Shares of Windstream Holdings Inc. surged almost 10 percent Thursday after the Little Rock company reported a smaller-than-expected second-quarter loss and announced plans for a new share-repurchasing program.

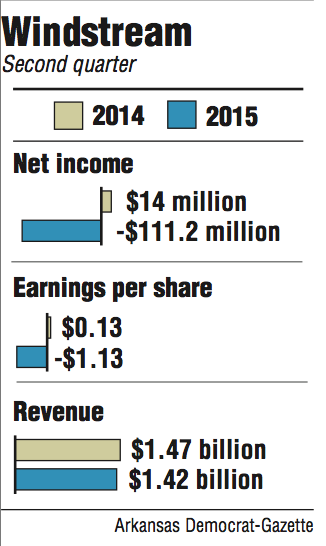

Windstream reported a loss of $111.2 million, or $1.13 per share, for the second quarter, compared with a profit of $14 million, or 13 cents per share, during the same period a year ago. The period's net income included a $54 million one-time expense.

Second-quarter revenue was $1.42 billion, down from $1.47 billion a year ago.

Windstream shares gained 51 cents to close Thursday at $5.69 in active trading on the Nasdaq stock exchange. The company released its financial results Thursday before the markets opened. Windstream's shares have traded between $4.42 and $18.14 in the past 52 weeks.

The telecommunications company had adjusted earnings per share of 48 cents, according to Zacks Equity Research. This beat analysts' estimates of a loss of 61 cents for the second quarter, which ended June 30.

"The trends were a little bit better than expected," said Frank Louthan, an analyst with Raymond James & Associates. "The repurchase program has really gotten investors more excited."

The company said Thursday that a new $75 million share-repurchasing program would be completed by Dec. 31, 2016.

The announcement of the program helped push the company's shares up Thursday because buybacks return cash to shareholders, Louthan said.

"Windstream stock is significantly undervalued and a share buyback is an attractive investment and an efficient way to return capital to shareholders," Windstream Chief Executive Officer Tony Thomas said in a statement.

Windstream said it paid down $3.2 billion in debt in relation to the spinoff of its copper and fiber networks into a real estate investment trust called Communications Sales & Leasing Inc., also known as CS&L, earlier this year.

"We are on the right track strategically and financially. The new business unit structure has sharpened our focus and is driving operational excellence," Thomas said in a statement. "The board and management team are confident in the future and remain focused on enhancing profitability and creating value for our shareholders."

Business on 08/07/2015