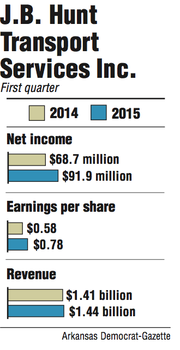

J.B. Hunt Transport Services Inc. reported profits of $91.9 million for the first quarter of 2015, a 34 percent increase from a year ago that led to a record day for company stock.

Earnings per share for the Lowell-based company rose to 78 cents during the quarter, beating analyst estimates of 72 cents. J.B. Hunt reported net income of $68.7 million and earnings per share of 58 cents for the first quarter of 2014.

J.B. Hunt's operating revenue of $1.44 billion was a 2.4 percent increase from $1.41 billion for the first quarter of 2014. It fell short of analyst estimates of $1.54 billion, but analyst Brad Delco of Stephens Inc. in Little Rock characterized the company's performance as "quite strong" during the quarter.

"We saw strong results in intermodal, in dedicated and in trucking relative to expectations," Delco said.

J.B. Hunt shares ended trading Tuesday at $91.82, up $4.09 per share, as a result of its first-quarter earnings. It was the highest closing price for company shares, which are up 24 percent from a year ago.

The intermodal business continued to lead the way. Intermodal revenue rose from $835.5 million in the first quarter of 2014 to $843.9 over the same three months of 2015 even though the labor dispute along West Coast ports "limited eastbound traffic," according to J.B. Hunt.

The sector -- which accounts for 59 percent of the company's total revenue -- posted $104.3 million in operating income. It was a 12 percent increase from a year ago.

Intermodal load volumes increased by 6 percent in the quarter. The eastern network enjoyed 12 percent growth, while transcontinental loads experienced 2 percent growth despite the labor dispute.

"I think it did impact volumes to some degree," Delco said of the West Coast port issues. "I don't think it was as bad as what people had feared."

Revenue for J.B. Hunt's dedicated contract services was $345.2 million in the first quarter of 2015, which was a 7 percent increase from $322 million a year ago. The company attributed the growth to "rate increases and more activity at customer accounts."

J.B. Hunt said an additional 336 revenue-producing trucks were in the fleet by the end of the quarter compared with the previous year "primarily from new contract implementations in the current and prior periods." Operating income in the dedicated sector experienced 130 percent growth, moving from $15.6 million in the first quarter of 2014 to $35.8 million.

"I think overall, the two big things that I think stand out is intermodal efficiency and pricing seemed to drive better margin improvement than what we thought," Delco said. "Second, dedicated segment results and margins were a lot better. I think that, to some degree, is a function of a better operating environment, i.e. weather. But also I think there's been some changes made with particular customers and contracts that have ultimately improved profitability."

J.B. Hunt reported a 17 percent increase in load growth from integrated capacity solutions -- the company's freight brokerage division -- but lower revenue per load kept sales flat from the first quarter of 2014. J.B. Hunt reported $163.2 million in revenue from the sector, which was a slight increase from $162.6 million in the first quarter last year.

Revenue from J.B. Hunt's trucking segment was down 1 percent, falling from $92.5 million for the first quarter of 2014 to $91.2 million in the same period this year. The company said the decrease was the result of lower revenue per tractor per week.

Operating income for J.B. Hunt's trucking operations increased by 248 percent compared with the first quarter of 2014, growing from $2.4 million to $8.5 million. The company said sales increased "primarily from higher customer rates and more efficient operating costs of its newer equipment."

J.B. Hunt's operating income across all segments was $155 million, a 32 percent increase from $117 million for the first quarter of 2014. The company said it benefited from rate increases, improved asset utilization, lower equipment maintenance costs, improved equipment fuel economy and more effective use of third-party carriers. J.B. Hunt said the benefits "more than offset" increases in costs like driver wage increases, higher equipment depreciation, insurance rates and toll expenses.

Business on 04/15/2015