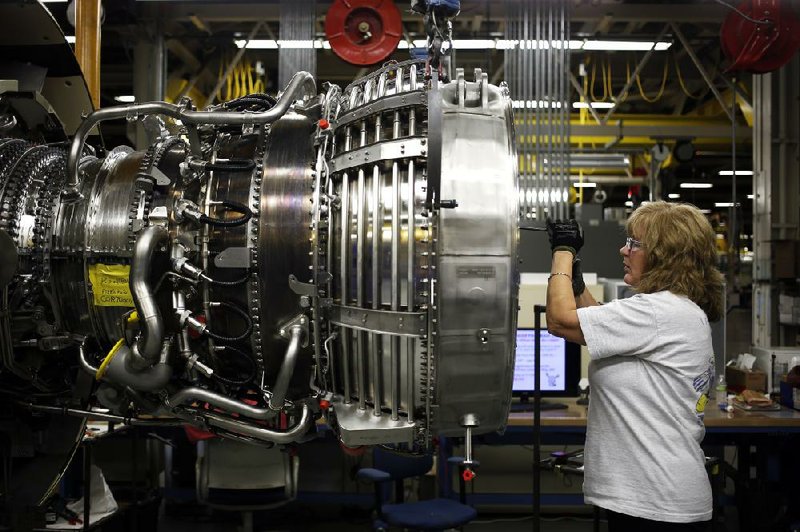

WASHINGTON -- U.S. factory output increased for the fifth-straight month in June as manufacturers cranked out more aircraft, chemicals and furniture.

Factory production rose 0.1 percent last month, the Federal Reserve said Wednesday, down from a gain of 0.4 percent in the previous month. May's data were revised slightly lower, but April's reading was revised much higher.

Despite June's small increase, manufacturing output rose in the second quarter at the fastest pace in more than two years, helping strengthen the economy after it contracted sharply in the first three months of the year. Factory output climbed 6.7 percent at an annual rate in the second quarter, the most in more than two years and up from just 1.4 percent in the first quarter.

Overall industrial production, which includes manufacturing, mining and utilities, edged up 0.2 percent in June, down from a 0.5 percent gain in May.

Mining output, which includes oil and gas drilling, surged 0.8 percent. Utility production fell 0.3 percent, mostly reflecting weather patterns. Industrial production rose at an annual rate of 5.5 percent in the second quarter, the best showing in nearly four years.

"The industrial economy is in reasonable shape but the recovery is steady rather than spectacular," said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Most economists are optimistic that factory output will keep rising. The Federal Reserve Bank of New York said earlier this week that its regional manufacturing index reached a four-year high in July.

Americans are buying more cars and businesses are spending more on steel and other metals and computers. Auto sales reached an eight-year high in June. Auto production slipped last month, the Fed said, but that followed several months of strong gains.

Petroleum output fell, but mostly because of a temporary disruption at a large refinery, according to the Fed's report.

A separate report Wednesday said confidence among U.S. homebuilders rose more than forecast in July, reaching the highest level in six months, as growing payrolls brightened the outlook after a shaky first half.

The National Association of Home Builders/Wells Fargo sentiment measure climbed to 53 from 49 in June, the Washington-based group said. Readings above 50 mean more respondents said conditions were good. The median forecast in a Bloomberg survey of economists projected it would rise to 50.

The housing market is showing signs of improvement after higher mortgage rates and a harsh winter stalled the recovery earlier this year. A strengthening labor market, combined with wage gains and rising consumer sentiment, will probably support further progress in the industry as the Federal Reserve winds down its unprecedented stimulus program.

"If you're thinking about buying a home, it's a pretty good time," said Brian Jones, a senior economist at Societe Generale in New York, who correctly forecast in the jump in builder sentiment. "You get employment going, you're in the midst of a fairly low interest rate environment and home affordability is actually pretty high."

Estimates in the Bloomberg survey for the homebuilder sentiment index ranged from 48 to 53. June's reading was unrevised, the report showed.

The measure of the six-month sales outlook rose to its highest level since September, climbing to 64 this month from 58 in June.

In a third economic report Wednesday, the Labor Department said that the producer price index, which measures the cost of goods and services before they reach the consumer, rose 0.4 percent last month. The increase follows a 0.2 percent decrease in May.

The wholesale price of gasoline rose 6.4 percent in June. Steel prices shot up 3 percent. But prices fell for grains, cheese and rental cars to offset some of those increases.

In the past 12 months, producer prices have risen 1.9 percent, roughly in line with the Federal Reserve's inflation target of 2 percent.

But inflation appears unlikely to accelerate based on producer prices. Crude-oil prices have fallen this month, after surging in June on reports of Iraq being destabilized by the Sunni militia known as the Islamic State of Iraq and the Levant.

"Nothing here is going to worry the Fed, particularly not when crude-oil prices have most recently fallen back," said Paul Ashworth, chief US economist at Capital Economics.

Information for this article was contributed by Christopher S. Rugaber and Josh Boak of The Associated Press and by Victoria Stilwell of Bloomberg News.

Business on 07/17/2014