1 school district to exit state's grip; 2 others join distress list

Friday, May 9, 2014

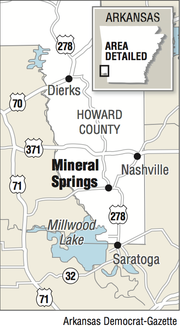

The Mineral Springs School District will regain local control Oct. 1 after a new school board for the once financially troubled system is elected and trained.

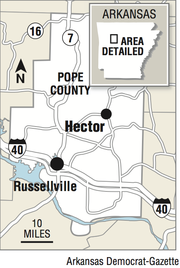

The vote by the Arkansas Board of Education for the release of the Howard County system from state control came at a meeting Thursday where the board placed the Lee County and Hector school districts into the state's fiscal-distress program.

The vote was a double whammy for the Lee County district. The Education Board voted last month to put that district under state control for chronically low academic achievement, dissolving the Lee County School Board and making the superintendent report to state Education Commissioner Tom Kimbrell.

The Mineral Springs district, which has an enrollment of about 440 students, was taken over by the state education commissioner in May 2013 because of financial problems that included questions about the ability to meet its immediate payroll. The elected School Board was removed. The acting superintendent at the time was retained until Kimbrell appointed Curtis Turner, then the superintendent of the Eureka Springs system, to head the Mineral Springs district.

"We turned some things around," Turner simply told the Education Board on Thursday in asking for the release.

Education Board member Sam Ledbetter told Turner that "there was a lot going on there that the department and the board were unaware of before you got there."

Asked by Ledbetter if he plans to stay in the district, Turner said he intends to remain if that is the desire of the new School Board members, who will be elected in the regular school election in September.

The Education Board's vote to release the district from state control is in recognition that the district has complied with its financial improvement plan and rebuilt its reserve funds.

The district was down to $422,465 in unrestricted reserves at the end of the 2011-12 school year but is now expected to end the current school year with at least $2.7 million in unrestricted reserves, according to state Department of Education records. Unrestricted reserves do not include building funds, federal grants, food-service funds and other funds the district receives that that are earmarked for very specific purposes.

At the time of the district's takeover, state officials reported general disarray in the financial operations. Not only was the ability to make payroll uncertain, but the district was also paying two superintendents, having suspended one but never severing his contract. Earlier in the year the district attracted state attention when the state attempted to help develop an improvement plan for the district's low-performing Saratoga High -- only to discover it to be a "phantom" school because all students coded as attending Saratoga were actually attending Mineral Springs.

The district has now officially closed the Saratoga campus, reduced the number of district employees through attrition, restructured its bond debt, put in a new purchase-order system and added other financial controls.

Mike Hernandez, the state's assistant commissioner for finance, said at a break in Thursday's meeting that the Mineral Springs' district was helped in rebuilding its reserves by the realization that a power plant's property initially thought to be in the Hope School District was in Mineral Springs. That raised the total assessed value of property in Mineral Springs by $90 million, Hernandez said.

The Mineral Springs district now generates so much tax revenue from its increased assessment that it is no longer eligible for the state foundation aid that most districts receive to help them meet minimum per-pupil funding requirements.

In contrast to their satisfaction about the Mineral Springs district, Education Board members found the Lee County district's finances especially troubling.

Hazel Burnett, the Education Department's coordinator for fiscal-distress accountability and reporting, said the district's unrestricted balances fell from $2.6 million in 2012 to $239,00 at the end of 2013.

In actuality, the balances in 2012 were probably only about $800,000, Burnett said. A bookkeeper at the time was making entries into accounts and then reversing them, inflating the balances at times.

Burnett said there has been no finding of fraud in the bookkeeping. She said that as a result of the district being placed in fiscal distress, she and her staff will be able to more closely evaluate how the district has managed its funds.

"That's taxpayer dollars," said Education Board member Vicki Saviers of Little Rock. "If I'm in that community, I'm raising my eyebrows. I would want to be sure that there is fiduciary integrity maintained there. This is serious business. Communities need to understand that this is something that we don't take lightly."

Board member Toyce Newton of Crossett said it is important to explain to the Lee County residents what has happened in regard to the district's finances and what it means to be in the state's fiscal-distress program. She said that a casual observer of a district may equate fiscal distress to their family finances and believe that funding is "tight," but they don't necessarily connect fiscal distress to the district being overstaffed or overextended in terms of bond debt.

"What happens is we get an explanation, but that isn't extended out into the community so that they know," Newton said.

The district has about 91 certified teachers and administrators and about 88 noncertified staff members, Superintendent Willie Murdock said.

"That doesn't seem right, does it?" Saviers asked.

"That's something we'll be looking at as we do a more in-depth review with them," Burnett said.

Lee County and Hector now join the Pulaski County Special, Helena-West Helena and Hughes districts as being in the fiscal-distress program, which obligates the districts to develop and comply with a state-approved financial improvement plan. The state typically restricts the districts in fiscal distress from entering into contracts for new expenses.

Burnett said the Hector School District's balances had declined over time. The district had unrestricted balances of $563,000 at the end of last school year that is projected to shrink to $290,000 at the end of this school year.

Superintendent Walt Davis told the board that the the district had to make a complete repayment of a $340,000 on its bond debt, which had to come from the district's operating costs.

"We have had loss of students and loss of assessment," he said. "It all hit us pretty quick. We feel like we've made some adjustments that are going to help us."

Metro on 05/09/2014