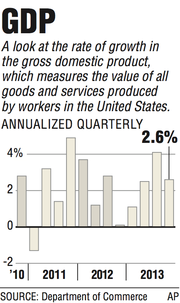

The U.S. economy grew by 2.6 percent in the final months of 2013, the Commerce Department said Thursday, a slight uptick from its previous estimate but still well below the pace of growth recorded in the third quarter.

The revised data for last quarter, in what was the government’s third and final estimate of economic growth for the period, reflected slightly healthier consumer spending than first thought.

The previous estimate for the months of October, November and December, reported in late February, was 2.4 percent. Thursday’s upward adjustment was in line with expectations among economists on Wall Street. The pace in the third quarter was 4.1 percent.

Still, the 3.3 percent increase in personal consumption expenditures last quarter was the healthiest showing since the fourth quarter of 2010, when consumption rose 4.3 percent.

It also came despite wintry weather in many parts of the country during the final weeks of the Christmas shopping season, which prompted some economists to conclude that underlying consumer behavior was somewhat more robust than recent data had suggested.

“The number for gross domestic product is good,” said Lawrence Creatura, a portfolio manager at Federated Investors in Rochester, N.Y. “It is not the exciting number that is typical of postrecession recoveries, but it is good enough. This has been a stumbling sort of recovery all along, and this number is a continuation of that pattern.”

For the current quarter,many economists predict the economy will expand at an annual rate of 1 percent to 2 percent.

Corporate profits rose by 2.2 percent in the fourth quarter but for the year were up 4.6 percent, which suggested companies continued to improve profits at a slightly faster rate than overall economic growth, thanks in part to efficiency gains.

While the stock market and corporate profits have been healthy in recent years, those gains have not translated into the kind of hiring seen in previous recoveries.

In a separate report, the Labor Department said Thursday that initial claims for unemployment dropped by 10,000 last week to 311,000 on a seasonally adjusted basis.

Economists had been expecting a slight increase in initial claims, so that figure represented a potential bright spot.

“It seems to be genuinely good news for the labor market,”said Guy Berger, a U.S. economist at RBS Securities Inc. in Stamford, Conn.

“In all likelihood, employment growth in March is going to be stronger than what we’ve seen in the last three months, and this claims data is consistent with that.”

The four-week moving average for unemployment claims, which tends to be a bit more reliable than the more volatile week-to-week numbers, fell to 318,000, also an improvement from previous weeks and the healthiest rate in six months.

The number of people continuing to receive jobless benefits dropped by 53,000 to 2.82 million in the week ending March 15, the lowest since Dec. 21. The unemployment rate among people eligible for benefits held at 2.2 percent in the same period.

A third report Thursday showed that contracts to purchase previously owned U.S. homes unexpectedly fell in February for an eighth straight month, a sign of further weakness in the industry.

The index of pending home sales decreased 0.8 percent after a 0.2 percent drop the prior month that was previously reported as a gain, the National Association of Realtors said.

Lower-than-normal temperatures probably played a role in discouraging prospective buyers faced with rising mortgage rates, higher prices and limited supply of cheaper properties. At the same time, the Realtors group said buyer traffic is stabilizing, which may help spur demand as temperatures warm.

“For housing, it’s been primarily an issue of bad weather,” Russell Price, senior economist at Ameriprise Financial Inc. in Detroit, said before the report.

“Not a lot of buyers were enticed to go out and look, and not a lot of sellers put their best foot forward” in terms of staging the property or hosting an open house. “Conditions will improve as the weather improves,” he said.

With the arrival of spring and better weather, the thinking goes, the economy’s momentum could pick up slightly.

Information for this article was contributed by Nelson D. Schwartz of The New York Times and Michelle Jamrisko Shobhana Chandra and Ainhoa Goyeneche of Bloomberg News.

Business, Pages 25 on 03/28/2014