Hutchinson, Coleman talk up their education, tax-cut plans

Sunday, May 11, 2014

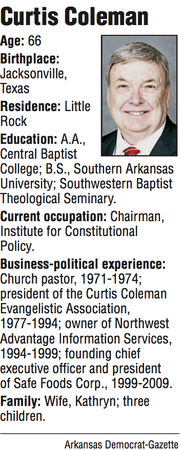

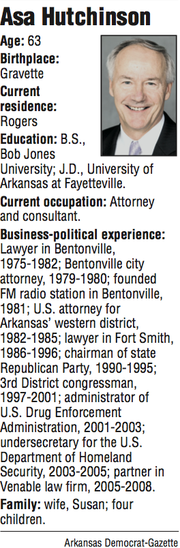

Former U.S. Rep. Asa Hutchinson of Rogers cites his conservative record and his plans for improving Arkansas as he seeks the Republican nomination for governor in the May 20 primary. Meanwhile, his opponent, Curtis Coleman of Little Rock, touts his business experience.

Hutchinson and Coleman have taken a few jabs at each other during the past several months, though Hutchinson has aimed his criticism primarily at Democratic gubernatorial candidate Mike Ross of Little Rock.

Coleman has called Hutchinson a Washington insider. Hutchinson has pointed out that while Coleman emphasizes his business experience, state government aided the business that Coleman helped found with a state loan of several million dollars and the use of technology developed at the University of Arkansas for Medical Sciences.

Hutchinson, an attorney, said voters should elect him as the Republican gubernatorial nominee partly because of his conservative record and because he’s more likely to defeat the Democratic opponent in the November general election.

He said he has proposed a plan to create jobs by lowering the state’s individual income tax rates, expanding computer-science education to each of the state’s high schools, and improving workforce training from high school through the community colleges.

“I trust the voters to recognize my conservative principles, and my plan for Arkansas justifies their support,” said Hutchinson, who has served stints as a federal Department of Homeland Security undersecretary, administrator of the federal Drug Enforcement Administration, and U.S. attorney in Arkansas.

Coleman, chairman of the Curtis Coleman Institute for Constitutional Policy, said voters should elect him because he’s been a businessman who created more than 50 jobs at one point at Safe Foods Corp. in North Little Rock, where he was founding chief executive officer from 1999-2009.

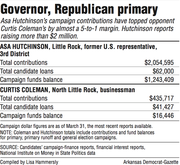

Coleman, who lost a 2010 bid for the Republican U.S. Senate nomination, said Hutchinson has been able to raise more money because Hutchinson has the benefit of a Rolodex full of contributors’ names from unsuccessful races for the U.S. Senate in 1986, attorney general in 1990 and governor in 2006, while Coleman has focused on building a grass-roots campaign organization.

But Hutchinson said his fundraising edge shows that he has “tremendous grassroots support, as well as the capability to overcome a Democratic Party fundraising advantage.”

He said he wants the Legislature to approve cuts in individual income tax rates that he estimates would reduce state tax revenue by about $100 million a year to make the state’s tax rates more competitive and create more jobs.

During his first year as governor, Hutchinson said he would ask the Legislature to cut the state’s income-tax rate from 7 percent to 6 percent for people earning between $34,000 and $75,000, and from 6 percent to 5 percent on those earning between $20,400 and $34,000. With the help of a growing economy and tax revenue, he said, he hopes to expand the tax cut in future years.

Hutchinson said he’d continue funding the state’s essential services, including a constitutionally-mandated adequate education for public school students.

Hutchinson said he’ll ask the Legislature to pass a law to have computer-science courses count toward core high school graduation credits in math or science, so each high school offers computer-science courses. He said he’ll ask the Legislature to create eight regional councils to guide the state’s fragmented workforce-training program and direct certain corporate income tax revenue to specific and approved training programs at the state’s community colleges.

Coleman said he wants the Legislature to cut taxes by more than $2.3 billion over an eight-year period, including $65 million in the first year, to help create more jobs in the state.

He’s proposed cutting the state’s individual income taxes by at least 20 percent, exempting some businesses from the state’s corporate income tax, eliminating capital-gains taxes, exempting military retirees’ benefits from the state’s individual income tax, and preventing the state budget from growing faster than the state’s gross domestic product.

“It is the most responsible and reasonable tax cut that anybody has proposed because it is a gradual reduction over eight years that is married to an economic development plan that will stimulate the economy and broaden the tax base,” Coleman said. He has said his proposed tax cuts would get a higher priority than providing an adequate education to public school. Last week, he described the priorities as complementary.

Among other things, Coleman also wants to increase state funding for community colleges by $42 million a year.

He said he would temporarily take $21 million per year from state allocations for four-year universities and shift it to two-year schools. He promised to raise the other $21 million per year by reducing “administrative and oversight costs” in the state Department of Education budget. He said the increased funding is tied to the community colleges working with regional high schools to restore vocational and technical training because “it is an emergency.”

The candidates’ positions on other issues are:

Abortion: Coleman said he opposes abortion except to save the life of the mother. Hutchinson said he opposes abortion except to save the life of the mother and in cases of rape and incest.

Common Core: Coleman said he would push for the Legislature to repeal the Common Core standards and/or the state Board of Education to reverse its 2010 approval of the standards to allow local school boards to decide whether their districts would use the standards, standardized tests and curriculum.

Hutchinson said he’ll conduct a full review of Common Core and the state’s education policy with the aim of ensuring that the policy is determined in Arkansas and not taking “what is simply dictated by Washington, D.C,” adding that he wants to read the Common Core standards before he makes his final decision.

Gay marriage: Coleman said God — not government — instituted marriage between men and women, so “I think it is presumptuous of government to redefine an institution that pre-existed.”

Hutchinson said he supports the Arkansas Constitution’s definition of marriage as being between a man and a woman.

Lottery: Hutchinson said he believes that voters cast their ballots for “a traditional lottery” when they approved a constitutional amendment in 2008 to allow for a lottery for college scholarships, and he doesn’t think they “had in mind multiple types of electronic gaming.” He said he shares several legislators’ concerns about the lottery’s plans to implement electronic monitor games.

Coleman said he’d encourage the lottery to give more of its revenue to college scholarships by cutting overhead and reducing the number of winners.

Lottery officials have warned that the lottery would sell fewer tickets and raise less money for scholarships if it cuts the size of prizes, but Coleman disagrees, explaining: “I don’t know anybody that looks at the cards to know what their odds of winning are.”

Private option: Hutchinson said he wants to learn more about the more than 120,000 low-income Arkansans who have been enrolled for health insurance coverage through the state’s “private option” program, including how many previously had private health insurance, how many have jobs, and whether the state can get a waiver from the federal government to impose an asset test on recipients.

“I don’t believe anybody has done a deep dive into the cost impact three to five years down the road, and that’s one of the criteria that I will use to measure whether this is working and right for our future,” he said.

The expansion of the Medicaid program, approved by the Legislature last year, extends coverage to adults with incomes of up to 138 percent of the poverty level — $16,105 for an individual or $32,913 for a family of four.

Enrollees get government-funded private health insurance coverage.

The federal government will pay the full cost of coverage until 2017, when states will begin paying 5 percent. The states’ cost will then rise each year until it reaches 10 percent in 2020.

Coleman said he opposes the private-option program, but “we don’t want to kick anybody off” health insurance.

Ending the private option is going to take a transition period of at least a year or two, he said, and require the development of an effective health-care plan for Arkansans through the private sector.