be accessed on the company's website at ir.murphyoilcorp.com or by the phone at 1-888-812-8569 using the code 7572173.

Business on 01/29/2015