Wal-Mart Stores Inc. scaled back its earnings outlook for the year and saw profits decline 15 percent, even as same-store sales and traffic continued to show improvement in the U.S., the company reported Tuesday.

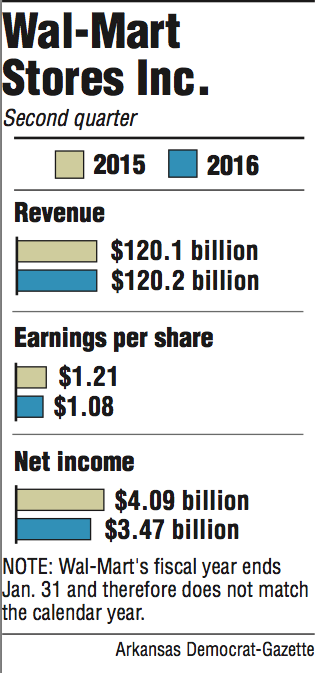

Earnings of $3.47 billion, or $1.08 per share, were down from $4.09 billion, or $1.21 per share, for the same three-month period last year. Wal-Mart missed analysts' estimates of $1.12 per share as expenses related to employee wage investments and e-commerce continued to affect the retailer's bottom line.

Wal-Mart's $120.2 billion in second-quarter revenue could have been higher, the company said, if not for smaller-than-expected pharmacy reimbursements from insurance companies and losses related to "shrink," or inventory that was damaged, lost or stolen.

Executives, including CEO Doug McMillon, continued to stand behind the retailer's commitment to labor, wages and e-commerce costs. Still, McMillon noted the company did "fall short on managing the bottom line," even as Wal-Mart reported a fourth consecutive quarter of positive same-store sales growth and grew traffic in its U.S. stores.

Wal-Mart downgraded its outlook for the 2016 fiscal year to between $4.40 and $4.70 per share. Previously the retailer issued guidance of between $4.70 and $5.05 per share.

Shares of Wal-Mart stock ended trading Tuesday at $69.48, down $2.43 from the day before. Wal-Mart stock traded as low as $69.24 during the day, a 52-week low.

"The changes we need to make require investment," McMillon said in a prerecorded call. "We made continued progress towards our plan this quarter. Even if it's not as fast as we'd like, the fundamentals of serving our customers are consistently improving, and it's reflected in our company and revenue growth."

Wal-Mart, which invested $1 billion in wage and training improvements for 500,000 workers this year, did see encouraging signs from its U.S. division, which accounts for about 60 percent of its annual revenue. Traffic in U.S. stores was up 1.3 percent, and same-store sales, also known as comp or comparable sales, increased 1.5 percent.

Even as stock prices plummeted, analysts who cover Wal-Mart said the company's investments in labor, wages and e-commerce are needed long-term. Morningstar retail analyst Ken Perkins said the second quarter report from Wal-Mart was "one big plus and some minuses."

Improvements in the U.S. provided executives and analysts reason to be optimistic. Perkins and other analysts agreed with McMillon that Wal-Mart's future requires expenditures on in-store employees and e-commerce.

"Sales trends are moving in the right direction and those sales are mostly driven by traffic increases. We think that's encouraging," Perkins said. "I think the big challenge they're facing right now in investment community, is the difference in expectations of the time required to turn things around."

Stephens Inc. retail analyst Ben Bienvenu said Wal-Mart stock remains attractive for anyone who is looking for longer-term investment opportunities. Wal-Mart is ramping up a stock repurchase program, has identified areas where it wants to improve in the long run and continues to have strong cash flow, Bienvenu said.

"You're in the midst of a pretty transformational strategy overhaul. I think it takes time," Bienvenu said. "They've made a commitment to invest in the future through wage and e-commerce investment. It takes time before you reap the benefits of that investment.

Chief Financial Officer Charles Holley said the company is seeing improved metrics when gauging customer satisfaction. Shoppers are happier with the in-store experience, according to internal polls that are focused on whether customers view the store as "clean, fast and friendly."

Gains in customer satisfaction are signs the in-store investments in labor and wages are paying off, Holley said.

Investors shouldn't have been caught off guard by those expenses, said Edward Jones retail analyst Brian Yarbrough. Factors related to pharmacy and merchandise are concerning, however.

"We know about the labor, e-commerce and wage investments," Yarbrough said. "What was concerning was the pharmacy benefit reimbursement issue and higher shrink. Those were headwinds we didn't see coming."

Sam's Club, the warehouse retailing division of Wal-Mart, grew net sales 2.8 percent for the quarter. Same-store sales were up 1.3 percent. Traffic for samsclub.com was up 20 percent and CEO Rosalind Brewer said she is pleased with that the division's investments are contributing to improvements in operations.

International performance was a mixed bag for Wal-Mart.

Canada and Mexico both reported gains for the quarter. Other major markets like the United Kingdom, Brazil and China posted negative same-store sales numbers, and overall operating income declined 1.5 percent for Wal-Mart International.

Same-store sales in the U.K. were down 5.2 percent, while same-store sales in Mexico increased 5.4 percent. Canadian same-store sales were up 3.9 percent, while they declined 1.0 percent in Brazil and 1.4 percent in China.

Stronger international performance is critical for Wal-Mart's long-term growth, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

While much of the discussion surrounding Wal-Mart's financial performance has centered on U.S.-store growth, wages and online investments, Williams said international performance should also be part of the discussion. Wal-Mart still hasn't gained momentum in international markets like Brazil and China and is facing economic downturns in the U.K.

Growth in e-commerce also slowed, although the segment remained the best-performing within Wal-Mart. Sales were up 16 percent, down from the 20-plus percent gains seen in recent quarters. Global eCommerce CEO Neil Ashe said the division will continue to invest in technology and people to "remain in a leadership position."

Wal-Mart recently opened two additional e-commerce fulfillment centers with two more planned for later this year. Once all four additional facilities are online, the company is expecting to see cost savings from a more efficient supply chain.

Those fulfillment centers and the purchase of the remaining 49 percent of e-commerce site Yihaodian in China are among the between $1 billion-$1.5 billion Wal-Mart will spend for its online business this year.

McMillon said the retailer will continue to monitor expenses and is not "pleased or satisfied." Wal-Mart is committed to running more efficiently and "cutting costs where appropriate," he added. McMillon has previously spoken of reducing red tape and bureaucracy at the home office level to help in-store operations run better.

"Obviously we'd like to see it ramp higher and faster," McMillon said. "We also recognize it won't be a linear path up and to the right, but we like the trend line."

Business on 08/19/2015