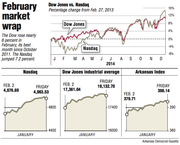

February was a strong month for U.S. stocks, even though it ended in downbeat fashion.

Major stock indexes closed lower Friday, capping a week of subdued trading that still delivered a couple of new highs for the Dow Jones industrial average and Standard & Poor's 500 index. It also brought the Nasdaq composite within striking distance of its March 2000 high.

The Dow fell 81.72 points, or 0.5 percent, to close Friday at 18,132.70. That's down 0.5 percent from its recent high of 18,224.57 on Wednesday.

The S&P 500 slid 6.24 points, or 0.3 percent, to 2,104.50. The index is down 0.5 from a high of 2,115.48 on Tuesday.

The Nasdaq fell 24.36 points, or 0.5 percent, to 4,963.53. The index has been inching closer to crossing the 5,000-point mark, something it hasn't done since March 2000 at the height of the dot-com era. It's now within 86 points of that peak.

The Nasdaq notched the biggest monthly gain at 7.2 percent. But the S&P 500's 5.5 percent performance marked its best monthly increase since October 2011, and a turnaround from its 3.1 percent slide in January.

Trading was listless for much of Friday as investors balanced encouraging reports on housing and consumer confidence against data showing that the U.S. economy grew at a slower annual rate in the final months of 2014 than previously estimated. Oil rose, recouping some of its losses from a day earlier. Technology stocks were among the biggest decliners.

"Many people are trying to figure out what to do, taking some profits when they can. We saw that over the past couple of days with tech stocks," said JJ Kinahan, TD Ameritrade's chief strategist. "It's a wait-and-see attitude."

The three main U.S. stock indexes are all up for the year.

The current bull market, now in its sixth year, has been powered by strong corporate earnings growth and low interest rates, which make stocks more attractive relative to bonds. Strong job growth and improving consumer confidence have also encouraged traders, despite signs of sluggishness in Europe and elsewhere.

Some of that confidence appeared shaken Friday, when the Commerce Department reported that the U.S. economy grew at an annual rate of 2.2 percent in the October-December quarter, weaker than the 2.6 percent estimate last month. The latest growth projection represents a major slowdown from the previous quarter, which produced the strongest growth in 11 years.

Other economic bellwethers were more upbeat: An index of pending-home sales -- an indicator of potentially completed sales -- rose in January, and the December figure was revised higher to show a smaller decline. Separately, the University of Michigan's index of consumer sentiment slipped this month. It remains at the highest level in eight years.

Investors should get a better sense of the economy and consumers' willingness to spend next week, when automakers report their February sales figures and the government issues its monthly update on hiring.

Benchmark U.S. crude rose $1.59 to $49.76 a barrel on the New York Mercantile Exchange. Brent crude rose $2.53 to $62.58 a barrel in London.

Business on 02/28/2015