Correction: Bear State Financial reported fourth-quarter core earnings of $3.4 million, up from $248,000 in the fourth quarter of 2013. A description of the change in Bear State’s fourth-quarter core earnings was incorrect in this article.

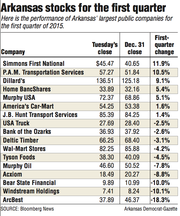

Simmons First National's stock had the best performance of Arkansas' largest public companies in the first quarter, gaining 11.9 percent over the past three months.

Simmons shares closed Tuesday at $45.47 on more than 640,000 shares traded, nine times its average volume and its highest volume in the past year.

On Feb. 27, the Pine Bluff bank closed on two major acquisitions announced last year, Community First Bancshares of Union City, Tenn., and Liberty Bancshares of Springfield, Mo.

"I think people are recognizing that Simmons is building a good franchise," said Randy Dennis, president of DD&F Consulting Group, a Little Rock bank consulting firm. "[Simmons is] expanding in good markets and the expanded business they will do through those markets is going to have a material impact on their bottom line."

With the purchase of the Tennessee and Missouri banks, Simmons will be able run its product line through those markets, Matt Olney, a banking analyst with Simmons, said in a recent research report.

"This includes products such as credit card, trust, agriculture lending and equipment financing," Olney said in the report.

P.A.M. Transportation Services of Tontitown had the second-best performance, rising 10.5 percent for the quarter.

"Improvements in revenue per truck and a reduction in empty miles were among the metrics during the fourth quarter last year attracting the attention of investors," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock. "Diversification has paid off for the company, which has reported considerable short-term growth in the brokerage division."

Dillard's was third with 9.1 percent growth in its stock price in the first quarter.

The Little Rock retailer was recently described as "one of the great turnaround stories of retail in the recent decade" in a report by CS First Boston, Williams said.

"It's not surprising to see Dillard's on this list," Williams said. "Its shares have garnered attention after strong fourth-quarter results."

In the fourth quarter, Dillard's showed the highest quarterly revenue since the third quarter of 2012, Williams said.

Dillard's also has had "robust comparable-store sales growth," Williams said.

Ten stocks fell and seven rose in the first quarter.

Fort Smith-trucker ArcBest had the worst performance of the quarter, falling 18.3 percent.

Among the Arkansas stocks, ArcBest has the highest price volatility, Williams said.

"Despite lower fuel costs as a result of falling oil prices, the fuel surcharges passed on to customers are dropping, too, leading to reduced revenues," Williams said. "And the impact of severe weather has historically resulted in increased company insurance claims and may be scaring off some investors."

Windstream Holdings' loss for the quarter was 10.1 percent, slightly worse than shares of Bear State Financial, the Little Rock banking firm, which fell 10 percent.

Bear State's core earnings fell in the fourth quarter compared with the fourth quarter of 2013, Williams said.

Bear State recently folded the charters of First Federal Bank in Harrison, First National Bank in Hot Springs and Heritage Bank in Jonesboro into branches of Bear State.

Industry analysts are concerned about Bear State's ability to compete and its market share in the communities where it has branches, Williams said.

Business on 04/01/2015