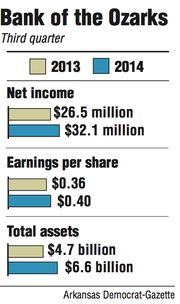

Bank of the Ozarks earned $32.1 million in the third quarter, a 21 percent gain from $26.5 million in the same period last year, the Little Rock bank said Tuesday.

The bank earned 40 cents a share for the quarter, beating average expectations of 39 cents a share projected by 10 analysts surveyed by Thomson Reuters.

Bank of the Ozarks shares rose 26 cents to close Tuesday at $30.87. The bank released its earnings after the market closed.

The bank's ability to increase its loans and leases even without including acquisitions "has contributed significantly to our growth and profitability in recent years," George Gleason, chairman and chief executive officer of the bank, said in a statement.

Bank of the Ozarks' nonpurchased loans increased $468 million in the third quarter and more than $1 billion for the first nine months of the year, Gleason said.

If the recent drop in the stock market continues and the economy slows down, it would be more challenging to improve loan growth for Bank of the Ozarks, said Matt Olney, an analyst in Little Rock with Stephens Inc.

It's difficult to determine how an economic slowdown would affect Bank of the Ozarks' pursuit of banks to buy, Olney said.

"You could make a case that [a slowdown] would make it better or worse [to make more acquisitions]," Olney said. "It goes back to what would make the seller of a bank want to sell. If there is a better economy, would [a seller] feel like he could get a better price? Maybe he would want to wait.

"But if it is a worse economy, he might think there could be more challenges for him in the next few years. It would be a case-by-case situation. I don't know if the economy is going to determine mergers and acquisitions [for Arkansas banks seeking more purchases]."

Bank of the Ozarks has bought a dozen banks since 2010. It said in July that it would acquire New York-based Intervest Bancshares Corp. for $228.5 million in Ozarks' stock. Intervest has six branches in the Tampa Bay, Fla., area, where it has the 11th-highest market share of deposits. Intervest has $1.6 billion in assets, making it Bank of the Ozarks' largest purchase.

The Intervest transaction is expected to close in early 2015, Bank of the Ozarks said Tuesday.

Bank of the Ozarks has 165 offices in nine states -- 88 in Arkansas, 28 in Georgia, 21 in Texas, 17 in North Carolina, five in Florida, three in Alabama and one each in South Carolina, New York and California.

Bank of the Ozarks will conduct a conference call today at 10 a.m. to discuss its third-quarter results. To access the discussion, dial (888) 771-4371 and ask for the Bank of the Ozarks call.

Business on 10/15/2014