Profit falls 68% at Murphy Oil; high costs cited

Thursday, July 31, 2014

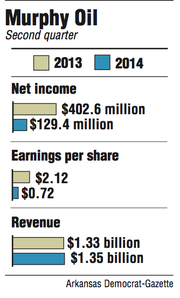

Murphy Oil Corp. on Wednesday reported a 67.9 percent drop in second-quarter profit.

The El Dorado-based oil exploration and production company posted a net income of $129.4 million during the quarter compared with $402.6 million in the same period a year ago.

Excluding discontinued operations and other items that affect comparability of results between periods, the company had an income of $161.7 million during the quarter.

In the second half of 2013, the company separated its retail gasoline business from its exploration and production operations, creating Murphy USA Inc., an independent company.

Murphy Oil attributed the drop in profit to higher exploration expenses, higher costs of extraction in Malaysian oil fields and lower realized oil and natural gas sales prices for production from its Sarawak wells in Malaysia.

The company said "unfavorable effects in the U.S. from commodity contracts, and higher financing costs" also weighed on its financial results for the second quarter.

The company reported earnings per share of 72 cents, down from $2.12 a year ago and missing analysts estimates of $1.21.

Pavel Molchanov, an analyst for Raymond James and Associates, said Wednesday before Murphy Oil released its quarterly report that he expected the company to report earnings per share of $1.45.

"Following the company's [first quarter], we cut the production forecast for the second time this year," he said in an email. "Despite three quarters of disappointing dry holes and choppy production, full year production growth ... reflects new fields in Malaysia and sustained Eagle Ford expansion." Eagle Ford is a south Texas shale formation.

Murphy Oil released its financial results after markets closed Wednesday. Shares fell 51 cents to $66.72 on the New York Stock Exchange in average trading volume.

Murphy Oil took in $1.35 billion in revenue during the three months that ended June 30, compared with $1.33 billion during the same period last year.

"We continue to make progress on three fronts: profitable production and reserves growth, execution at [Eagle Ford] and lowering operating expenses," Roger Jenkins, president and chief executive officer, said in a statement. "Once again we will more than replace our production in 2014 and our overall operating expenses continue to trend down this year even with the initial start up of several fields."

The company said it spent $125 million to buy back shares of the company's common stock. Murphy Oil has repurchased about 18 million shares since 2012.

Murphy Oil will hold a conference call today at noon to discuss its financial results. The call can be accessed at (877) 329-7568 using pass code 9711325.It will also be available live online at http://ir.murphyoilcorp.com.

Business on 07/31/2014