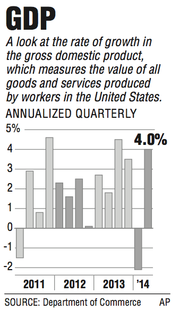

4% jump in GDP reported

Economists shift to rosier outlook

In this July 17, 2014 photo, construction workers build a commercial complex in Springfield, Ill. The government issues its first of three estimates of how fast the U.S. economy grew in the April-June quarter on Wednesday, July 30, 2014.

Thursday, July 31, 2014

WASHINGTON -- The nation's gross domestic product rose at a 4 percent annualized rate from April through June after shrinking a revised 2.1 percent in the first quarter, the Commerce Department said Wednesday.

RELATED ARTICLES

http://www.arkansas…">Fed cuts bond buys; wages still a concern

The second-quarter jump in GDP and the revision of the first-quarter measurement was a sign the economic slump in the first three months of 2014 was an anomaly, analysts said.

"The economy is looking pretty darned good," said Stuart Hoffman, chief economist at PNC Financial Services Group Inc. in Pittsburgh. "The momentum for the second half is solid. The labor market is driving this growth, which means companies are looking for workers. The big picture looks a lot brighter and is probably more accurate" than the first-quarter reading suggested.

Whether the healthier expansion will lead the Federal Reserve to raise interest rates sooner than expected is unclear. In a statement it issued Wednesday after a policy meeting, the Fed offered no clearer hint of when it will start raising its benchmark short-term rate.

The economy sprang back to life after a dismal winter in which it shrank at a sharp 2.1 percent annual rate. The government upgraded that figure from a previous estimate of a 2.9 percent drop. But it was still the biggest contraction since early 2009 in the depths of the recession.

Last quarter's rebound reinforced analysts' consensus view that the economy's momentum is extending into the second half of the year, when they forecast annual growth of around 3 percent.

The government also updated its estimates of growth leading into this year. They show the economy expanded in the second half of 2013 at the fastest pace in a decade and more than previously estimated. The revised data also show that the economy grew faster in 2013 than previously estimated, though more slowly in 2011 and 2012 than earlier thought.

The second quarter's growth in the gross domestic product -- the total output of goods and services -- was the fastest since a 4.5 percent increase in the July-September quarter of 2013.

At the same time, a higher trade deficit slowed growth as imports outpaced an increase in exports.

Paul Ashworth, chief U.S. economist at Capital Economics, said that given last quarter's rebound, he's raising his estimate for growth this year to 2 percent, up from a previous 1.7 percent forecast. Ashworth said the economy's growth also supported his view that the Fed will be inclined to start raising interest rates early next year.

Most economists have been predicting that the Fed would wait until mid-2015 to start raising rates.

"This GDP report supports our view that an improving economy will persuade the Fed to begin raising rates in March next year," Ashworth wrote in a research note.

Ashworth is among a group of economists who think growing strength in the job market and the economy will prod the Fed to move faster to raise rates to make sure inflation doesn't get out of hand.

Stock prices turned generally negative after the GDP report was released because some investors saw a greater likelihood that the Fed would raise rates sooner than expected.

The Dow Jones industrial average slid 31.75 points, or 0.2 percent, to 16,880.36.

"We're at the point where we're not sure if good news is good news or bad news," said Jim Paulsen, chief investment strategist at Wells Capital Management.

The GDP report showed that one measure of inflation rose 2 percent last quarter, up from a 1.3 percent rise in the first quarter. The Fed's inflation target is 2 percent, and for two years the GDP measure of inflation has been running below that level. Low inflation has given the Fed leeway to focus on enhancing growth to fight high unemployment.

"The GDP report confirms the strong trend to date in the labor market," said Laura Rosner, an economist at BNP Paribas SA in New York and a former researcher at the Federal Reserve Bank of New York. "Demand is returning. It should propel hiring."

In its statement Wednesday, the Fed noted that inflation had risen closer to its 2 percent target. The statement said concerns that inflation would run persistently below the Fed's 2 percent target had "diminished somewhat." But it expressed no concerns about the slight acceleration in prices.

The economy's sudden contraction in the first quarter had resulted from several factors. A severe winter disrupted activity across industries and kept consumers away from shopping malls and auto dealerships. Consumer spending slowed to an annual growth rate of 1.2 percent, the weakest in nearly three years.

Last quarter, consumer spending accelerated to a growth rate of 2.5 percent. Spending on durable goods such as autos surged at a 14 percent annual rate, the biggest quarterly gain since 2009. Analysts said that was an encouraging sign of consumers' growing willingness to buy high-cost items such as cars.

"Better job growth, a rising stock market, falling gasoline prices -- all those things are starting to resonate on Main Street," said Stuart Hoffman, chief economist at PNC Financial Services Group.

Hoffman suggested that five straight months of job gains above 200,000 were buoying both consumer and business confidence. He predicted that the July jobs report, to be released Friday, would show job growth of around 225,000.

"I think the economy has finally moved from the slow lane to the passing lane," Hoffman said. He predicted growth of around 3 percent over the next year.

Still, he said he didn't think the faster growth would lead the Fed to accelerate its first interest-rate increase.

In the April-June quarter, business investment in equipment jumped at a 7 percent rate after having fallen in the first quarter. Businesses also increased their stockpiling. The increase in inventories contributed two-fifths of the growth in the quarter.

Housing, which had been falling for two-straight quarters, rebounded in the spring, growing at a 7.5 percent annual rate.

Government spending also recovered after two consecutive declines. The strength came from state and local governments, which offset the seventh quarterly decline in federal government spending.

The government's revised estimates going back to 2011 show the economy expanded at an annual rate of 4.5 percent in last year's third quarter, up from a previous 4.1 percent estimate. The growth rate was 3.5 percent in the fourth quarter, up from an earlier 2.6 percent estimate.

For 2013 as a whole, the government said the economy grew 2.2 percent, up from its earlier 1.9 percent estimate. But growth was weaker in 2011 and 2012 than previously estimated. It grew 2.3 percent in 2012, down from 2.8 percent. And growth in 2011 was downgraded to 1.6 percent from 1.8 percent.

Information for this article was contributed by Martin Crutsinger and Matthew Craft of The Associated Press and by Shobhana Chandra and Chris Middleton of Bloomberg News.

A Section on 07/31/2014