State general revenue in December increased by $15.4 million from a year ago to $533 million, with the state’s economy “just muddling along,” the state’s chief fiscal officer said Friday.

Last month’s tax collections are a state record for the month of December - exceeding the $517.6 million collected a year ago - but narrowly fell short of the state’s forecast by $1 million, the state Department of Finance and Administration reported Friday.

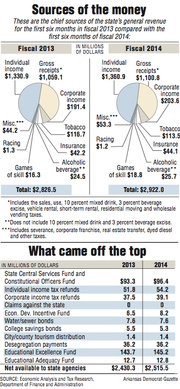

The state’s two largest sources of general revenue - individual income taxes and sales-and-use taxes - increased slightly from a year ago, but both fell short of the state’s forecast.

“We are not in any kind of high growth period,” said Richard Weiss, director of the department.

During the f irst six months of fiscal 2014, which began July 1, gross general revenue increased by $95.5 million (3.4 percent) over the same period last fiscal year to $2.922 billion. That exceeds the state’s forecast by $26.9 million (0.9 percent).

Tax refunds and some specific government expenditures, such as court-mandated desegregation expenses, come off the top of gross general revenue, leaving a net amount that agencies are allowed to spend.

During the first half of fiscal 2014, the net increased by $85.2 million (3.5 percent) compared with the first half of fiscal 2013 to $2.515 billion. That’s $32.2million (1.3 percent) above the state’s forecast.

“We are fairly optimistic that things are going to continue at kind of at their same level and our forecast will be pretty much right on,” said Weiss.

While the net available general revenue for state agencies is $32 million ahead of the forecast so far, “we expect that to pretty much even out and go back down to right being on forecast,” he said.

Weiss said he expects to see fluctuations in monthly individual income tax collections because some people paid taxes early to avoid paying higher federal income tax rates that took effect Jan. 1, 2013. State officials have said they received a one-time surge of individual income tax collections from these taxpayers in fiscal 2013, helping the state accumulate a $299.5 million surplus at the end of fiscal 2013.

Democratic Gov. Mike Beebe said the state’s onetime $100 million windfall in fiscal 2013 from taxpayers paying early is factored into the state’s general revenue forecast for 2014.

According to the finance department, December’s general revenue includes:

A $2.3 million (0.9 percent) increase in individual income tax collections over a year ago to $245.3 million, falling $1.9 million (0.8 percent) behind the state’s forecast.

Individual income withholding taxes last month declined by $6.4 million from a year ago to $211.2 million, which is $10.4 million below the state’s forecast, said Whitney McLaughlin, a tax analyst for the department.

Weiss said the reduction in withholding taxes doesn’t indicate that fewer people are working in the state.

“This is just pulling back to what would have been normal” collections, a result of some taxpayers paying taxes early to avoid the higher federal income tax rates that went into effect in January 2013, he said.

The state’s unemployment rate remained at 7.5 percent in November, the U.S. Bureau of Labor Statistics reported last month.

The state’s unemployment rate stood at 7.1 percent in December 2012 but climbed through much of 2013.

A $5.6 million (3.1 percent) increase in sales-and-use tax collections from a year ago to $186.5 million, falling $4.1 million (2.2 percent) short of the state’s forecast.

Last month’s sales-and use tax collections reflect taxes remitted to the state in December based on sales in November.

Weiss said he doesn’t know why sales-and-use taxes fell short of the forecast.

A $0.9 million (1.5 percent)increase in corporate income taxes from a year ago to $63.7 million, falling $0.2 million (0.3 percent) short of the state’s forecast.

State officials say fluctuations in monthly corporate income tax collections often reflect corporations’ tax strategies.

This month’s revenue report comes before the Legislative Council and Joint Budget Committee convene for budget hearings starting Jan. 14 in advance of the Legislature’s fiscal session starting Feb. 10. The Legislature will work to complete a budget for fiscal 2015.

Last month, the finance department said it’s forecasting a $129.9 million (2.1 percent) increase in gross general revenue to $6.333 billion in fiscal 2015 and a $96.9 million (2 percent) increase in net general revenue available for agencies to spend, to $5.040 billion.

These estimates for fiscal 2015 factor in the effects of $85.2 million in tax cuts and other tax-policy changes enacted this year by the Republican-controlled Legislature and Beebe, according to state officials.

The Legislature enacted a cornucopia of tax cuts that are projected to reduce state general revenue by $10.1 million in fiscal 2014 and $141.2 million in fiscal 2016.

During the past two months, Beebe has repeatedly pointed out that the Legislature enacted tax cuts in anticipation of savings resulting from its authorization of accepting millions more federal Medicaid dollars. The money will be used to purchase private health insurance for low-income Arkansans through health exchanges - the so-called private option. He has warned that the Legislature will either have to repeal some tax cuts or trim state government if it doesn’t reauthorize the use of federal funds for the private option in the fiscal session.

The federal dollars are aimed at helping an estimated 250,000 uninsured Arkansans obtain insurance. So far, more than 60,000 Arkansans have signed up for the health-insurance coverage, according to the state Department of Human Services.

Front Section, Pages 1 on 01/04/2014