Bank of the Ozarks is considering opening lending offices in Seattle, Washington, D.C., Boston and Chicago over the next two years, says George Gleason, the bank's chairman and chief executive officer.

The offices would be expansions of Bank of the Ozarks' successful real estate lending strategy, which has generated loans throughout the country.

The bank's real estate specialties group focuses on making high quality, complex real estate loans, particularly construction loans, on a national platform, Gleason said in the bank's recent fourth-quarter conference call.

"Our significant real estate expertise has made us the lender of choice for many of the top real estate firms in the country, especially on extremely complex projects," Gleason said.

The Seattle office would serve Seattle; Portland, Ore.; Salt Lake City; Denver; and other northwest markets, Gleason said. The Washington, D.C., office would serve the mid-Atlantic area. The Boston office would serve New England, and the Chicago office would serve the upper Midwest.

"It wouldn't surprise me if over the next 24 months you saw us open as many as four additional real estate specialties group offices, and with that I think we can pretty much cover the United States," Gleason said on the call.

Bank of the Ozarks has offices focused on real estate lending in Dallas, Houston and Austin in Texas; Atlanta; Asheville, N.C.; New York City and Los Angeles.

The existing lending offices have made loans in 41 states, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

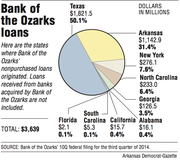

Just more than 50 percent of the $3.6 billion in loans the bank didn't buy through acquisitions were originated out of the Texas offices. But the state with the most collateral on the loans was Arkansas, with about 26 percent, according to Bank of the Ozarks' third-quarter federal filing.

Almost 24 percent of collateral on the bank's loans is in Texas. He is not worried about the impact those loans in Texas may have on Bank of the Ozarks with oil prices dropping significantly, Gleason said.

"I want to tell you if we had 50 percent or 60 percent or 70 percent of our loans in Texas, that would not bother me at all, because I think the Texas economy, even in the depressed oil price environment, is still one of the best economies in the United States," Gleason said. "We have very little exposure in the Texas markets like Midland-Odessa that are very dependent on oil and gas."

Bank of the Ozarks has done extremely well with lending in Texas since 2003, said Randy Dennis, president of DD&F Consulting Group, a Little Rock bank consulting firm.

"Since then, they've been very successful [with the bank's national lending]," Dennis said. "So I'm not surprised [about the possible expansion] because they've always been one to look at opportunities."

Since 2003, Bank of the Ozarks has gotten "tons of traction" in its Dallas lending office, Olney said.

"They hired some unique individuals there with some unique backgrounds," Olney said.

Those lenders honed their craft and the real estate specialties group was developed out of the Dallas office, Olney said.

"They just realized that there is a niche there that nobody else is doing right now," Olney said. "It's more work; it's more challenging. Other banks like to keep things in a box. But some of the transactions Ozarks does aren't in the normal bank box."

Olney gave an example of a loan Bank of the Ozarks made in Houston several years ago.

The city of Houston was willing to give developers tax credits to build a hotel in one area of the city, Olney said.

"The borrower had a hard time finding financing for the loan that included the tax credits," Olney said. "Tax credits aren't typically part of a loan package. Ozarks put the tax credits in their model but the other banks couldn't quite figure out how to do that."

When Bank of the Ozarks realized there weren't any banks doing loans like that, it began to find more similar loans, Olney said.

"That's just one example of [Bank of the Ozarks] trying to figure out something that may not fit the normal profile," Olney said.

He is not concerned that Bank of the Ozarks is too concentrated on its real estate specialties loans, Gleason said.

"Real estate lending accounts for the majority of our loan portfolio, but we do not consider this a concentration because of the geographic diversity of the portfolio and the diversity among product types within the portfolio," Gleason said.

Bank of the Ozarks considers the specialized real estate loans less risky than its other loans, Olney said.

"To say it another way, if they are going to have a niche this big, it had better be the highest quality loans," Olney said.

The real estate specialties group is the strongest of Bank of the Ozarks' five earning engines, Greg McKinney, the bank's chief financial officer, said during the conference call. The other growth areas for the bank are its branch banks, leasing division, investment securities portfolio and the corporate loan specialties group, McKinney said.

SundayMonday Business on 02/01/2015