Simmons' 2nd-quarter profit rises 50%

PB bank racks up $9.9 million; total loans grow to $2.4 billion, a 27% increase

Friday, July 18, 2014

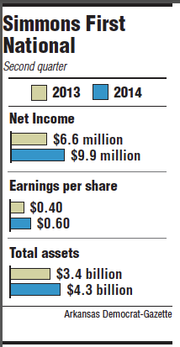

Simmons First National Corp. on Thursday reported a profit of $9.9 million for the second quarter, up 50 percent from $6.6 million in the same period last year.

The Pine Bluff bank earned 60 cents a share, better than the 54 cents projected by three analysts contacted by Thomson Reuters and up from 40 cents a share in the second quarter last year.

Shares of Simmons fell $1.79 to close Thursday at $37.63 in trading on the Nasdaq exchange.

Simmons' total loans increased 27 percent to $2.4 billion at the end of the quarter.

Loan growth is coming from markets in Arkansas, Missouri and Kansas, George Makris, Simmons' chief executive officer, said in a conference call.

"We're seeing some of the new lenders we hired about a year ago in the Kansas and Missouri markets starting to really have some production success," Makris said.

The bank reported nice loan growth in St. Louis; the Kansas City area; and Wichita, Kan., said David Bartlett, Simmons' president.

"And Little Rock and central Arkansas are still providing some nice loan growth," Bartlett said.

Simmons is likely to wait before announcing another bank purchase, said Matt Olney, a banking analyst for Stephens Inc. in Little Rock. Olney owns no Simmons stock.

Simmons announced two large acquisitions in May -- First State Bank of Union City, Tenn., and Liberty Bancshares of Springfield, Mo. -- that totaled about $3 billion in assets. Earlier this year, Simmons also announced the purchase of Delta Trust & Bank of Little Rock.

All three deals should close by the end of this year, bank officials said.

"Simmons is pretty busy right now," Olney said. "I think they are probably more focused on getting those transactions to the finish line. My anticipation is that another deal announcement this year is probably unlikely. But next year there are a lot of opportunities to consolidate with smaller banks."

Makris acknowledged on the conference call that the earliest Simmons would consider a large acquisition would be early next year, although a small bank in an existing market might be considered for a deal.

With the integration of the three banks this year, Simmons will have assets of about $8 billion, moving it close to the $10 billion level that requires closer federal regulatory scrutiny.

"We have to spend a little time visiting with regulators about how things will change for us after we pass $10 billion," Makris said.

Simmons would prefer any out-of-state purchases in the future to be able to operate by themselves and be at least $1 billion in size, Makris said. The bank is interested in expanding in markets where it already has offices, as well as in Oklahoma and Texas, Makris said.

Business on 07/18/2014