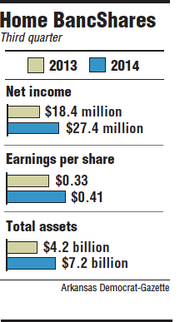

Home BancShares, which has Centennial Bank branches in three states, earned $27.4 million in the third quarter, up $9 million and 49 percent from the third quarter last year, the Conway-based bank said Thursday.

The bank earned 41 cents per share for the quarter, up from 33 cents per share in the third quarter last year.

Excluding expenses for acquisitions, Home BancShares earned 45 cents per share, matching the average projection of nine analysts surveyed by Thomson Reuters.

Shares of Home BancShares rose $1.97, or 7 percent, to close Thursday at $30.11 in heavy trading on the Nasdaq exchange.

One major surprise was that the bank generated $208 million in loans excluding loans acquired in purchases, said Matt Olney, an analyst in Little Rock with Stephens Inc.

"That was something that has been the only weakness in the last few quarters," said Olney, who owns no stock in Home BancShares. "They have been able to offset that from the Liberty Bancshares transaction. So it was good to see the [nonpurchased] loan growth come back again."

The biggest change that led to the increased loans was the change in lending in Florida, Olney said

"I think the borrowers in Florida have more confidence," Olney said. "There is a lot more volume and a lot more activity in Florida now versus a year ago. Arkansas also is doing well this year."

Home BancShares closed the acquisition of Florida Traditions Bank of Dade City, Fla., during the third quarter.

It is still seeking more acquisitions and has several targets to choose from, said John Allison, chairman of the bank.

"The problem is you have to pick the right one that makes the deal work," Allison said in a conference call Thursday. "We're working aggressively. We've got a couple picked out that we want to do, that we think we can do. Hopefully we can bring those home some time, maybe next year. They are pretty good size transactions."

Home BancShares would like to make some acquisitions on the east coast of Florida, Allison said. And the bank has been invited to look at a few possible acquisitions in Texas, where Centennial has no banks, Allison said.

"If we went outside our footprint, we would probably look in that state," Allison said.

The bank won't do deals just for the sake of making an acquisition, as some banks are doing nationally, Allison said. Many potential deals wouldn't be profitable enough, he said.

"If it works for the seller and it works for the buyer, then the combined entity's shareholders get rewarded," Allison said.

Centennial Bank has 80 branches in Arkansas, 61 in Florida and seven in Alabama. Of its $7.2 billion in assets, 66 percent is in Arkansas, 30 percent is in Florida and 4 percent is in Alabama.

Centennial closed or merged two branches in Arkansas in the third quarter and will probably close more branches in the future, Allison said.

Business on 10/17/2014