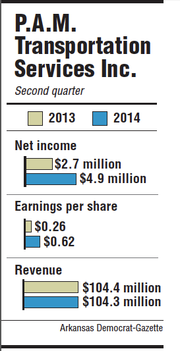

P.A.M. Transportation Services Inc. reported net income of $4.9 million for the second quarter, an 81 percent jump from the same period last year.

Earnings per share for P.A.M., the trucking and transportation firm headquartered in Tontitown, were 62 cents for the second quarter. According to the company, those are the highest earnings per share in its history. P.A.M. was founded in 1980 and incorporated in 1986.

Revenue was down slightly for April, May and June, dipping from $104.4 million to $104.3 million, but CEO Daniel H. Cushman was encouraged by the company's performance.

"We are very pleased to announce another quarter of improved results," Cushman said in a news release. "This quarter's earnings per share represents our highest single quarter earnings per share on record."

P.A.M.'s net income for the first six months of 2014 has eclipsed all of 2013. Last year, the company reported $5.1 million in income, and at the midway point of 2014 the company is at about $6.2 million, including $1.35 million in the first quarter.

Cushman said the financial performance so far this year is proof that the company's "strategic plans are maturing."

Traditionally strong in its automotive division, P.A.M. continued to perform well there. Cushman said P.A.M. had experienced growth in its Mexico division as well as its expedited and dedicated services. Expedited business, Cushman said, accounts for 20 percent of the company's revenue.

Empty miles logged by P.A.M. drivers, 6.6 percent, has decreased 7.21 percent during the same period last year. Total loads and revenue per truck have increased for the company, factors that have helped the company attract and retain drivers.

"We continue to seek opportunities that we believe are driver friendly and as a result, we have increased our driver count despite the difficulties in the driver market," Cushman said.

"We have always had a lot of automotive-dedicated business. In the past, we have had limited success in securing dedicated business outside of the automotive area, but within the last nine months we have been more successful in the diversification of our dedicated customer base," Cushman added. "Again, this is freight that typically appeals to drivers."

P.A.M. stock has performed well in 2014. Board members authorized the buyback of 675,000 shares in January at $20.50 per share. Since then the value has seen a steady increase, and stock ended Monday trading at $34.15.

Business on 07/29/2014