The world's largest retailer blamed the long, cold winter for keeping some U.S. customers away, resulting in lower-than-expected revenue and earnings in its first quarter of fiscal 2015, Wal-Mart Stores Inc. reported Thursday.

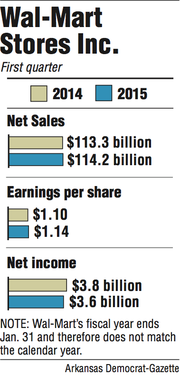

The company reported earnings of $1.10 per share for the quarter ending April 30, down 3.5 percent from the same period last year and a nickle below analysts' estimates of $1.15. Net sales were $114.2 billion for the quarter, up 0.8 percent from $113.3 billion in last year's first quarter, yet revenue was below the Wall Street estimate of $116.25 billion. Profits were down 5 percent compared to the first quarter of fiscal 2014.

Severe weather that gripped most of the nation in February and into March affected U.S. retail in general, including Wal-Mart.

Wal-Mart U.S. is the largest of the retailer's three business segments and is the nation's biggest grocer. Bill Simon, president and chief executive officer of Wal-Mart U.S., said the weather resulted in higher utility bills; unanticipated costs for snow and ice removal in parking lots; and disruption of the supply chain, the process by which goods are moved to the stores from manufacturers. About 200 stores were closed for a period when the weather was the worst.

Randy Koontz, first vice president of investments at Pinnacle Wealth Management at Raymond James in Rogers, refutes the claim that weather's to blame.

"It was cold and the weather sucked, but I don't remember that I stopped eating or using toothpaste or deodorant because the weather sucked," he said. "Weather affected them some, but that's not their biggest problem."

The company said its 34 percent tax rate was partially to blame.

Wal-Mart U.S.'s same-store sales in stores open a year or more -- excluding fuel sales -- dropped 0.1 percent. Foot traffic was down 1.4 percent. It was the fifth consecutive quarter for negative or flat same-store sales in the U.S. Management is hoping the recent addition of extra services within stores, such as the Walmart-2-Walmart money transfer business and its partnership in an auto-insurance comparison business, AutoInsurance.com, will draw more people to stores.

"We're moving into some of the areas of services that customers have told us they want, and [we're] pleased with the results of those," Simon said. There's more to come in the current fiscal year, he added.

Wal-Mart is bullish on its Neighborhood Market store format, which experienced a 5 percent increase in same-store sales at stores open at least a year. There are about 400 Neighborhood Markets open or opening in the country, with plans of having "well over 500" open by the end of the year, Simon said. April marked the 46th consecutive month of increases in same-store sales at these smaller, mostly grocery Wal-Mart stores.

There were other bright spots, as well, such as a 27 percent increase in quarter-over-quarter e-commerce sales worldwide and a positive performance by Wal-Mart International. The foreign segment was the only one to post a profit during the quarter, with a gain in operating income of 3.4 percent.

"I'm optimistic because of the improved sales trends and the progress we continue to make on operational efficiencies," Wal-Mart President and CEO Doug McMillon said in a pre-recorded call with several members of the management team.

The company invested roughly 11 cents per share in e-commerce in the last fiscal year and expects to spend an incremental 2 cents to 4 cents per share to continue growth in fiscal 2015.

"I think it's a long-term investment that Wal-Mart is making but one it really has to make because of the evolution of retail in general," said Stewart Samuel, project director with food and grocery industry experts IGD Services Canada.

"We're on the horizon of a new era of retailing and multichannel capabilities. E-commerce, in particular, is going to be key to driving growth in the future," Samuel said. "Wal-Mart's done a good job in terms of leveraging its assets, it stores, its supply chain to create that kind of seamless channel for shoppers."

The quarter was another tough one for Sam's Club, and it could be a while before there's improvement, said Charles Holley, Wal-Mart executive vice president and chief financial officer. Same-store sales, minus fuel receipts, dropped about 0.5 percent during the quarter. Sam's Club President and CEO Rosalind Brewer said challenges for the warehouse retailer's core customer resulted in one of the segment's more difficult quarters.

Looking ahead to the current quarter, Holley estimated earnings per share to be $1.15 to $1.25, which is below previous predictions of $1.28. The pull-back in expectations is precipitated mostly by higher health-care costs for the company, ongoing effects from cuts in the federal Supplemental Nutrition Assistance Program, higher tax rates for the company and the investment in the new cash-back rewards program for Sam's Clubs' "Plus" members, he said.

The changes to the food stamp program, used mostly by the lowest-income Wal-Mart customers, will continue to have an effect on the company's bottom line until this fall, when the changes will have been in effect for one year, Simon said.

"We have a customer in the 'middle and down' that's still very cautious," Simon said. "They're very resilient, but they're very cautious. They've managed to find ways to adapt to the situation as it exists today."

This was McMillon's first quarterly earnings release after being promoted to CEO from the company's international division. During the management call, he made no hints of his strategy for taking the company forward.

Brian Yarbrough, a consumer analyst with Edward Jones in St. Louis, said it's likely too soon to see any of the real changes McMillon plans to make, if any.

"I think a lot of people are waiting to see what his thoughts are long-term on international," Yarbrough said. "I think a lot of the Street would like to see Wal-Mart exit some markets that aren't as strong as others and really focus on improving the profit growth and income within those international markets."

Wal-Mart closed at $76.83, down 2.4 percent.

Business on 05/16/2014